Az Form 140 Instructions

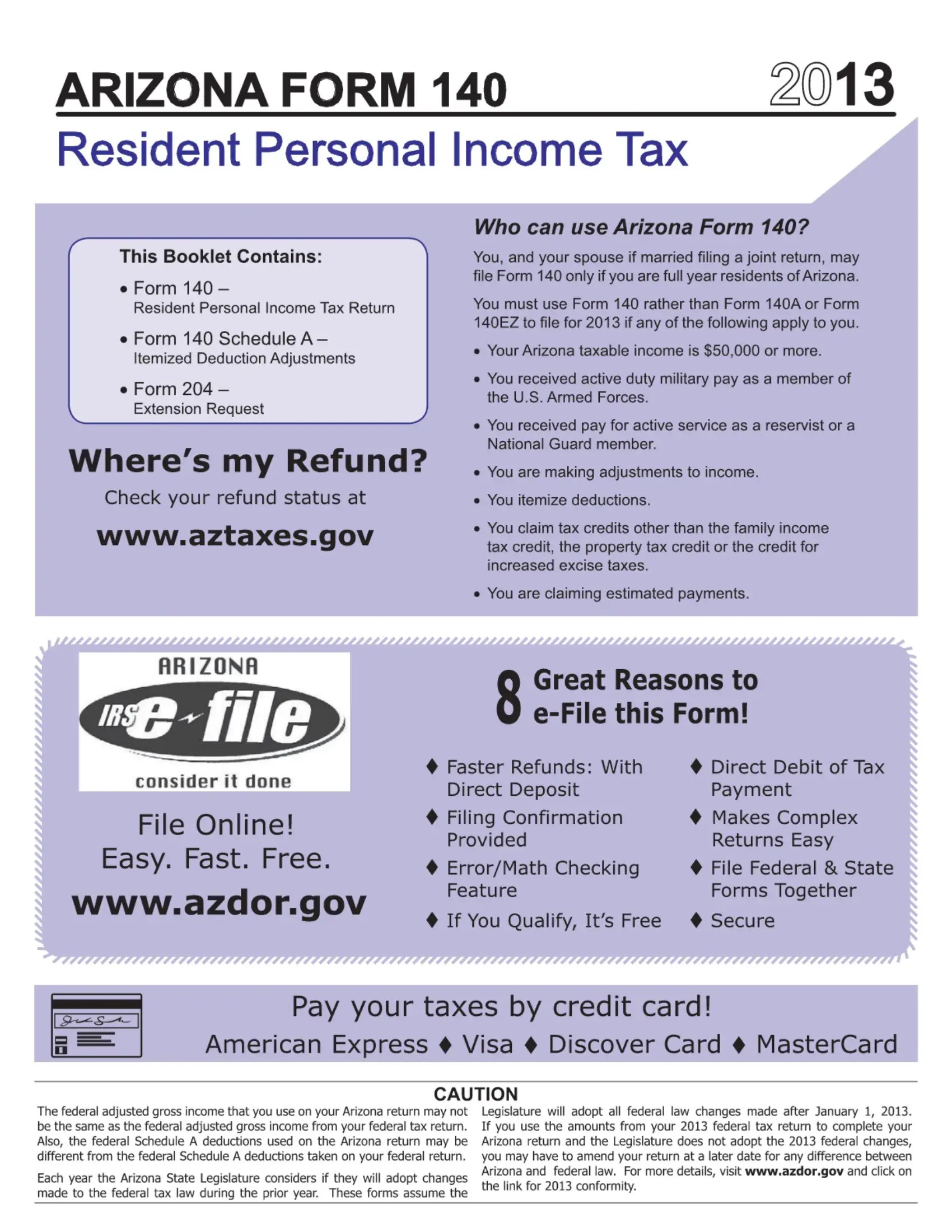

Az Form 140 Instructions - Find out what to include and what to exclude in your 2024 arizona income tax return with form 140. See the form instructions for eligibility, adjustments, deductions, credits, and more. It includes sections for individual details, filing status,. It includes information on important dates, filing requirements,. Gather necessary personal and financial documents. Follow the department’s instructions and pay any tax due when you file your original 2021 return and you file and pay the required amended return by the extended due date of your 2022 return. Learn how to file form 140 if you are a full year resident of arizona with taxable income of $50,000 or more, or if you make adjustments to income, itemize deductions, or claim credits. Download or view the printable packet of instructions for filling out your arizona form 140 tax return. Follow the instructions to complete the form and calculate your tax liability or refund. Single or married filing separately and gross income (gi) is greater than $14,600;. This document is the arizona form 140 for the tax year 2023, which is used by residents to file personal income tax returns. How to fill out the arizona resident personal income tax form 140? It includes information on important dates, filing requirements,. The form includes sections for personal information, income details,. See the form instructions for eligibility, adjustments, deductions, credits, and more. Single or married filing separately and gross income (gi) is greater than $14,600;. Note the update on the standard deduction worksheet for 2020 charitable. Download and print the official form for filing your arizona state income tax return for calendar year 2023. Do you have to file? Arizona filing requirements these rules apply to all arizona taxpayers. Fill out form 140 with accurate income and deduction information. See the form instructions for eligibility, adjustments, deductions, credits, and more. The form includes sections for personal information, income details,. Download and open the forms from your computer. If the taxpayer does not file both returns together, the. You must file if you are: It includes sections for individual details, filing status,. 11 rows download the form and instructions for filing your arizona personal income tax return. We last updated arizona form 140 instructions in february. Note the update on the standard deduction worksheet for 2020 charitable. Arizona form 140 is designed for residents of arizona to file their personal income tax returns for the year 2021. Arizona filing requirements these rules apply to all arizona taxpayers. Single or married filing separately and gross income (gi) is greater than $14,600;. Download or view the printable packet of instructions for filling out your arizona form 140 tax return.. The form includes sections for personal information, income details,. This document provides the essential guidelines for completing arizona form 140, the resident personal income tax return. Arizona filing requirements these rules apply to all arizona taxpayers. 11 rows download the form and instructions for filing your arizona personal income tax return. Learn how to file form 140 if you are. It includes sections for individual details, filing status,. If the taxpayer does not file both returns together, the. Download and fill out form 140 to file your personal income tax return as a full year resident of arizona. For more information, see form 140 instructions. 