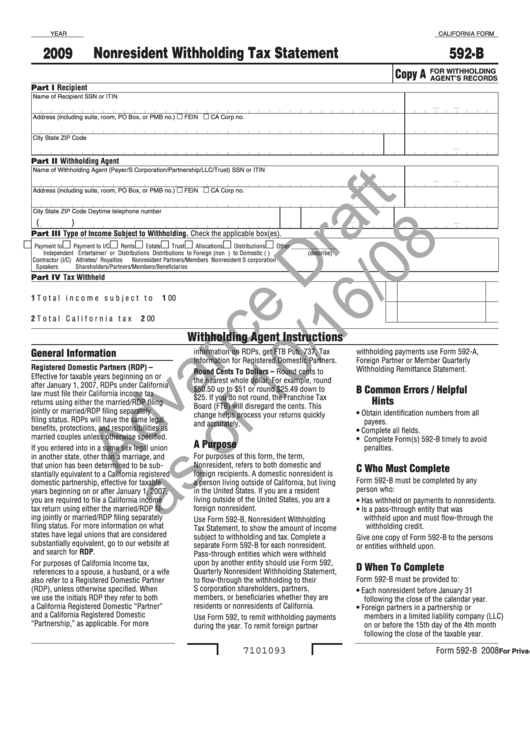

Ca Form 592 B

Ca Form 592 B - This ensures california collects taxes on. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Also see ca form 592. California partners are taxed based on the amount of the cash and property distributions that each partner receives. Form 592 includes a schedule of payees section, on side 2, that requires the. Paperless workflow free mobile app edit on any device money back guarantee Instead, you withheld an amount to help pay taxes when you do your california return. All california withholding that you enter at the federal level that transfers to the california individual return defaults to form 540, line 71 or form 540nr, line 81. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Also see ca form 592. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. California partners are taxed based on the amount of the cash and property distributions that each partner receives. Paperless workflow free mobile app edit on any device money back guarantee Form 592 includes a schedule of payees section, on side 2, that requires the. This ensures california collects taxes on. Instead, you withheld an amount to help pay taxes when you do your california return. All california withholding that you enter at the federal level that transfers to the california individual return defaults to form 540, line 71 or form 540nr, line 81. All california withholding that you enter at the federal level that transfers to the california individual return defaults to form 540, line 71 or form 540nr, line 81. Also see ca form 592. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Instead, you withheld an amount to help pay taxes when. Form 592 includes a schedule of payees section, on side 2, that requires the. Instead, you withheld an amount to help pay taxes when you do your california return. All california withholding that you enter at the federal level that transfers to the california individual return defaults to form 540, line 71 or form 540nr, line 81. By default, any. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Form 592 includes a schedule of payees section, on side 2, that requires the. This ensures california collects taxes on. Instead, you withheld an amount to help pay taxes when you do your california return. All california withholding that you enter at the. Also see ca form 592. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. This ensures california collects taxes on. Paperless workflow free mobile app edit on any device money back guarantee California partners are taxed based on the amount of the cash and property distributions that each partner receives. Form 592 includes a schedule of payees section, on side 2, that requires the. This ensures california collects taxes on. Paperless workflow free mobile app edit on any device money back guarantee By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. All california withholding that you enter at the federal level that. California partners are taxed based on the amount of the cash and property distributions that each partner receives. Also see ca form 592. This ensures california collects taxes on. Paperless workflow free mobile app edit on any device money back guarantee By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Paperless workflow free mobile app edit on any device money back guarantee This ensures california collects taxes on. California partners are taxed based on the amount of the cash and property distributions that each partner receives. Instead, you withheld an amount to help pay taxes when you do your california return. Form 592 includes a schedule of payees section, on. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Paperless workflow free mobile app edit on any device money back guarantee Form 592 includes a schedule of payees section, on side 2, that requires the.. California partners are taxed based on the amount of the cash and property distributions that each partner receives. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. All california withholding that you enter at the federal level that transfers to the california individual return defaults to form 540, line 71 or form. This ensures california collects taxes on. California partners are taxed based on the amount of the cash and property distributions that each partner receives. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Also see ca form 592. Paperless workflow free mobile app edit on any device money back guarantee Instead, you withheld an amount to help pay taxes when you do your california return. This ensures california collects taxes on. Form 592 includes a schedule of payees section, on side 2, that requires the. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Paperless workflow free mobile app edit on any device money back guarantee Also see ca form 592. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592.CA 592B reporting eFileMyForms

Fillable California Form 592B Resident And Nonresident Withholding

CA 592B reporting eFileMyForms

44 California Ftb 592 Forms And Templates free to download in PDF

Fillable California Form 592B Resident And Nonresident Withholding

Fillable California Form 592 B Nonresident Withholding Tax Statement

Sample Form 592B printable pdf download

Form 592B Download Fillable PDF or Fill Online Resident and

California Form 592B Draft Nonresident Withholding Tax Statement

CA FTB 592F 2020 Fill out Tax Template Online US Legal Forms

All California Withholding That You Enter At The Federal Level That Transfers To The California Individual Return Defaults To Form 540, Line 71 Or Form 540Nr, Line 81.

California Partners Are Taxed Based On The Amount Of The Cash And Property Distributions That Each Partner Receives.

Related Post: