Cancel Ein Letter Template

Cancel Ein Letter Template - Up to 40% cash back to cancel your ein and close your irs business account, you need to send us a letter that includes: To cancel your ein and close your irs business account, you need to send us a letter that includes: Simplify the process and stay compliant. At the same time, you might want to cancel your current ein number for different reasons such as dissolving your business, retiring, transferring your ownership rights, or. Cancellation due to change in coverage needs [your name] [your address] [city, state zip] [email address] [phone number] [date] [insurance company name]. Pick the web sample in the library. Learn how to cancel an employer identification number (ein) with the irs by downloading and mailing a cancellation letter. Type all required information in the necessary fillable areas. The complete legal name of the business. Simple templates and expert tips included! Type all required information in the necessary fillable areas. Please let me know if you have any questions or need anything else. Simple templates and expert tips included! This letter must be precise, complete, and adhere to the irs’s. The complete legal name of the business; Pick the web sample in the library. Cancellation due to change in coverage needs [your name] [your address] [city, state zip] [email address] [phone number] [date] [insurance company name]. Find out the benefits, steps, and contact. Comply with our simple steps to get your close business account/cancel ein ready rapidly: Instead of canceling your ein, what the irs can do is close your tax account. Learn how to cancel an employer identification number (ein) with the irs by downloading and mailing a cancellation letter. Up to $50 cash back the business or organization that is legally required to file for an employer identification number (ein) must file a letter of cancellation to the internal revenue. Pick the web sample in the library. The complete legal. Simple templates and expert tips included! Need to close your business? Type all required information in the necessary fillable areas. Simplify the process and stay compliant. Please let me know if you have any questions or need anything else. The complete legal name of the business. To do this, send the agency a letter that includes your company's complete legal name, the ein, the business. Instead of canceling your ein, what the irs can do is close your tax account. Simple templates and expert tips included! Please let me know if you have any questions or need anything else. To do this, send the agency a letter that includes your company's complete legal name, the ein, the business. Find out the benefits, steps, and contact. If you don’t meet the criteria to close your exempt organization, see terminate your exempt organization or call. Up to $50 cash back the business or organization that is legally required to file for. Please close the business account associated with the ein listed above. This letter must be precise, complete, and adhere to the irs’s. Please let me know if you have any questions or need anything else. If you don’t meet the criteria to close your exempt organization, see terminate your exempt organization or call. I am no longer using this account. Type all required information in the necessary fillable areas. Up to 40% cash back to cancel your ein and close your irs business account, you need to send us a letter that includes: To cancel your ein and close your irs business account, you need to send us a letter that includes: Simple templates and expert tips included! Cancellation due. Comply with our simple steps to get your close business account/cancel ein ready rapidly: Pick the web sample in the library. To cancel your ein and close your irs business account, you need to send us a letter that includes: Need to close your business? Instead of canceling your ein, what the irs can do is close your tax account. The complete legal name of the business. The complete legal name of the business; To cancel your ein and close your irs business account, you need to send us a letter that includes: Please let me know if you have any questions or need anything else. Simplify the process and stay compliant. Cancellation due to change in coverage needs [your name] [your address] [city, state zip] [email address] [phone number] [date] [insurance company name]. I am no longer using this account. Instead of canceling your ein, what the irs can do is close your tax account. To deactivate your ein, send us a letter with: At the same time, you might want. Up to $50 cash back the business or organization that is legally required to file for an employer identification number (ein) must file a letter of cancellation to the internal revenue. Find out the benefits, steps, and contact. Pick the web sample in the library. If you don’t meet the criteria to close your exempt organization, see terminate your exempt. This letter must be precise, complete, and adhere to the irs’s. The complete legal name of the business. Up to $50 cash back the business or organization that is legally required to file for an employer identification number (ein) must file a letter of cancellation to the internal revenue. Instead of canceling your ein, what the irs can do is close your tax account. Find out the benefits, steps, and contact. Browse 3 irs letter templates collected for any of your needs. Up to 40% cash back to cancel your ein and close your irs business account, you need to send us a letter that includes: Here i will give you a sample letter and answer all faqs regarding the ein cancellation letter. Comply with our simple steps to get your close business account/cancel ein ready rapidly: Please close the business account associated with the ein listed above. To cancel your ein and close your irs business account, you need to send us a letter that includes: At the same time, you might want to cancel your current ein number for different reasons such as dissolving your business, retiring, transferring your ownership rights, or. Cancellation due to change in coverage needs [your name] [your address] [city, state zip] [email address] [phone number] [date] [insurance company name]. To do this, send the agency a letter that includes your company's complete legal name, the ein, the business. Learn how to cancel an employer identification number (ein) with the irs by downloading and mailing a cancellation letter. If you don’t meet the criteria to close your exempt organization, see terminate your exempt organization or call.47 Powerful Cancellation Letter Sample RedlineSP

47+ Cancellation Letter Sample RedlineSP

How to Cancel Your EIN with the IRS YouTube

Cancel Ein Sample Letter

13+ Sample Cancellation Letters Writing Letters Formats & Examples

Sample Account Cancellation Letter (with Template)

47+ Cancellation Letter Sample RedlineSP

10+ Cancellation Letter Template Format, Sample & Example

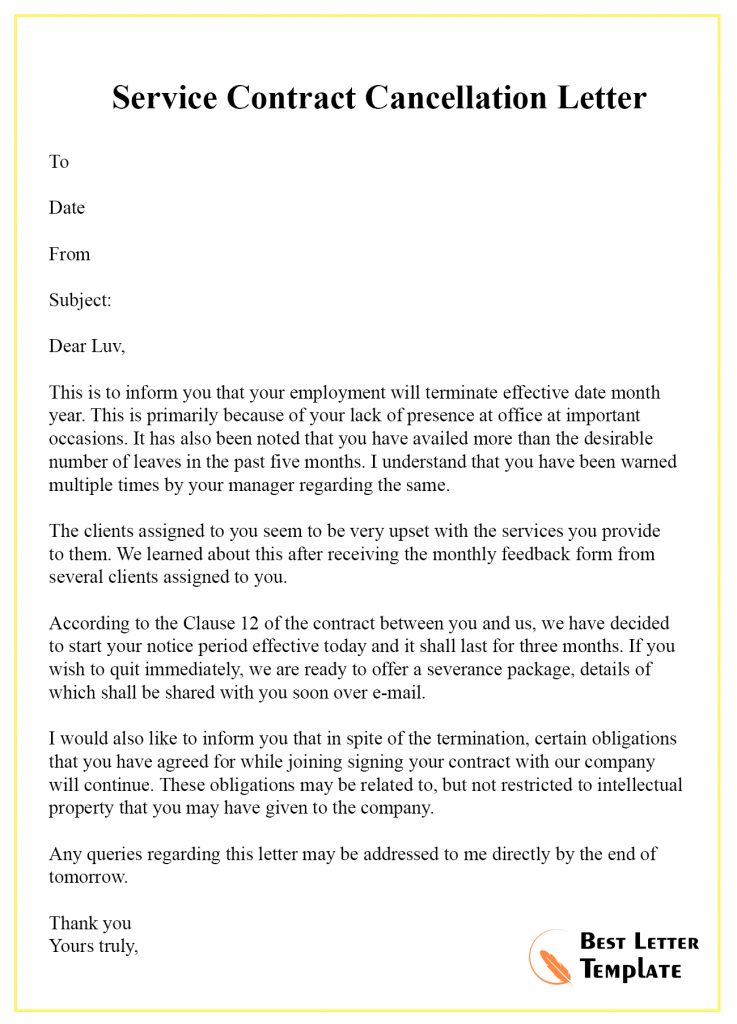

Cancellation Letter Template of Contract Format, Sample & Example

Free Printable Cancellation Letter Templates [PDF, Word]

Type All Required Information In The Necessary Fillable Areas.

Submitting A Meticulously Prepared Letter To The Irs Is The Primary Method For Requesting Ein Cancellation.

I Am No Longer Using This Account.

Need To Close Your Business?

Related Post:

![Free Printable Cancellation Letter Templates [PDF, Word]](https://i2.wp.com/www.typecalendar.com/wp-content/uploads/2023/05/letter-to-cancel-contract.jpg?gid=75)