4549 Form

4549 Form - Learn what to do if you agree or disagree with form 4549 and how to file an appeal with form 12661. Form 4549 is an irs form that shows the proposed changes to your tax return after an audit. Adjustments to credits under section 6431 for certain state and local bonds created date: You could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. It also requires the taxpayer's signature and. This bit compares what you reported on your taxes with what the irs thinks the numbers should be. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax. If you get one, it means the irs is questioning your. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. You could have received the form 4549 along with a notice of deficiency when you have unfiled returns and the irs has determined that you owe. It also requires the taxpayer's signature and. Adjustments to credits under section 6431 for certain state and local bonds created date: Find out the difference between agreed and unagreed rars,. Form 4549 is an irs form that shows the proposed changes to your tax return after an audit. This bit compares what you reported on your taxes with what the irs thinks the numbers should be. Irs form 4549, known as income tax examination changes, outlines audit results, detailing proposed changes to reported income, deductions, credits, and tax liability. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. This bit compares what you reported on your taxes with what the irs thinks. Form 4549 breaks down a few key things: Learn how to prepare and submit rars, which are reports of adjustments and tax liability computed by examiners. Paperless workflowcancel anytime30 day free trialmoney back guarantee Irs form 4549, known as income tax examination changes, outlines audit results, detailing proposed changes to reported income, deductions, credits, and tax liability. You could have. In this case, you have the choice of. Adjustments to credits under section 6431 for certain state and local bonds created date: Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Irs form 4549, known as income tax examination changes, outlines audit results, detailing proposed changes to reported. In this case, you have the choice of. Form 4549 breaks down a few key things: Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. If you get one, it means the irs is questioning your. Form 4549 is used by the irs to report the results of. If you get one, it means the irs is questioning your. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Form 4549 is an irs form that shows the proposed changes to your tax return after an audit.. Find out the difference between agreed and unagreed rars,. Learn how to prepare and submit rars, which are reports of adjustments and tax liability computed by examiners. Paperless workflowcancel anytime30 day free trialmoney back guarantee Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. Adjustments to credits under section 6431. If you get one, it means the irs is questioning your. Learn what to do if you agree or disagree with form 4549 and how to file an appeal with form 12661. Paperless workflowcancel anytime30 day free trialmoney back guarantee Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. Form. Form 4549 breaks down a few key things: Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. On march 15, 2010 irs sent a notice of deficiency for 2007 tax including a a illed up form 4549 to my address according jax tax jd, ll.m in. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. Learn how to prepare and submit rars, which are reports of adjustments and tax liability computed by examiners. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs. Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. On march 15, 2010 irs sent a notice of deficiency for 2007 tax including a a illed up form 4549 to my address according jax tax jd, ll.m in business and taxation, irs enrolled agent. Irs form 4549, known as income. Form 4549 breaks down a few key things: This bit compares what you reported on your taxes with what the irs thinks the numbers should be. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Learn what to do if you agree or disagree with form 4549 and how to file an appeal with form 12661. Learn how to prepare and submit rars, which are reports of adjustments and tax liability computed by examiners. In this case, you have the choice of. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax. On march 15, 2010 irs sent a notice of deficiency for 2007 tax including a a illed up form 4549 to my address according jax tax jd, ll.m in business and taxation, irs enrolled agent. Include a daytime and evening telephone number. It also requires the taxpayer's signature and. Find out the difference between agreed and unagreed rars,. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. Paperless workflowcancel anytime30 day free trialmoney back guarantee Essentially, if the irs conducts an audit of. Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. Adjustments to credits under section 6431 for certain state and local bonds created date:IRS Audit Reconsideration Form 4549 The Full Guide

Form 4549 Response to IRS Determination

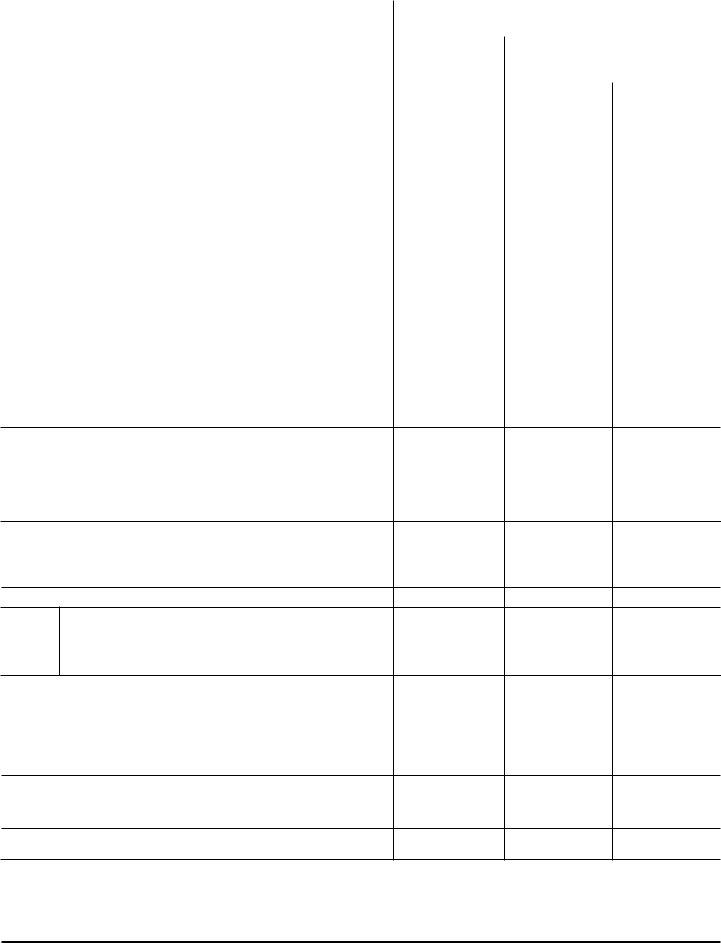

Form 4549 Tax Examination Changes Internal Revenue Service

Form 4549A Tax Examination Changes printable pdf download

Form 4549B Tax Examination Changes Form printable pdf download

Demystifying Form 4549 Understanding Your IRS Audit Report

Form 4549 Tax Examination Changes Internal Revenue Service

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Form 4549e Tax Dicrepancy Adjustments printable pdf download

The IRS Form 4549 (Guidelines) Top Tax AI

If You Get One, It Means The Irs Is Questioning Your.

Form 4549 Is An Irs Form That Shows The Proposed Changes To Your Tax Return After An Audit.

Form 4549, Or Income Tax Examination Changes, Is A Document The Irs Uses To Propose Adjustments To Your Income Tax Return.

Irs Form 4549, Known As Income Tax Examination Changes, Outlines Audit Results, Detailing Proposed Changes To Reported Income, Deductions, Credits, And Tax Liability.

Related Post: