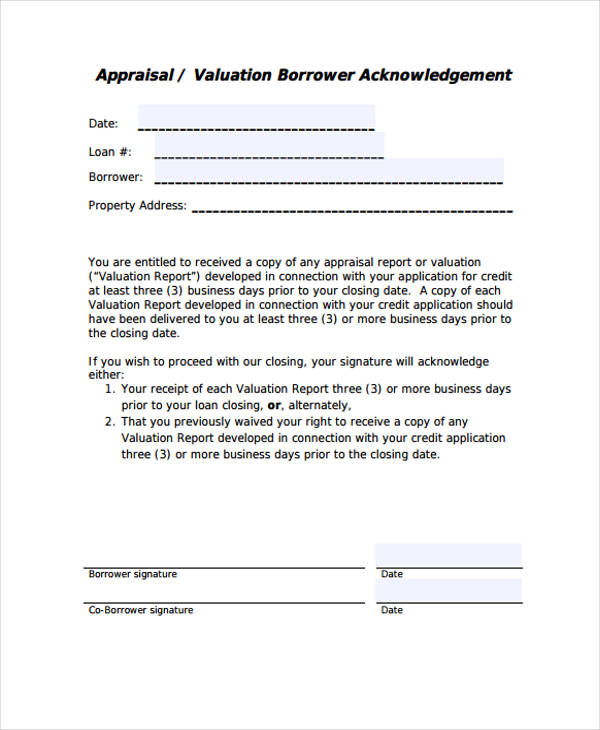

Appraisal Delivery Waiver Form

Appraisal Delivery Waiver Form - You are entitled to receive a copy of the appraisal report(s) obtained in connection with your application for credit at least 3 business days prior to the closing of your loan. The waiver is only for the timing of. Without the waiver, you cannot close until 3 business days after the appraisal comes in. The appraisal waiver form serves to inform borrowers about their rights regarding appraisal reports in the mortgage process. They say it's an insurance policy so that we. By signing below, i waive the three (3) business day advance receipt of any appraisal report or developed in connection with your application for credit and agree closing. Up to 40% cash back send 3 day appraisal delivery disclosure and waiver via email, link, or fax. Federal law requires that csc is to inform you within three days of receiving your mortgage loan application that you will promptly receive a copy of any valuation materials (“valuation”) used. An appraisal gap waiver is a clause that homebuyers can use to adjust their contract price and increase the chance of their. Understanding appraisal gap coverage clause. By signing this form, borrowers acknowledge their. The waiver allows the lender to deliver the appraisal at or before consummation. Appraisal waiver letter documents the waiver received by the lender. The appraisal waiver form serves to inform borrowers about their rights regarding appraisal reports in the mortgage process. Understanding appraisal gap coverage clause. So can they waive their right verbally, or do i need a signed form? They say it's an insurance policy so that we. Up to 40% cash back send 3 day appraisal delivery disclosure and waiver via email, link, or fax. The regulation itself is silent on the form of the waiver. Federal law requires that csc is to inform you within three days of receiving your mortgage loan application that you will promptly receive a copy of any valuation materials (“valuation”) used. By signing below, i waive the three (3) business day advance receipt of any appraisal report or developed in connection with your application for credit and agree closing. Signing this waiver authorizes acra lending to provide you with any valuation materials used when reviewing your loan application at the consummation of your loan, except where. It means you are waiving. Appraisal waiver letter documents the waiver received by the lender. You are entitled to receive copies of appraisal reports and other written valuations obtained in connection with your application for credit at least 3 business days prior to the closing of your. The appraisal waiver form serves to inform borrowers about their rights regarding appraisal reports in the mortgage process.. The waiver is only for the timing of. Federal law requires that csc is to inform you within three days of receiving your mortgage loan application that you will promptly receive a copy of any valuation materials (“valuation”) used. Edit your appraisal delivery waiver. By signing below, i waive the three (3) business day advance receipt of any appraisal report. The waiver is only for the timing of. It means you are waiving the right to review the appraisal 3 days prior to closing. Edit your appraisal delivery waiver. Appraisal waiver letter documents the waiver received by the lender. Understanding appraisal gap coverage clause. So can they waive their right verbally, or do i need a signed form? You are entitled to receive a copy of the appraisal report(s) obtained in connection with your application for credit at least 3 business days prior to the closing of your loan. The appraisal waiver form serves to inform borrowers about their rights regarding appraisal reports in. By signing this form, borrowers acknowledge their. Without the waiver, you cannot close until 3 business days after the appraisal comes in. An appraisal gap waiver is a clause that homebuyers can use to adjust their contract price and increase the chance of their. The spectrum balances traditional appraisals with appraisal alternatives. Federal law requires that csc is to inform. Understanding appraisal gap coverage clause. By signing this form, borrowers acknowledge their. Signing this waiver authorizes acra lending to provide you with any valuation materials used when reviewing your loan application at the consummation of your loan, except where. Without the waiver, you cannot close until 3 business days after the appraisal comes in. The appraisal waiver form serves to. The regulation itself is silent on the form of the waiver. By signing this form, borrowers acknowledge their. You can also download it, export it or print it out. It means you are waiving the right to review the appraisal 3 days prior to closing. The waiver is only for the timing of. The appraisal waiver form serves to inform borrowers about their rights regarding appraisal reports in the mortgage process. Up to 40% cash back send 3 day appraisal delivery disclosure and waiver via email, link, or fax. The spectrum balances traditional appraisals with appraisal alternatives. The regulation itself is silent on the form of the waiver. It means you are waiving. Edit your appraisal delivery waiver. You can also download it, export it or print it out. It means you are waiving the right to review the appraisal 3 days prior to closing. Federal law requires that csc is to inform you within three days of receiving your mortgage loan application that you will promptly receive a copy of any valuation. By signing this form, borrowers acknowledge their. The spectrum balances traditional appraisals with appraisal alternatives. You are entitled to receive copies of appraisal reports and other written valuations obtained in connection with your application for credit at least 3 business days prior to the closing of your. By signing below, i waive the three (3) business day advance receipt of any appraisal report or developed in connection with your application for credit and agree closing. So can they waive their right verbally, or do i need a signed form? Up to 40% cash back send 3 day appraisal delivery disclosure and waiver via email, link, or fax. The appraisal waiver form serves to inform borrowers about their rights regarding appraisal reports in the mortgage process. You can also download it, export it or print it out. They say it's an insurance policy so that we. It means you are waiving the right to review the appraisal 3 days prior to closing. Appraisal waiver letter documents the waiver received by the lender. The waiver allows the lender to deliver the appraisal at or before consummation. Federal law requires that csc is to inform you within three days of receiving your mortgage loan application that you will promptly receive a copy of any valuation materials (“valuation”) used. Edit your appraisal delivery waiver. The waiver is only for the timing of. We have some originators that want to add a waiver to the initial disclosure package that would waive the 3 day appraisal delivery requirement.Waiver Service Form Complete with ease airSlate SignNow

Appraisal Delivery Waiver Form Fill Out, Sign Online and Download PDF

FREE 19+ Sample Appraisal Forms in PDF

Exploring The Appraisal Waiver Pros And Cons What You Need To Know

Sample Waiver Form Free Printable Documents

FREE 6+ Appraisal Waiver Forms in PDF Ms Word

FREE 11+ Appraisal Waiver Form Samples, PDF, MS Word, Google Docs

FREE 6+ Sample Appraisal Disclosure Forms in PDF

Fillable Online Fillable Online APPRAISAL WITH WAIVER (ECOA) Fax

Fillable Online Appraisal Waiver Form Fax Email Print pdfFiller

The Regulation Itself Is Silent On The Form Of The Waiver.

Understanding Appraisal Gap Coverage Clause.

Without The Waiver, You Cannot Close Until 3 Business Days After The Appraisal Comes In.

You Are Entitled To Receive A Copy Of The Appraisal Report(S) Obtained In Connection With Your Application For Credit At Least 3 Business Days Prior To The Closing Of Your Loan.

Related Post: