4972 Tax Form

4972 Tax Form - Learn about the tax implications. Additionally, these line items are also completed: We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Is the form supported in our program? These documents are in adobe acrobat portable document format (pdf). This is an example of form 4972 (2022) with items included as described in the text. The primary requirement for using form. Current year prior years estate/inheritance tax use tax If you need assistance in obtaining any of these forms, please call our. Once completed, please submit the applicable form (s) below via email or mail to the address provided on the form. This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to retirement plans. This is an example of form 4972 (2022) with items included as described in the text. Once completed, please submit the applicable form (s) below via email or mail to the address provided on the form. Illinois department of revenue returns, schedules, and registration and related forms and instructions. If your answers are accurate, there should be no concern about using the. We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Find out about the 20% capital gain election,. Current year prior years estate/inheritance tax use tax If you need assistance in obtaining any of these forms, please call our. These documents are in adobe acrobat portable document format (pdf). These documents are in adobe acrobat portable document format (pdf). Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Understand its benefits, requirements, and how it saves money. Once completed, please submit. Learn about the tax implications. If you need assistance in obtaining any of these forms, please call our. This is an example of form 4972 (2022) with items included as described in the text. If your answers are accurate, there should be no concern about using the. Additionally, these line items are also completed: Find out about the 20% capital gain election,. This is an example of form 4972 (2022) with items included as described in the text. The primary requirement for using form. If your answers are accurate, there should be no concern about using the. If you need assistance in obtaining any of these forms, please call our. If you need assistance in obtaining any of these forms, please call our. This is an example of form 4972 (2022) with items included as described in the text. We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Is the form supported in our program? If your answers are accurate, there should be no concern about using the. This is an example of form 4972 (2022) with items included as described in the text. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. These documents are in adobe acrobat portable document format (pdf). Current year prior years estate/inheritance tax use. The primary requirement for using form. Current year prior years estate/inheritance tax use tax Additionally, these line items are also completed: Once completed, please submit the applicable form (s) below via email or mail to the address provided on the form. If your answers are accurate, there should be no concern about using the. Once completed, please submit the applicable form (s) below via email or mail to the address provided on the form. Understand its benefits, requirements, and how it saves money. The buzzle article below explains the. The primary requirement for using form. Is the form supported in our program? We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Once completed, please submit the applicable form (s) below via email or mail to the address provided on the form. Understand its benefits, requirements, and how it saves money. This is an example of form 4972 (2022) with items included as described in the text. Illinois department of revenue returns,. These documents are in adobe acrobat portable document format (pdf). The primary requirement for using form. Understand its benefits, requirements, and how it saves money. If your answers are accurate, there should be no concern about using the. The buzzle article below explains the. If your answers are accurate, there should be no concern about using the. Current year prior years estate/inheritance tax use tax The buzzle article below explains the. Find out about the 20% capital gain election,. We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Current year prior years estate/inheritance tax use tax This comprehensive guide provides a detailed understanding of irs form 4972, its eligibility criteria, how to fill it out, and its relevance to retirement plans. Additionally, these line items are also completed: If your answers are accurate, there should be no concern about using the. Is the form supported in our program? The primary requirement for using form. Find out about the 20% capital gain election,. The buzzle article below explains the. These documents are in adobe acrobat portable document format (pdf). Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Understand its benefits, requirements, and how it saves money. We'll provide a comprehensive walkthrough of completing form 4972, highlighting. Once completed, please submit the applicable form (s) below via email or mail to the address provided on the form.Form 4972 2024 2025

IRS Form 4972 Instructions Lump Sum Distributions

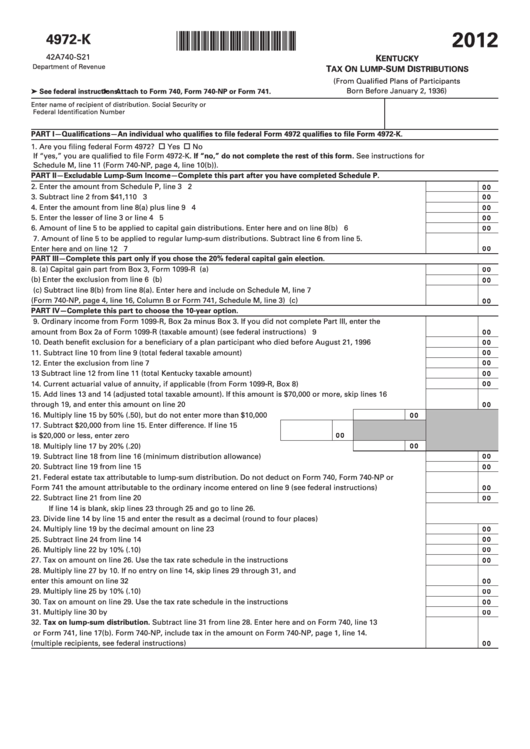

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2012

IRS Form 4972 2019 Fill Out, Sign Online and Download Fillable PDF

4972 20212024 Form Fill Out and Sign Printable PDF Template

Fillable Online Form 4972Tax on LumpSum Distributions (From

Irs Form 4972 Fillable Printable Forms Free Online

IRS Form 4972 Instructions Lump Sum Distributions

Form SC4972 2022 Fill Out, Sign Online and Download Printable PDF

IRS Form 4972 Instructions Lump Sum Distributions

Learn About The Tax Implications.

If You Need Assistance In Obtaining Any Of These Forms, Please Call Our.

Illinois Department Of Revenue Returns, Schedules, And Registration And Related Forms And Instructions.

This Is An Example Of Form 4972 (2022) With Items Included As Described In The Text.

Related Post: