Arkansas Tax Withholding Form

Arkansas Tax Withholding Form - Corporation income tax fiduciary tax franchise income tax individual income tax. Governor sanders has issued an executive order extending the deadline to file an income tax return for citizens in all counties across the state. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Keep this certificate with your. Form ar3mar is your annual reconciliation of monthly withholding. Home taxes income tax administration withholding tax branch withholding tax forms & instructions. The publication explains the tax forms you must complete, the forms you must give your employees, the forms your employees must give you and those you must return to the state of. Keep this certificate with your records. File this form with your employer to exempt your earnings from state income tax withholding. The state of arkansas income tax withholding formula includes the following changes: The publication explains the tax forms you must complete, the forms you must give your employees, the forms your employees must give you and those you must return to the state of. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Adobe reader may be required for your browser or you may need to download the. File this form with your employer. File this form with your employer. The ar4ec allows employees to specify their marital status,. File this form with your employer to exempt your earnings from state income tax withholding. The standard deduction amount has changed from $2,340 to $2,410. Arkansas and north carolina require that. File this form with your employer. Home taxes income tax administration withholding tax branch withholding tax forms & instructions. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Arkansas and north carolina require that. File this form with your employer. File this form with your employer. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. File this form with your employer to exempt your earnings from state income tax withholding. The publication explains the tax forms you must complete, the forms you must give your employees, the forms your employees must give you and those you. [ ] i am single and my gross. Keep this certificate with your records. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Keep this certificate with your. The ar4ec allows employees to specify their marital status,. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. [ ] i am single and my gross. The state of arkansas income tax withholding formula includes the following changes: Keep this certificate with your. Yes, the winner will be subject to any tax withholding requirements established by the internal revenue service (“irs”) and/or the arkansas department of finance and. Iowa, for instance, mandates 5% state tax withholding on taxable retirement distributions unless you opt out by filing a state form. Otherwise, your employer must withhold state income tax from. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Governor sanders has issued an executive order extending the deadline to file an income tax return for citizens in all counties across the state. Keep this certificate with your. Corporation income tax fiduciary tax franchise income tax individual income tax. The. An annual reconciliation form must be completed and returned to our ofice by february 28 of the. Yes, the winner will be subject to any tax withholding requirements established by the internal revenue service (“irs”) and/or the arkansas department of finance and. [ ] i am single and my gross. Keep this certificate with your. Keep this certificate with your. Keep this certificate with your. Some internet browsers have a built in pdf viewer that may not be. Governor sanders has issued an executive order extending the deadline to file an income tax return for citizens in all counties across the state. Keep this certificate with your records. To change your address or to close your business for withholding purposes,. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Your withholding is subject to review by the irs. File this form with your employer. An annual reconciliation form must be completed and returned. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Your withholding is subject to review by the irs. Form ar3mar is your annual reconciliation of monthly withholding. Keep this certificate with your records. Home taxes income tax administration withholding tax branch withholding tax forms & instructions. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. For each month listed, fill in the actual. Form ar3mar is your annual reconciliation of monthly withholding. An annual reconciliation form must be completed and returned to our ofice by february 28 of the. Arkansas and north carolina require that. Keep this certificate with your records. The standard deduction amount has changed from $2,340 to $2,410. Corporation income tax fiduciary tax franchise income tax individual income tax. Iowa, for instance, mandates 5% state tax withholding on taxable retirement distributions unless you opt out by filing a state form. The state of arkansas income tax withholding formula includes the following changes: Keep this certificate with your records. Your withholding is subject to review by the irs. File this form with your employer to exempt your earnings from state income tax withholding. Adobe reader may be required for your browser or you may need to download the. Home taxes income tax administration withholding tax branch withholding tax forms & instructions. File this form with your employer.Arkansas Employer's Annual Report For Tax Withheld Form

Employee's Withholding Exemption Certificate Arkansas Free Download

Fillable Online 2013 AR1000S ARKANSAS INDIVIDUAL TAX RETURN Fax

Fillable Online arkansas AR4RR STATE OF ARKANSAS Withholding Tax Refund

Fillable Arkansas State Tax Withholding Form printable pdf download

Arkansas State Tax Withholding Form 2023 Printable Forms Free Online

Fillable Online Withholding Tax Forms and Instructions Department

Arkansas State Tax Withholding Form 2023 Printable Forms Free Online

Fillable Change Of Name Or Address Withholding Tax Form State Of

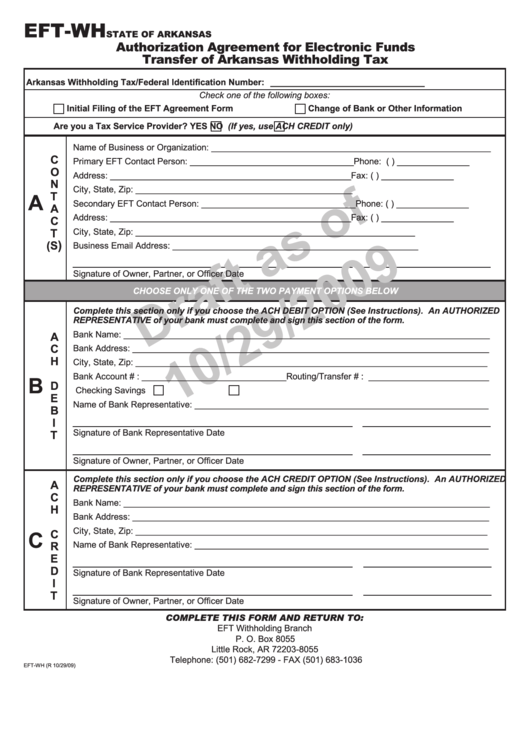

Form EftWh Draft Authorization Agreement For Electronic Funds

Keep This Certificate With Your.

The Ar4Ec Allows Employees To Specify Their Marital Status,.

The Publication Explains The Tax Forms You Must Complete, The Forms You Must Give Your Employees, The Forms Your Employees Must Give You And Those You Must Return To The State Of.

Otherwise, Your Employer Must Withhold State Income Tax From Your Wages Without Exemptions Or Dependents.

Related Post: