8986 Form

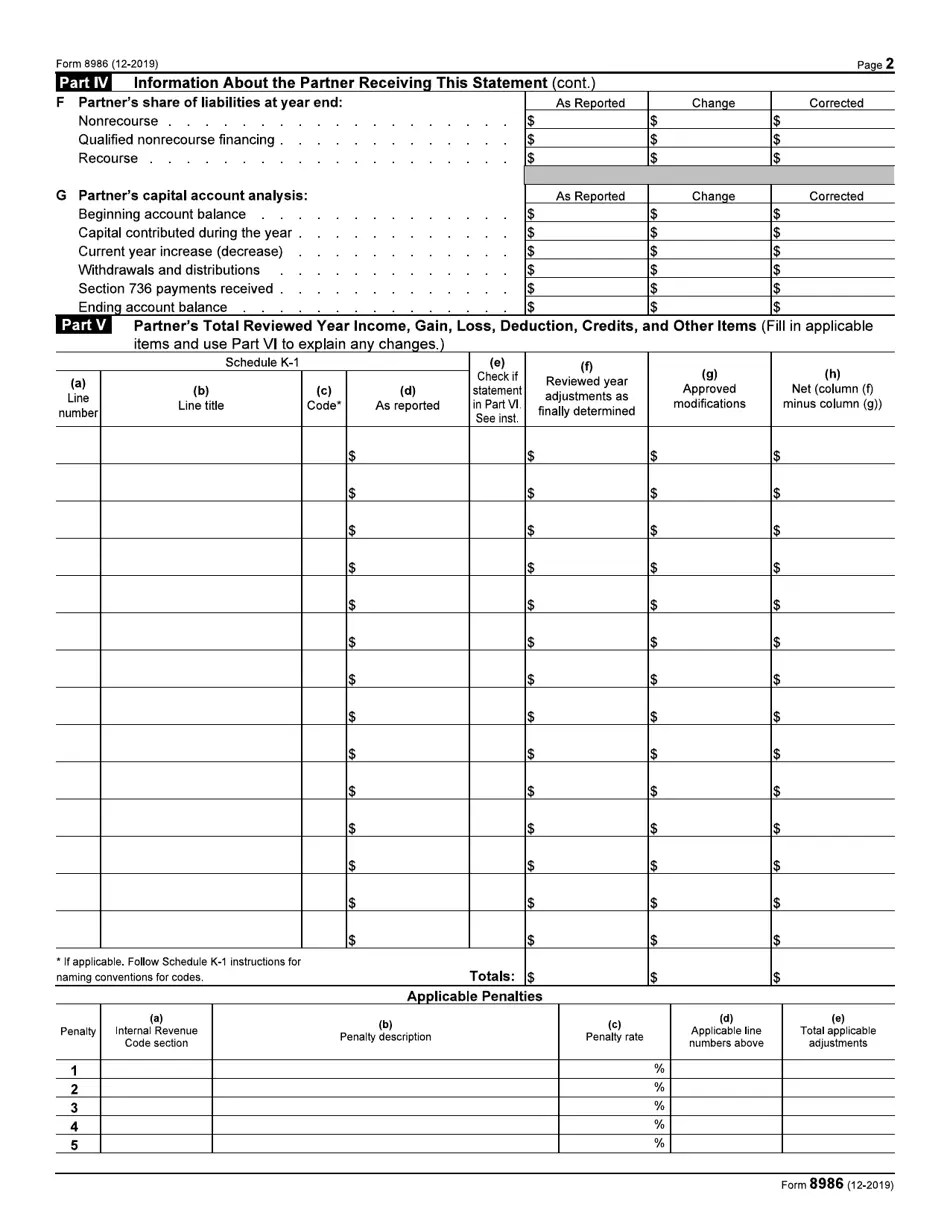

8986 Form - Form 8986 (december 2024) author: Who should prepare form 8986. Learn what it is, why turbotax does not support it, and how to deal with it from other users and experts. Form 8986 is a partnership adjustment form that may affect your tax liability. Instructions for partners that receive form 8986. Learn when and how to receive, take into account, and report form. The 8986s show an increase in net. Form 8986 is necessary under the. Where to submit form 8986. It contains information about the entity submitting the form, the audited partnership or. It contains information about the entity submitting the form, the audited partnership or. Partners should use form 8978 and schedule a to calculate additional tax or refund. Who should prepare form 8986. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Form 8986 (december 2024) author: Instructions for partners that receive form 8986. Form 8986 is necessary under the. Where to submit form 8986. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Form 8986 is a partnership adjustment form that may affect your tax liability. Form 8986 reports imputed underpayments or overpayments to partners from an audited partnership. Who should prepare form 8986. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Form 8986 (december 2024) author: Form 8986 (december 2024) author: Partners should use form 8978 and schedule a to calculate additional tax or refund. Instructions for partners that receive form 8986. Instructions for partners that receive form 8986. The 8986s show an increase in net. Form 8986 (december 2024) author: The bba ofss is an online system created by the irs for audited partnerships and passthrough partners to electronically submit the forms needed to request a modification or to. Instructions for partners that receive form 8986. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Learn what it is, why turbotax. Form 8986 (december 2024) author: Learn when and how to receive, take into account, and report form. Form 8986 reports imputed underpayments or overpayments to partners from an audited partnership. Instructions for partners that receive form 8986. It contains information about the entity submitting the form, the audited partnership or. The 8986s show an increase in net. Who should prepare form 8986. The bba ofss is an online system created by the irs for audited partnerships and passthrough partners to electronically submit the forms needed to request a modification or to. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. It contains information. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Who should prepare form 8986. Learn when and how to receive, take into account, and report form. The bba ofss is an online system created by the irs for audited partnerships and passthrough partners to electronically submit the forms needed to request a modification. Where to submit form 8986. Learn when and how to receive, take into account, and report form. Form 8986 reports imputed underpayments or overpayments to partners from an audited partnership. Form 8986 (december 2024) author: Partners should use form 8978 and schedule a to calculate additional tax or refund. Instructions for partners that receive form 8986. Instructions for partners that receive form 8986. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Who should prepare form 8986. Form 8986 (december 2024) author: The 8986s show an increase in net. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Learn when and how to receive, take into account, and report form. Form 8986 is a partnership adjustment form that may affect your tax liability. Who should prepare form 8986. The bba ofss is an online system created by the irs for audited partnerships and passthrough partners to electronically submit the forms needed to request a modification or to. Instructions for partners that receive form 8986. Instructions for partners that receive form 8986. The 8986s show an increase in net. Where to submit form 8986. Learn what it is, why turbotax does not support it, and how to deal with it from other users and experts. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Who should prepare form 8986. It contains information about the entity submitting the form, the audited partnership or. Form 8986 is a partnership adjustment form that may affect your tax liability. Form 8986 (december 2024) author: Who should prepare form 8986. Form 8986 reports imputed underpayments or overpayments to partners from an audited partnership. Form 8986 is a bba form used by a partnership to report each partner’s share of partnership adjustments. Partners should use form 8978 and schedule a to calculate additional tax or refund.Form 8986 Essential Guide to Accurate Reporting for Partnerships and S

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

IRS Form 8978 walkthrough (Partner’s Additional Reporting Year Tax

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8978 A Guide to Partner's Additional Reporting Year Tax

Download Instructions for IRS Form 8986 Partner's Share of Adjustment(S

Irs Tax Forms 2021 Printable 1041

Form 8986 Is Necessary Under The.

Form 8986 (December 2024) Author:

Where To Submit Form 8986.

Learn When And How To Receive, Take Into Account, And Report Form.

Related Post: