Ca Sdi Tax Form

Ca Sdi Tax Form - In 2025, the sdi rate is 0.9% on income up to. That is california state disability insurance. So you need to report them on your federal. California state disability insurance (sdi) benefits are not. Samsung sdi lowered its pricing of new shares to 146,200 won last month. Sdi benefits aren't subject to federal or state income tax, so you won't get a tax form for those payments. Edd payments are reported to the internal revenue service (irs) and must be included. Yes, if someone received california state disability insurance (sdi) benefit payments (checks) from california employment development department (edd). That's why you haven't received anything from the disability. As of january 1, 2025, california’s state disability insurance (sdi) program provides higher wage replacement rates due to changes from senate bill 951. If you received unemployment insurance benefits, became disabled, and began. How much does sdi pay? California sdi benefits are not taxable for california state income tax, but they are taxable for federal income tax purposes. It is a mandatory tax. Edd payments are reported to the internal revenue service (irs) and must be included. To claim a deduction for these contributions, you must file a 1040 tax return and itemize your deductions. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. They're typically mailed out by january 31st and you can also access it through your sdi online. Learn about california’s state payroll taxes, including ui, ett, sdi, and pit, and how they apply to employer contributions and employee wages. For example, if an employee receives sdi benefits and also receives unemployment compensation or. It is a mandatory tax. Samsung sdi lowered its pricing of new shares to 146,200 won last month. For example, if an employee receives sdi benefits and also receives unemployment compensation or. If you received taxable unemployment compensation, including if you became disabled and began receiving disability benefits, your ui online account will be updated with this information by january. Yes, you need to report your sdi benefits on your taxes, but whether they're taxable depends on your situation. Yes, you will receive a 1099g form from edd for your sdi benefits. In california, sdi benefits are generally not taxable, but there are some exceptions. If you received unemployment insurance benefits, became disabled, and began. For example, if an employee. Edd payments are reported to the internal revenue service (irs) and must be included. Yes, you need to report your sdi benefits on your taxes, but whether they're taxable depends on your situation. Enter $11,080 if married filing joint with two or more. It is a mandatory tax. As of january 1, 2025, california’s state disability insurance (sdi) program provides. California state disability insurance (sdi) benefits are not. You will receive a form 1099g by mail for the most recent tax year during the last week of january. That is california state disability insurance. Sdi benefits aren't subject to federal or state income tax, so you won't get a tax form for those payments. To claim a deduction for these. It’s a relief during tough times, but you. That's why you haven't received anything from the disability. To claim a deduction for these contributions, you must file a 1040 tax return and itemize your deductions. Access and download disability insurance forms, claim guides, and helpful publications from the edd, including claim instructions, eligibility info, and more. Yes, you need to. Form 1099g information is available through your ui onlineaccount. If you received taxable unemployment compensation, including if you became disabled and began receiving disability benefits, your ui online account will be updated with this information by january 31. If you do not choose electronic delivery. Edd payments are reported to the internal revenue service (irs) and must be included. They're. In 2025, the sdi rate is 0.9% on income up to. As of january 1, 2025, california’s state disability insurance (sdi) program provides higher wage replacement rates due to changes from senate bill 951. How much does sdi pay? It is a mandatory tax. Pleted application form can be emailed to. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. Certain cities and counties may impose additional withholding requirements. Take the number found in box 14 and transferring it to section 5, labeled taxes. How much does sdi pay? The california code of regulations, title. In 2025, the sdi rate is 0.9% on income up to. It’s a relief during tough times, but you. Yes, if someone received california state disability insurance (sdi) benefit payments (checks) from california employment development department (edd). For example, if an employee receives sdi benefits and also receives unemployment compensation or. California sdi benefits are not taxable for california state. Certain cities and counties may impose additional withholding requirements. For example, if an employee receives sdi benefits and also receives unemployment compensation or. Sdi benefits aren't subject to federal or state income tax, so you won't get a tax form for those payments. In california, sdi benefits are generally not taxable, but there are some exceptions. You will receive a. If you received unemployment insurance benefits, became disabled, and began. It’s a relief during tough times, but you. To claim a deduction for these contributions, you must file a 1040 tax return and itemize your deductions. Edd payments are reported to the internal revenue service (irs) and must be included. Form 1099g information is available through your ui onlineaccount. State disability insurance (sdi) california also requires workers to contribute to the state disability insurance (sdi) program. You will receive a form 1099g by mail for the most recent tax year during the last week of january. Form 1099g is a tax document that reports the total taxable income we issue to you in a calendar year. If you received taxable unemployment compensation, including if you became disabled and began receiving disability benefits, your ui online account will be updated with this information by january 31. For example, if an employee receives sdi benefits and also receives unemployment compensation or. As of january 1, 2025, california’s state disability insurance (sdi) program provides higher wage replacement rates due to changes from senate bill 951. California sdi benefits are not taxable for california state income tax, but they are taxable for federal income tax purposes. Learn about california’s state payroll taxes, including ui, ett, sdi, and pit, and how they apply to employer contributions and employee wages. Take the number found in box 14 and transferring it to section 5, labeled taxes. Access and download disability insurance forms, claim guides, and helpful publications from the edd, including claim instructions, eligibility info, and more. The california code of regulations, title 8, section 17306 requires the rtwsp application to be made on the electronic form on the department of industrial relations.Sdi Form 2525 ≡ Fill Out Printable PDF Forms Online

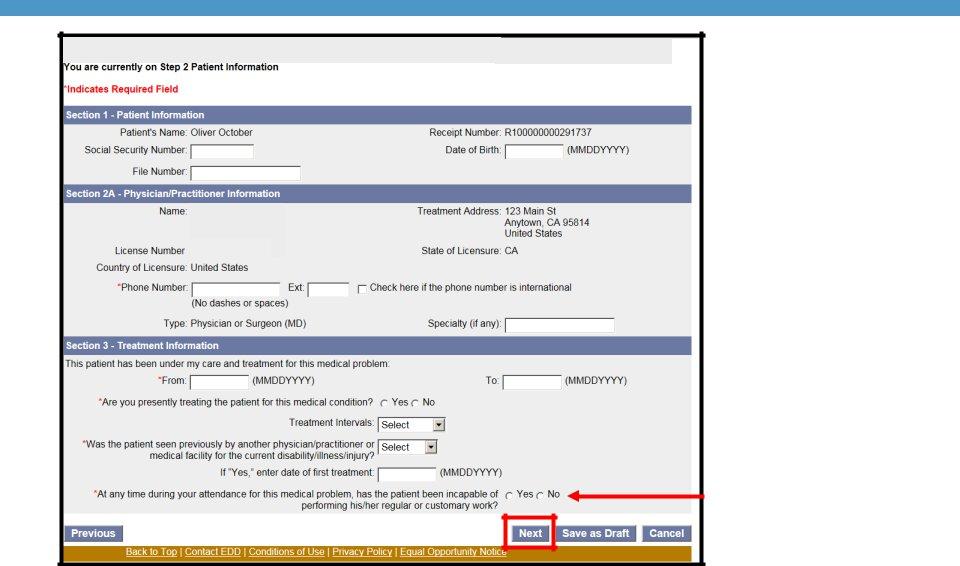

Form SOC409 Fill Out, Sign Online and Download Fillable PDF

Sdi Form 2525 ≡ Fill Out Printable PDF Forms Online

Tax Segment 6 Filing a California Tax Return

Sdi Form 2525 ≡ Fill Out Printable PDF Forms Online

Form De 1964 Claim For Refund Of Excess California State Disability

The Comprehensive Guide to CA SDI AttendanceBot

Ca State Disability Forms Fill Online, Printable, Fillable, Blank

Ca Sdi 2025 Nadia Valaree

Form SOC409 Download Fillable PDF or Fill Online Ihss/Cmips Elective

How Much Does Sdi Pay?

That's Why You Haven't Received Anything From The Disability.

Samsung Sdi Lowered Its Pricing Of New Shares To 146,200 Won Last Month.

Sdi Benefits Aren't Subject To Federal Or State Income Tax, So You Won't Get A Tax Form For Those Payments.

Related Post: