941 Form 2019

941 Form 2019 - For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. The irs provides instructions for filing form 941 to give employers background information on the form, help them determine when and where to file form 941, and how to. Printable versions of your completed form 941 for 2019 can be. We need it to figure and collect the right amount of tax. Read the separate instructions before you complete form 941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. When preparing to file, be sure to use this 2019 form 941 checklist. Answer these questions for this quarter. Online customers supportedit on any device3m+ satisfied customers We’ve provided a sneak peak into all the information you’ll need in order to complete the 941 form. Cpeos generally must file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Form 941 (2023) employer's quarterly federal tax return for 2023. Report for this quarter of 2019 (check one.) 1: We need it to figure and collect the right amount of tax. Online customers supportedit on any device3m+ satisfied customers The irs provides instructions for filing form 941 to give employers background information on the form, help them determine when and where to file form 941, and how to. Simply provide the following information: Information about form 941, employer's quarterly federal tax. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. • how should the form 1099 be prepared for recipient’s name and tin? For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Learn about the tax rates, filing addresses, payroll credit, cpeo program, and more for 2019. When preparing to file, be sure to use this 2019 form 941 checklist. We’ve provided a sneak peak into all the. Form 941 (2023) employer's quarterly federal tax return for 2023. Learn about the tax rates, filing addresses, payroll credit, cpeo program, and more for 2019. The irs provides instructions for filing form 941 to give employers background information on the form, help them determine when and where to file form 941, and how to. Form 941 is used by employers. Information about form 941, employer's quarterly federal tax. Form 941 (2023) employer's quarterly federal tax return for 2023. Form 941 is the employer's quarterly federal tax return for social security and medicare taxes. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or. Learn about the tax rates, filing addresses, payroll. Learn about the tax rates, filing addresses, payroll credit, cpeo program, and more for 2019. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. We ask for the information on form 941 to carry out the internal revenue laws of the united states. • how should the form. Report for this quarter of 2019 (check one.) 1: • how should the form 1099 be prepared for recipient’s name and tin? Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Answer these questions for this quarter. For the latest information about developments related to form 941 and. Form 941 is the employer's quarterly federal tax return for social security and medicare taxes. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Form 941 (2023) employer's quarterly federal tax return for 2023. When preparing to file, be sure to use this 2019 form. Read the separate instructions before you complete form 941. Simply provide the following information: Report for this quarter of 2019 (check one.) 1: Printable versions of your completed form 941 for 2019 can be. Online customers supportedit on any device3m+ satisfied customers Cpeos generally must file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. We’ve provided a sneak peak into all the information you’ll need in order to complete the 941 form. • how should the form 1099 be prepared for recipient’s name and tin? Read the separate instructions before you complete form 941. Report. Printable versions of your completed form 941 for 2019 can be. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Read the separate instructions before you complete form 941. We ask for the information on form 941 to carry out the internal revenue laws of the united states.. Read the separate instructions before you complete form 941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Simply provide the following information: Form 941 (2023) employer's quarterly federal tax return for 2023. Printable versions of your completed form 941 for 2019 can be. When preparing to file, be sure to use this 2019 form 941 checklist. The irs provides instructions for filing form 941 to give employers background information on the form, help them determine when and where to file form 941, and how to. Printable versions of your completed form 941 for 2019 can be. Read the separate instructions before you complete form 941. Cpeos generally must file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Simply provide the following information: We need it to figure and collect the right amount of tax. Report for this quarter of 2019 (check one.) 1: Information about form 941, employer's quarterly federal tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or. Cpeos generally must file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. Type or print within the boxes. Online customers supportedit on any device3m+ satisfied customers Completing form 941 for 2019 is quick and easy with taxbandits! Form 941 is the employer's quarterly federal tax return for social security and medicare taxes. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.File Form 941 Online for 2019 Express941

Where To Mail Form 941 With Payment 2024 Tiffi Philis

What Employers Need to Know about 941 Quarterly Tax Return?

How to Fill out IRS Form 941 Simple StepbyStep Instructions YouTube

Printable 941 Tax Form For 2019 Form Resume Examples ojYqbglrVz

How to Print Form 941 ezAccounting Payroll

IRS 941PR 2019 Fill out Tax Template Online US Legal Forms

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

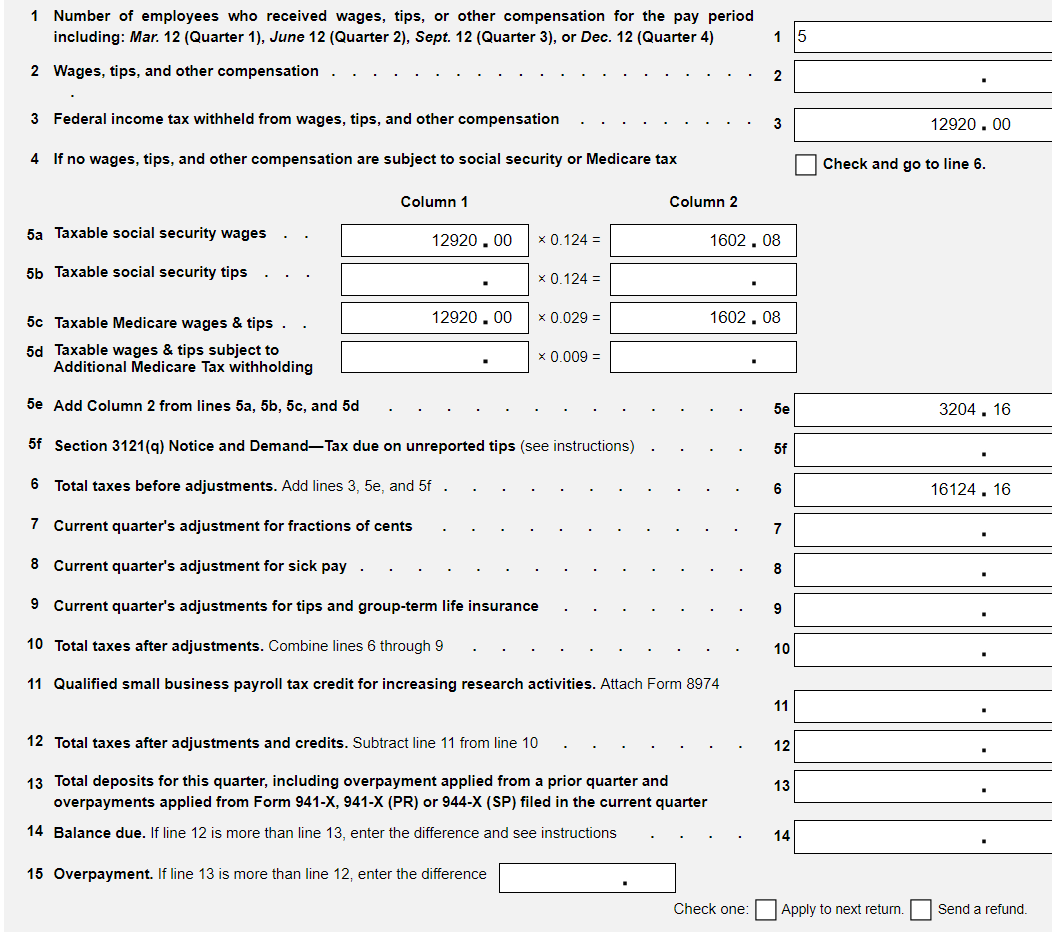

Solved Complete Form 941 for the 2nd quarter of 2019 for

Fill Out Form 941

Learn About The Tax Rates, Filing Addresses, Payroll Credit, Cpeo Program, And More For 2019.

Answer These Questions For This Quarter.

We Ask For The Information On Form 941 To Carry Out The Internal Revenue Laws Of The United States.

For The Latest Information About Developments Related To Form 941 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form941.

Related Post: