California Form 593 Instructions

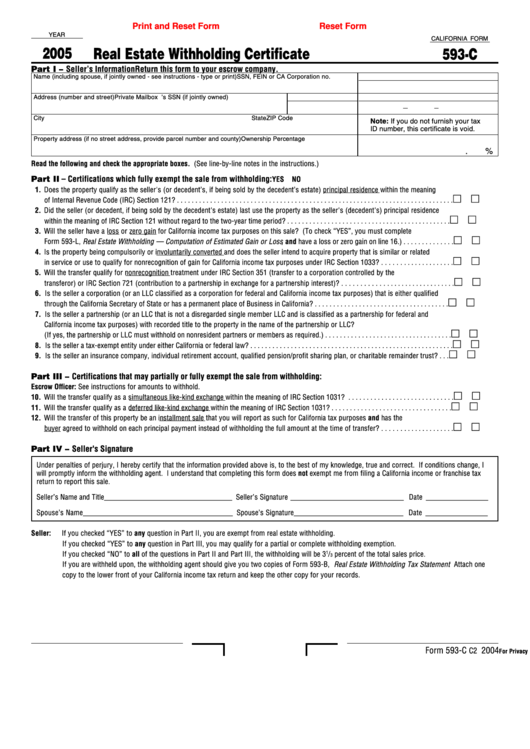

California Form 593 Instructions - Provide a copy of form 593 to the seller. From the ftb 2024 instructions for form 593: Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation methods. Use the forms and instructions in this booklet for real estate sales or transfers closing in 2019. Entering california real estate withholding on. Your california real estate withholding has to be entered on both the state and the federal return. Explain how and when form 593 is to be submitted? A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Learn about the requirements and exemptions of california real estate withholding, a prepayment of income tax due from sellers on the gain from the sale of real property. Check all boxes that apply to the property being sold or transferred. Use the forms and instructions in this booklet for real estate sales or transfers closing in 2019. Explain how and when form 593 is to be submitted? See the following links for form instructions: Use form 593 to report real estate withholding on sales closing in 2011, on installment payments made in 2011, or on exchanges that were completed or failed in 2011. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate transaction. Start with your federal return. The forms should be submitted by mail. From the ftb 2024 instructions for form 593: Learn how to complete form 593, real estate withholding statement, for taxable years beginning on or after january 1, 2015. As of january 1, 2020, california real estate withholding changed. For more details, refer to the form 593 instructions and ftb publication 1016, real estate withholding guidelines. The forms should be submitted by mail. • the property qualifies as the seller’s (or decedent's, if sold. The buyer's personal details, similar to above. Learn how to complete form 593, real estate withholding statement, for taxable years beginning on or after january. Steps to fill out the form 593: Explain how and when form 593 is to be submitted? We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate transaction. Entering california real estate withholding on. Determine whether you qualify for a full withholding exemption. The buyer's personal details, similar to above. Check all boxes that apply to the property being sold or transferred. Entering california real estate withholding on. The property qualifies as the seller’s principal residence. Your california real estate withholding has to be entered on both the state and the federal return. Use form 593 to report real estate withholding on sales closing in 2011, on installment payments made in 2011, or on exchanges that were completed or failed in 2011. Determine whether you qualify for a full withholding exemption. Learn how to complete form 593, real estate withholding statement, for taxable years beginning on or after january 1, 2015. From the. Can they be submitted in bulk each month or should they be sent in individually? Updated 2 years ago by greg hatfield. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation methods. For more details,. Explain how and when form 593 is to be submitted? A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Start with your federal return. See the following links for form instructions: If your turbotax navigation looks different from what’s. See the following links for form instructions: We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate transaction. Updated 2 years ago by greg hatfield. Find out the withholding requirements, exemptions, methods, and rates for different types of real estate transactions in california. Steps to fill out the form 593: Find out the withholding requirements, exemptions, methods, and rates for different types of real estate transactions in california. Determine whether you qualify for a full withholding exemption. For more information about real estate withholding, get ftb publication 1016, real estate. Entering california real estate withholding on. Provide a copy of form 593 to the seller. Determine whether you qualify for a full withholding exemption. Learn about the requirements and exemptions of california real estate withholding, a prepayment of income tax due from sellers on the gain from the sale of real property. Enter your personal information, including name, ssn or itin, address, city, state, and zip code. For more details, refer to the form 593. Determine whether you qualify for a full withholding exemption. Start with your federal return. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate transaction. Entering california real estate withholding on. The forms should be submitted by mail. From the ftb 2024 instructions for form 593: See the following links for form instructions: Find out how to file. Select the links below for solutions to frequently asked questions on entering form 593 into the dispositions screen in an individual return. For more information about real estate withholding, get ftb publication 1016, real estate. Use form 593 to report real estate withholding on sales closing in 2011, on installment payments made in 2011, or on exchanges that were completed or failed in 2011. Steps to fill out the form 593: A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. The property qualifies as the seller’s principal residence. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation methods. Start with your federal return. If your turbotax navigation looks different from what’s. The forms should be submitted by mail. Check all boxes that apply to the property being sold or transferred. As of january 1, 2020, california real estate withholding changed. The buyer's personal details, similar to above.California Form 593C Draft Real Estate Withholding Certificate

California Form 593E Draft Real Estate Withholding Computation Of

California Form 593 2024 Instructions Inna Rennie

California Form 593 2025 Instructions Robert C Hill

California Form 593 2024 Instructions Inna Rennie

Form 593 2018 Fill Out, Sign Online and Download Fillable PDF

Instructions For Form 593 Real Estate Withholding Tax Statement

Instructions For Form 593I Real Estate Withholding Installment Sale

Fillable California Form 593C Real Estate Withholding Certificate

Form JV593 Fill Out, Sign Online and Download Fillable PDF

Learn About The Requirements And Exemptions Of California Real Estate Withholding, A Prepayment Of Income Tax Due From Sellers On The Gain From The Sale Of Real Property.

Check All Boxes That Apply To The Property Being Sold Or Transferred.

Updated 2 Years Ago By Greg Hatfield.

Find Out The Withholding Requirements, Exemptions, Methods, And Rates For Different Types Of Real Estate Transactions In California.

Related Post: