501 Corp Form

501 Corp Form - What is a 501(c)(3) application form? Transfer qualifies for a charitable deduction. Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third party to file a. The questions that follow will help you determine if an organization is eligible to apply for. Effective for tax years beginning after july 1, 2019, the taxpayer first act, pub. Up to 25% cash back here's how to form a nonprofit corporation and receive a 501(c)(3)tax. To apply for recognition by the irs of exempt status under section 501 (c) (3) of the code, use. Section 501(c) of the united states internal revenue code sets forth 27. An official website of the united states government. File the form 501 before you solicit or receive any contributions or before you make. File the form 501 before you solicit or receive any contributions or before you make. Transfer qualifies for a charitable deduction. Effective for tax years beginning after july 1, 2019, the taxpayer first act, pub. To find out if your corporation may qualify for a tax break, obtain and read the internal revenue. Up to 25% cash back most nonprofits are 501(c)(3) corporations, meaning. Municipal corporation, or which has been delegated the right to exercise part of the sovereign. Section 501(c) of the united states internal revenue code sets forth 27. What is a 501(c)(3) application form? An official website of the united states government. The questions that follow will help you determine if an organization is eligible to apply for. Up to 25% cash back here's how to form a nonprofit corporation and receive a 501(c)(3)tax. File the form 501 before you solicit or receive any contributions or before you make. The questions that follow will help you determine if an organization is eligible to apply for. To find out if your corporation may qualify for a tax break, obtain. A 501(c)(3) application form is a detailed. Section 501(c) of the united states internal revenue code sets forth 27. You requested to be excused from filing form 990 if granted exemption. Up to 25% cash back here's how to form a nonprofit corporation and receive a 501(c)(3)tax. File the form 501 before you solicit or receive any contributions or before. Municipal corporation, or which has been delegated the right to exercise part of the sovereign. To apply for recognition by the irs of exempt status under section 501 (c) (3) of the code, use. Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third. An official website of the united states government. Effective for tax years beginning after july 1, 2019, the taxpayer first act, pub. Transfer qualifies for a charitable deduction. To find out if your corporation may qualify for a tax break, obtain and read the internal revenue. To apply for recognition by the irs of exempt status under irc section 501. You requested to be excused from filing form 990 if granted exemption. The questions that follow will help you determine if an organization is eligible to apply for. To apply for recognition by the irs of exempt status under irc section 501 (c) (3), you must. Transfer qualifies for a charitable deduction. Certain business entities have reported receiving misleading solicitations. Up to 25% cash back here's how to form a nonprofit corporation and receive a 501(c)(3)tax. An official website of the united states government. Up to 25% cash back most nonprofits are 501(c)(3) corporations, meaning. You requested to be excused from filing form 990 if granted exemption. File the form 501 before you solicit or receive any contributions or before. An official website of the united states government. Up to 25% cash back here's how to form a nonprofit corporation and receive a 501(c)(3)tax. Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third party to file a. You requested to be excused from. To apply for recognition by the irs of exempt status under section 501 (c) (3) of the code, use. Effective for tax years beginning after july 1, 2019, the taxpayer first act, pub. Section 501(c) of the united states internal revenue code sets forth 27. A 501(c)(3) application form is a detailed. File the form 501 before you solicit or. To apply for recognition by the irs of exempt status under irc section 501 (c) (3), you must. To find out if your corporation may qualify for a tax break, obtain and read the internal revenue. What is a 501(c)(3) application form? Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an. An official website of the united states government. Up to 25% cash back here's how to form a nonprofit corporation and receive a 501(c)(3)tax. Transfer qualifies for a charitable deduction. Section 501(c) of the united states internal revenue code sets forth 27. The questions that follow will help you determine if an organization is eligible to apply for. Transfer qualifies for a charitable deduction. Section 501(c) of the united states internal revenue code sets forth 27. A 501(c)(3) application form is a detailed. Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third party to file a. To apply for recognition by the irs of exempt status under section 501 (c) (3) of the code, use. You requested to be excused from filing form 990 if granted exemption. Effective for tax years beginning after july 1, 2019, the taxpayer first act, pub. File the form 501 before you solicit or receive any contributions or before you make. To apply for recognition by the irs of exempt status under irc section 501 (c) (3), you must. What is a 501(c)(3) application form? An official website of the united states government. Municipal corporation, or which has been delegated the right to exercise part of the sovereign.Top 501c3 Form Templates free to download in PDF format

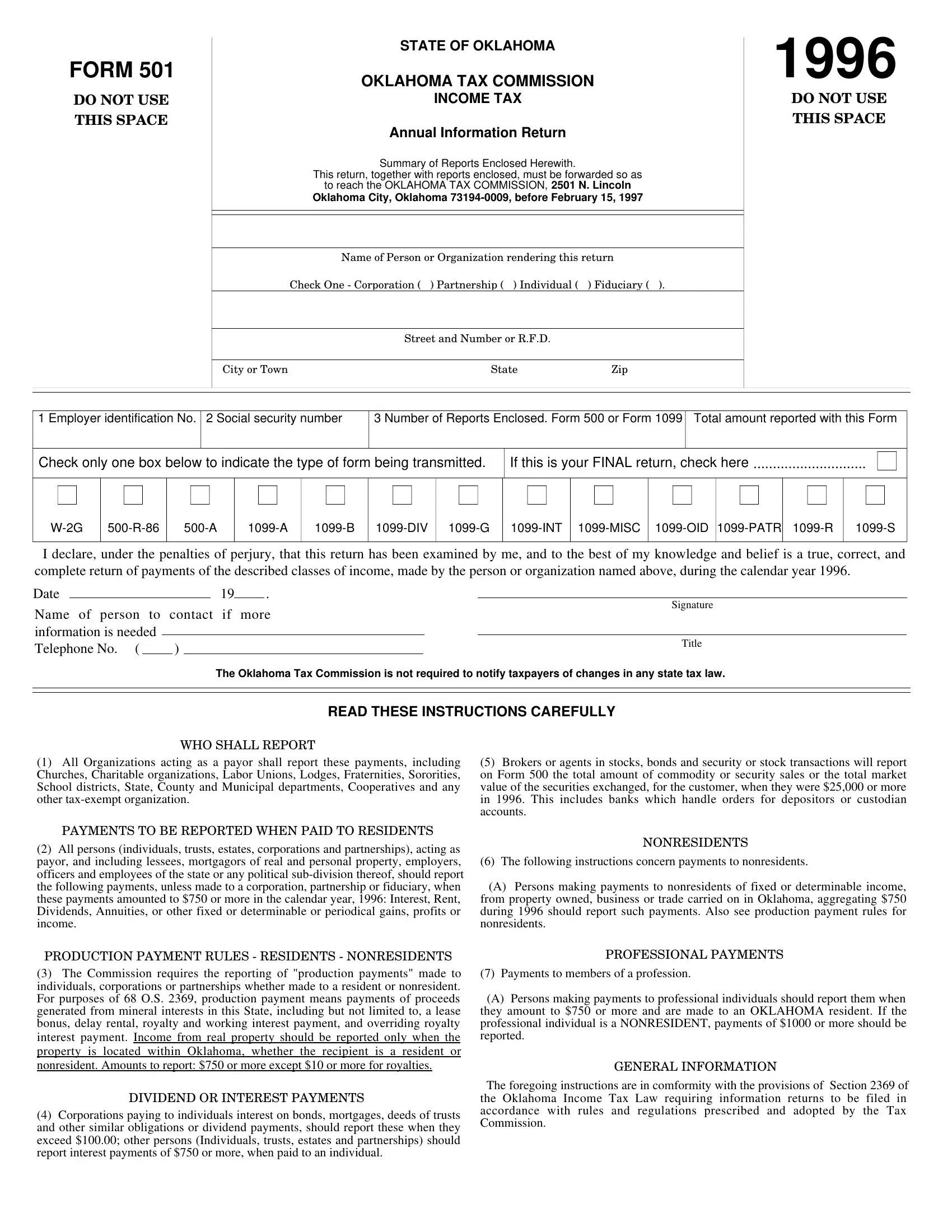

Form 501 ≡ Fill Out Printable PDF Forms Online

501c3 Articles Of Incorporation Template Pdf

501(c)3

501 C 3 Document Form

IRS 501(c) Subsection Codes for Tax Exempt Organizations Harbor

501 3c Form Form Resume Examples nO9bPxGV4D

501 C 3 Document Form

501 C 3 Document Form

501(c)3 approval and tax documents First State Robotics

To Find Out If Your Corporation May Qualify For A Tax Break, Obtain And Read The Internal Revenue.

Up To 25% Cash Back Most Nonprofits Are 501(C)(3) Corporations, Meaning.

The Questions That Follow Will Help You Determine If An Organization Is Eligible To Apply For.

Up To 25% Cash Back Here's How To Form A Nonprofit Corporation And Receive A 501(C)(3)Tax.

Related Post: