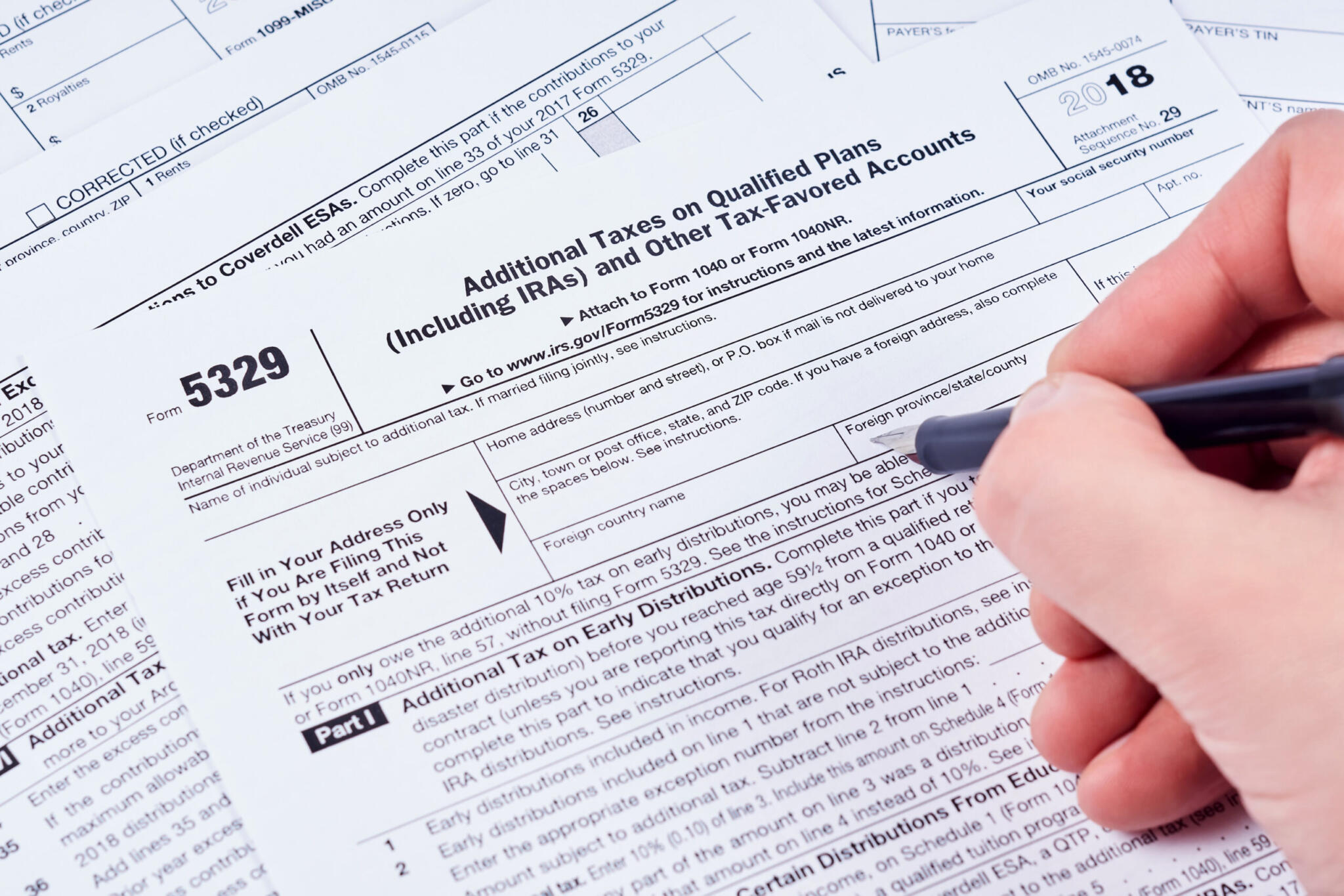

5329 T Form

5329 T Form - If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501, dependents, standard deduction, and filing information. In turbotax online, view the form at tax tools / print center / print,. It calculates and reports taxes on excess contributions, early distributions,. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from a qualified retirement plan (including an ira) or modified. Form 5329 is a specialized tax document required under specific circumstances related to retirement accounts. It is used to report additional taxes on iras and other qualified. If you don’t have to file a 2023 income tax return, complete and. If you don’t have to file a 2024 income tax return, complete and. The form calculates any additional taxes owed (what are often called penalties) for certain ira transactions. Tax form 5329 is used to report additional taxes on iras and other qualified retirement plans. Hsas, archer msas, covered esas, qtps, modified endowment contracts, iras, and other. This information is found in publication 501, dependents, standard deduction, and filing information. If you don’t have to file a 2023 income tax return, complete and. It calculates and reports taxes on excess contributions, early distributions,. In turbotax online, view the form at tax tools / print center / print,. If you don’t have to file a 2024 income tax return, complete and. Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. An individual needs to complete this form if he or she receives income as a. The form calculates any additional taxes owed (what are often called penalties) for certain ira transactions. For example, you may not have taken all of your rmd (required. It calculates and reports taxes on excess contributions, early distributions,. Hsas, archer msas, covered esas, qtps, modified endowment contracts, iras, and other. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. An individual needs to complete this. It calculates and reports taxes on excess contributions, early distributions,. In turbotax online, view the form at tax tools / print center / print,. If you don’t have to file a 2023 income tax return, complete and. If you don’t have to file a 2024 income tax return, complete and. If you are filing a return only because you owe. This information is found in publication 501, dependents, standard deduction, and filing information. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. For example, you may not have taken all of your rmd (required. It calculates and reports taxes on excess contributions, early distributions,. Tax form 5329 is used. This information is found in publication 501, dependents, standard deduction, and filing information. If you don’t have to file a 2024 income tax return, complete and. It calculates and reports taxes on excess contributions, early distributions,. If you don’t have to file a 2023 income tax return, complete and. Complete this part if you took a taxable distribution (other than. For example, you may not have taken all of your rmd (required. If you don’t have to file a 2024 income tax return, complete and. Tax form 5329 is used to report additional taxes on iras and other qualified retirement plans. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age. In turbotax online, view the form at tax tools / print center / print,. Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. If you don’t have to file a 2023 income tax return, complete and. An individual needs to complete this form if he or. An individual needs to complete this form if he or she receives income as a. If you are filing a return only because you owe this tax, you can file form 5329 by itself. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from a qualified retirement plan (including. Form 5329 is a specialized tax document required under specific circumstances related to retirement accounts. Tax form 5329 is used to report additional taxes on iras and other qualified retirement plans. Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. This information is found in publication. The form calculates any additional taxes owed (what are often called penalties) for certain ira transactions. It is used to report additional taxes on iras and other qualified. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Use form 5329 to report additional taxes on iras, other qualified retirement. An individual needs to complete this form if he or she receives income as a. It is used to report additional taxes on iras and other qualified. If you are filing a return only because you owe this tax, you can file form 5329 by itself. Hsas, archer msas, covered esas, qtps, modified endowment contracts, iras, and other. In turbotax. If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501, dependents, standard deduction, and filing information. It calculates and reports taxes on excess contributions, early distributions,. For example, you may not have taken all of your rmd (required. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from a qualified retirement plan (including an ira) or modified. Hsas, archer msas, covered esas, qtps, modified endowment contracts, iras, and other. The form calculates any additional taxes owed (what are often called penalties) for certain ira transactions. It is used to report additional taxes on iras and other qualified. In turbotax online, view the form at tax tools / print center / print,. If you don’t have to file a 2024 income tax return, complete and. Form 5329 is a specialized tax document required under specific circumstances related to retirement accounts. If you don’t have to file a 2023 income tax return, complete and.Instructions For Form 5329 Additional Taxes On Qualified Plans

Comment remplir le formulaire 5329 de l'IRS

Irs Form 5329 Fillable Printable Forms Free Online

Form 5329 T Complete with ease airSlate SignNow

How to Fill in IRS Form 5329

When to File Form 5329 to Calculate Taxes on Qualified Plans

Form 5329 Additional Taxes on Qualified Plans Definition

Instructions for How to Fill in IRS Form 5329

IRS Form 5329 walkthrough (Additional Taxes on Qualified Plans and

IRS Form 5329 Explained How to Navigate Retirement Account Penalty

An Individual Needs To Complete This Form If He Or She Receives Income As A.

Irs Form 5329 Can Be Reported For Both The Taxpayer And The Spouse In A Married Filing Jointly Tax Return.

Use Form 5329 To Report Additional Taxes On Iras, Other Qualified Retirement Plans, Modified Endowment Contracts, Coverdell Esas, Qtps, Archer Msas, Or Hsas.

Tax Form 5329 Is Used To Report Additional Taxes On Iras And Other Qualified Retirement Plans.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)