11 rows download the form and instructions for filing your arizona personal income tax return. This document is the arizona form 140 for the tax year 2023, which is used by residents to file personal income tax returns. Download and fill out form 140 to file your personal income tax return as a full year resident of arizona. The form includes sections for personal information, income details,. Arizona filing requirements these rules apply to all. This document provides the essential guidelines for completing arizona form 140, the resident personal income tax return. Single or married filing separately and gross income (gi) is greater than $14,600;. Note the update on the standard deduction worksheet for 2020 charitable. Gather necessary personal and financial documents. For more information, see form 140 instructions. Download and print the official form for filing your arizona state income tax return for calendar year 2023. Single or married filing separately and gross income (gi) is greater than $14,600;. Download and open the forms from your computer. 11 rows download the form and instructions for filing your arizona personal income tax return. If the taxpayer does not file. Download and print the official form for filing your arizona state income tax return for calendar year 2023. Note the update on the standard deduction worksheet for 2020 charitable. How to fill out the arizona resident personal income tax form 140? Single or married filing separately and gross income (gi) is greater than $14,600;. Find out what to include and. Arizona form 140 is designed for residents of arizona to file their personal income tax returns for the year 2021. Note the update on the standard deduction worksheet for 2020 charitable. Fill out form 140 with accurate income and deduction information. Follow the instructions to complete the form and calculate your tax liability or refund. This document provides the essential. Arizona form 140 is designed for residents of arizona to file their personal income tax returns for the year 2021. Gather necessary personal and financial documents. Arizona filing requirements these rules apply to all arizona taxpayers. The form includes sections for personal information, income details,. For more information, see form 140 instructions. Find out what to include and what to exclude in your 2024 arizona income tax return with form 140. If the taxpayer does not file both returns together, the. Note the update on the standard deduction worksheet for 2020 charitable. Download and open the forms from your computer. Download or view the printable packet of instructions for filling out your arizona form 140 tax return. It includes sections for individual details, filing status,. 11 rows download the form and instructions for filing your arizona personal income tax return. Download and print the official form for filing your arizona state income tax return for calendar year 2023. It includes information on important dates, filing requirements,. You must file if you are: How to fill out the arizona resident personal income tax form 140?Az Form 140 ≡ Fill Out Printable PDF Forms Online

Download Instructions for Arizona Form 140, ADOR10413 Nonresident

Instructions and Download of Arizona Form 140 Unemployment Gov

Download Instructions for Arizona Form 140SBI, ADOR11400 Small

Arizona Fillable Tax Form 140a Printable Forms Free Online

Download Instructions for Arizona Form 140SBI, ADOR11400 Small

Fillable Online Arizona Form 140 Instructions eSmart Tax Fax Email

Az 140 instructions Fill out & sign online DocHub

2021 Form AZ DoR 140 Instructions Fill Online, Printable, Fillable

Download Instructions for Arizona Form 140SBI, ADOR11400 Small

Do You Have To File?

Download And Fill Out Form 140 To File Your Personal Income Tax Return As A Full Year Resident Of Arizona.

Learn How To File Form 140 If You Are A Full Year Resident Of Arizona And Meet Certain Criteria.

Follow The Instructions To Complete The Form And Calculate Your Tax Liability Or Refund.

Related Post: