593 C Form

593 C Form - The escrow company will provide this form to the seller, typically. The seller will need to fill out the state of california. Form title and purpose required action; If the seller is an individual, enter the social. Use this booklet for real estate sales or transfers closing in 2016. The seller will need to fill out the state of california. Determine whether you qualify for a full withholding exemption. Check all boxes that apply to the property being sold or transferred. On january 1, 2020, our new form 593, real estate withholding statement went live. The property qualifies as the seller’s (or decedent's, if sold. The seller will need to fill out the state of california. Real estate withholding is required on the sale of ca real property held by a trust unless the. The seller will need to fill out the state of california. Determine whether you qualify for a full withholding exemption. The property qualifies as the seller’s (or decedent's, if sold. The escrow company will provide this form to the seller, typically. Completing california form 593 is a critical step in real estate transactions. If the seller is an individual, enter the social. Check all boxes that apply to the property being sold or transferred. Form title and purpose required action; The seller will need to fill out the state of california. Form title and purpose required action; The property qualifies as the seller’s (or decedent's, if sold. File a california income tax return and report the entire gain on schedule d, california capital. The seller will need to fill out the state of california real estate. On january 1, 2020, our new form 593, real estate withholding statement went live. Form title and purpose required action; The seller will need to fill out the state of california. Determine whether you qualify for a full withholding exemption. If the seller is an individual, enter the social. Completing california form 593 is a critical step in real estate transactions. The seller will need to fill out the state of california. The escrow company will provide this form to the seller, typically. Determine whether you qualify for a full withholding exemption. Check all boxes that apply to the property being sold or transferred. The seller will need to fill out the state of california real estate. Use this booklet for real estate sales or transfers closing in 2016. Check all boxes that apply to the property being sold or transferred. On january 1, 2020, our new form 593, real estate withholding statement went live. File a california income tax return and report the. If you are withheld upon, the reep should give you one copy of form 593. Check all boxes that apply to the property being sold or transferred. Completing california form 593 is a critical step in real estate transactions. File a california income tax return and report the entire gain on schedule d, california capital. Use this booklet for real. • verify form 593 is signed if the seller chooses the optional gain on sale withholding. The escrow company will provide this form to the seller, typically. If you are withheld upon, the reep should give you one copy of form 593. Form title and purpose required action; Real estate withholding is required on the sale of ca real property. On january 1, 2020, our new form 593, real estate withholding statement went live. The escrow company will provide this form to the seller, typically. The property qualifies as the seller’s (or decedent's, if sold. Form title and purpose required action; Check all boxes that apply to the property being sold or transferred. Determine whether you qualify for a full withholding exemption. The property qualifies as the seller’s (or decedent's, if sold. The escrow company will provide this form to the seller, typically. File a california income tax return and report the entire gain on schedule d, california capital. If the seller is an individual, enter the social. The seller will need to fill out the state of california. On january 1, 2020, our new form 593, real estate withholding statement went live. If you are withheld upon, the reep should give you one copy of form 593. Form title and purpose required action; Determine whether you qualify for a full withholding exemption. Completing california form 593 is a critical step in real estate transactions. The seller will need to fill out the state of california real estate. Real estate withholding is required on the sale of ca real property held by a trust unless the. Form title and purpose required action; Use this booklet for real estate sales or transfers closing in. Determine whether you qualify for a full withholding exemption. The seller will need to fill out the state of california. • verify form 593 is signed if the seller chooses the optional gain on sale withholding. Check all boxes that apply to the property being sold or transferred. Real estate withholding is required on the sale of ca real property held by a trust unless the. If you are withheld upon, the reep should give you one copy of form 593. Completing california form 593 is a critical step in real estate transactions. File a california income tax return and report the entire gain on schedule d, california capital. The seller will need to fill out the state of california real estate. On january 1, 2020, our new form 593, real estate withholding statement went live. The property qualifies as the seller’s (or decedent's, if sold. If the seller is an individual, enter the social.Fillable California Form 593C Real Estate Withholding Certificate

Form 593c 2018 Fill Out, Sign Online and Download Fillable PDF

2023 form 593 instructions Fill out & sign online DocHub

2015 Form 593C Real Estate Withholding Certificate Edit, Fill

Fillable California Form 593C Real Estate Withholding Certificate

593 Form 2023 Pdf Printable Forms Free Online

Form 593 Download Fillable PDF or Fill Online Real Estate Withholding

Fillable California Form 593C Real Estate Withholding Certificate

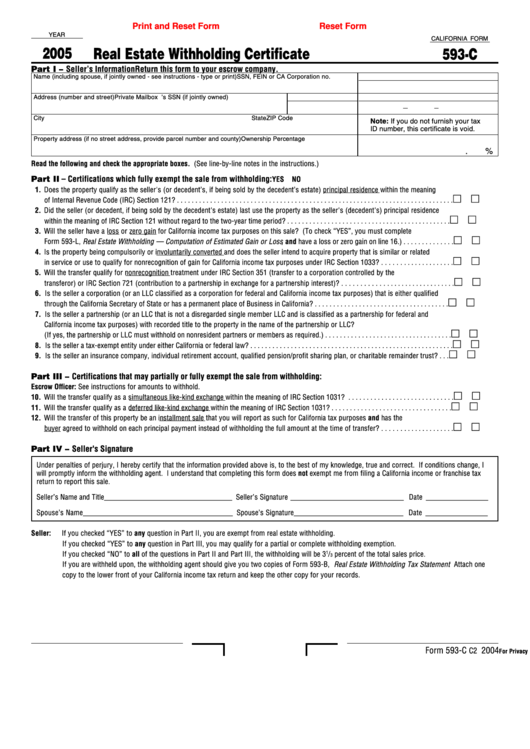

Form 593C Real Estate Withholding Certificate 2005 printable pdf

Form 593 Fillable Printable Forms Free Online

Use This Booklet For Real Estate Sales Or Transfers Closing In 2016.

Form Title And Purpose Required Action;

The Escrow Company Will Provide This Form To The Seller, Typically.

The Seller Will Need To Fill Out The State Of California.

Related Post: