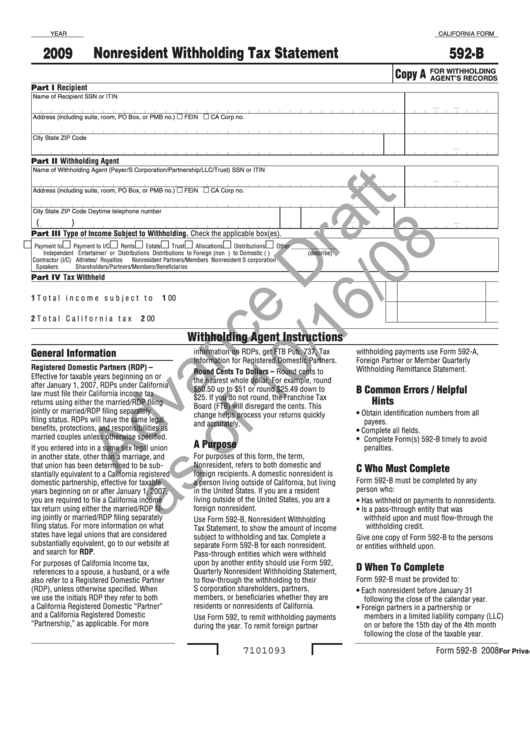

California Form 592 B

California Form 592 B - It provides detailed information regarding tax withheld. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Enter the total ca tax withheld. Also see ca form 592. The withholding that you enter at the federal level doesn't transfer to form 568. Instead, you withheld an amount to help pay taxes when you do your california return. Individuals or business entities who are. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Or are you self employed and my company is the ca. Enter the total backup withholding (if applicable). Form 592 includes a schedule of payees section, on side 2, that requires the. California partners are taxed based on the amount of the cash and property distributions that each partner receives. It provides detailed information regarding tax withheld. Also see ca form 592. The withholding requirements do not apply to: Individuals or business entities who are. This applies primarily to nonresidents. Enter the total backup withholding (if applicable). Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Instead, you withheld an amount to help pay taxes when you do your california return. The withholding requirements do not apply to: Instead, you withheld an amount to help pay taxes when you do your california return. This applies primarily to nonresidents. Also see ca form 592. Enter the total ca tax withheld. Or are you self employed and my company is the ca. Instead, you withheld an amount to help pay taxes when you do your california return. Form 592 includes a schedule of payees section, on side 2, that requires the. California partners are taxed based on the amount of the cash and property distributions that each partner receives. The withholding. It provides detailed information regarding tax withheld. The withholding that you enter at the federal level doesn't transfer to form 568. Also see ca form 592. The withholding requirements do not apply to: Form 592 includes a schedule of payees section, on side 2, that requires the. This applies primarily to nonresidents. Enter the total backup withholding (if applicable). Enter the total ca tax withheld. Also see ca form 592. Or are you self employed and my company is the ca. It provides detailed information regarding tax withheld. Also see ca form 592. Instead, you withheld an amount to help pay taxes when you do your california return. Form 592 includes a schedule of payees section, on side 2, that requires the. Or are you self employed and my company is the ca. This applies primarily to nonresidents. It provides detailed information regarding tax withheld. Individuals or business entities who are. Instead, you withheld an amount to help pay taxes when you do your california return. The withholding that you enter at the federal level doesn't transfer to form 568. Individuals or business entities who are. The withholding that you enter at the federal level doesn't transfer to form 568. Or are you self employed and my company is the ca. California partners are taxed based on the amount of the cash and property distributions that each partner receives. It provides detailed information regarding tax withheld. Instead, you withheld an amount to help pay taxes when you do your california return. Enter the total ca tax withheld. The withholding requirements do not apply to: It provides detailed information regarding tax withheld. Enter the total backup withholding (if applicable). California partners are taxed based on the amount of the cash and property distributions that each partner receives. Form 592 includes a schedule of payees section, on side 2, that requires the. This applies primarily to nonresidents. Or are you self employed and my company is the ca. Enter the total ca tax withheld. The withholding requirements do not apply to: Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Enter the total ca tax withheld. It provides detailed information regarding tax withheld. This applies primarily to nonresidents. By default, any california withholding is reported on form 540, line 71, or form 540nr, line 81. Or are you self employed and my company is the ca. Instead, you withheld an amount to help pay taxes when you do your california return. Enter the total backup withholding (if applicable). Also see ca form 592. California partners are taxed based on the amount of the cash and property distributions that each partner receives.592 B California 20212025 Form Fill Out and Sign Printable PDF

Fillable California Form 592B Resident And Nonresident Withholding

CA 592B reporting eFileMyForms

Fillable California Form 592 Resident And Nonresident Withholding

California Form 592B Draft Nonresident Withholding Tax Statement

California Form 592 Draft Resident And Nonresident Withholding

Sample Form 592B printable pdf download

California Form 592B Draft Resident And Nonresident Withholding Tax

Form 592B Download Fillable PDF or Fill Online Resident and

Form 592 Includes A Schedule Of Payees Section, On Side 2, That Requires The.

The Withholding That You Enter At The Federal Level Doesn't Transfer To Form 568.

Individuals Or Business Entities Who Are.

Related Post: