Arkansas Withholding Form

Arkansas Withholding Form - Please read the following instructions and complete the form on the reverse side. Corporation income tax fiduciary tax franchise income tax individual income tax partnership income tax s. Some internet browsers have a built in pdf viewer that may not be. Keep this certificate with your. Keep this certificate with your. An annual reconciliation form must be completed and returned to our office. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. These forms can be found on our website at. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Visit the arkansas department of. Am single and my gross income from all sources will. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Visit the arkansas department of. Keep this certificate with your records. Please read the following instructions and complete the form on the reverse side. Keep this certificate with your. Form ar3mar is your annual reconciliation of monthly withholding. File this form with your employer to exempt your earnings from state income tax withholding. Some internet browsers have a built in pdf viewer that may not be. File this form with your employer. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer. Yes, the winner will be subject to any tax withholding requirements established by the internal revenue service (“irs”) and/or the arkansas department of finance and. Visit the arkansas department of. The standard deduction amount has changed from $2,340 to $2,410. File this form with your employer to exempt your earnings from state income tax withholding. Keep this certificate with your records. Visit the arkansas department of. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Keep this certificate with your records. The state of arkansas income tax withholding formula includes the following changes: The standard deduction amount has changed from $2,340 to $2,410. File this form with your employer to exempt your earnings from state income tax withholding. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. An annual reconciliation form must be completed and returned to our office. The state of arkansas income tax withholding formula includes the following changes: To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. File this. File this form with your employer. Your withholding is subject to review by the irs. The publication explains the tax forms you must complete, the forms you must give your employees, the forms your employees must give you and those you must return to the state of. File this form with your employer to exempt your earnings from state income. Visit the arkansas department of. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Am single and my gross income from all sources will. File this form with your employer. Some internet browsers have a built in pdf viewer that may not be. File this form with your employer. Keep this certificate with your records. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer to exempt your earnings from state income tax withholding. Your withholding is subject to review by the irs. The state of arkansas income tax withholding formula includes the following changes: To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Visit the arkansas department of. File this form with your employer. File this form with your employer to exempt your earnings from state income tax withholding. Keep this certificate with your records. Yes, the winner will be subject to any tax withholding requirements established by the internal revenue service (“irs”) and/or the arkansas department of finance and. File this form with your employer. Keep this certificate with your. File this form with your employer to exempt your earnings from state income tax withholding. File this form with your employer to exempt your earnings from state income tax withholding. Corporation income tax fiduciary tax franchise income tax individual income tax partnership income tax s. File this form with your employer. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. The state of arkansas income. File this form with your employer to exempt your earnings from state income tax withholding. You are required to report any new employee to a designated state new hire registry. File this form with your employer. To change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Home taxes income tax administration withholding tax branch withholding tax forms & instructions. The state of arkansas income tax withholding formula includes the following changes: Keep this certificate with your records. Your withholding is subject to review by the irs. Keep this certificate with your. Please read the following instructions and complete the form on the reverse side. File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. These forms can be found on our website at. An annual reconciliation form must be completed and returned to our ofice by february 28 of the. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents.Fillable Form WtAr Application For Tax Withholding Refund

Arkansas W 4 2024 Karla Caitrin

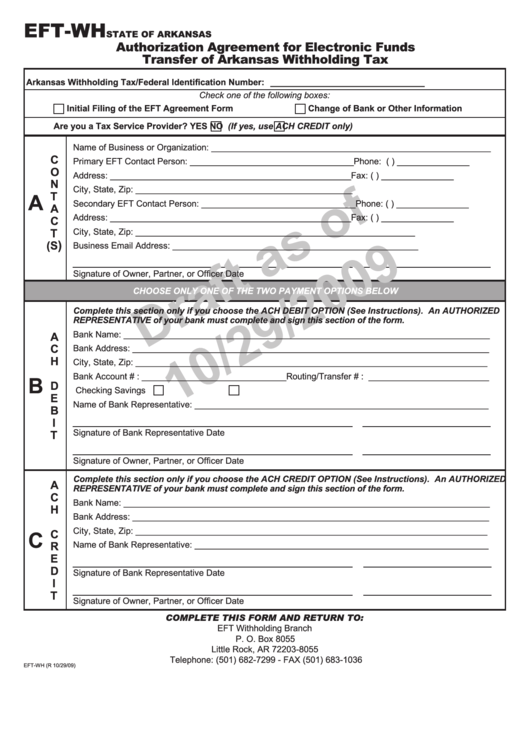

Form EftWh Draft Authorization Agreement For Electronic Funds

IRS Form W4 2019 Fill Out, Sign Online and Download Fillable PDF

Arkansas Employee Withholding 20212025 Form Fill Out and Sign

Fillable Form Ar1000 Arkansas Individual Tax Return 2009

Printable 941 Withholding Tax Form Printable Forms Free Online

Arkansas State Tax Withholding Form 2023 Printable Forms Free Online

How To Fill Out Federal Tax Withholding Form 2022

W4 Form 2025 Withholding Adjustment W4 Forms TaxUni

Yes, The Winner Will Be Subject To Any Tax Withholding Requirements Established By The Internal Revenue Service (“Irs”) And/Or The Arkansas Department Of Finance And.

Corporation Income Tax Fiduciary Tax Franchise Income Tax Individual Income Tax Partnership Income Tax S.

Keep This Certificate With Your Records.

An Annual Reconciliation Form Must Be Completed And Returned To Our Office.

Related Post: