Chase Payable On Death Form

Chase Payable On Death Form - Understanding the significance of this question, chase provides two primary options. Savings bonds) that allow for the money remaining in the account to pass directly to. They will be payable on death. Payable on death accounts are bank accounts (checking, savings, money market, cds, u.s. Learn why you should designate a beneficiary and how to select one. A person designated to receive money or property from a person who has died. These accounts name a beneficiary. If you have more than one account, a. Beneficiaries won't have access to the account while she is living. If the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. Payable on death accounts are bank accounts (checking, savings, money market, cds, u.s. If you have more than one account, a. Understanding the significance of this question, chase provides two primary options. Call the bank directly to ask how you can designate beneficiaries for each of your accounts. This designation applies only to the account identified below. Beneficiaries won't have access to the account while she is living. For example, someone can be designated as a beneficiary in a will or on a bank account (e.g.,. Chase onlinelets you manage your chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. Contact the three major credit bureaus. If the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. Contact the three major credit bureaus. A beneficiary is an entity or individual that accepts assets left by another individual. They will be payable on death. Savings bonds) that allow for the money remaining in the account to pass directly to. But have you ever considered what happens to your chase bank account when you die? A pod simplifies the transfer process and avoids the need for. Chase onlinelets you manage your chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. A certified copy of the death certificate is generally available from the funeral director who handled the deceased customer’s funeral arrangements, or from the registry of births, deaths. A person designated to receive money or property from a person who has died. A certified copy of the death certificate is generally available from the funeral director who handled the deceased customer’s funeral arrangements, or from the registry of births, deaths and. A pod simplifies the transfer process and avoids the need for. Learn why you should designate a. A pod simplifies the transfer process and avoids the need for. To prevent identity theft, send copies of the death certificate to equifax, experian and transunion. These accounts name a beneficiary. Call the bank directly to ask how you can designate beneficiaries for each of your accounts. They will be payable on death. Learn how to set up your own pod account. Payable on death accounts are bank accounts (checking, savings, money market, cds, u.s. For example, someone can be designated as a beneficiary in a will or on a bank account (e.g.,. Savings bonds) that allow for the money remaining in the account to pass directly to. This designation applies only to. A certified copy of the death certificate is generally available from the funeral director who handled the deceased customer’s funeral arrangements, or from the registry of births, deaths and. If you have more than one account, a. Contact the three major credit bureaus. To learn more, visit the banking education. A pod simplifies the transfer process and avoids the need. These accounts name a beneficiary. Understanding the significance of this question, chase provides two primary options. Call the bank directly to ask how you can designate beneficiaries for each of your accounts. For example, someone can be designated as a beneficiary in a will or on a bank account (e.g.,. Contact the three major credit bureaus. Payable on death accounts are bank accounts (checking, savings, money market, cds, u.s. This designation applies only to the account identified below. For example, someone can be designated as a beneficiary in a will or on a bank account (e.g.,. Learn how to set up your own pod account. A certified copy of the death certificate is generally available from. Learn how to set up your own pod account. These accounts name a beneficiary. Contact the three major credit bureaus. Savings bonds) that allow for the money remaining in the account to pass directly to. If you have more than one account, a. Call the bank directly to ask how you can designate beneficiaries for each of your accounts. Beneficiaries won't have access to the account while she is living. But have you ever considered what happens to your chase bank account when you die? Contact the three major credit bureaus. Chase onlinelets you manage your chase accounts, view statements, monitor activity, pay. Learn how to set up your own pod account. They will be payable on death. If you have more than one account, a. Contact the three major credit bureaus. Learn why you should designate a beneficiary and how to select one. Chase onlinelets you manage your chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. Payable on death accounts are bank accounts (checking, savings, money market, cds, u.s. A beneficiary can claim bank account. Call the bank directly to ask how you can designate beneficiaries for each of your accounts. A beneficiary is an entity or individual that accepts assets left by another individual. Understanding the significance of this question, chase provides two primary options. To learn more, visit the banking education. To prevent identity theft, send copies of the death certificate to equifax, experian and transunion. If the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. A pod simplifies the transfer process and avoids the need for. A person designated to receive money or property from a person who has died.Fillable Online PAYABLE ON DEATH (POD) BENEFICIARY DESIGNATION FORM

Fillable Online Payable on Death UPDATE FORM.doc Fax Email Print

Payable on Death (POD) Account Benefits and Drawbacks

Fillable Online Payable On Death Beneficiary Form Chase. Payable On

Fillable Online Claiming Money From a PayableonDeath Bank Account Fax

Fillable Online Transfer on Death Agreement (PDF) Chase Bank Fax

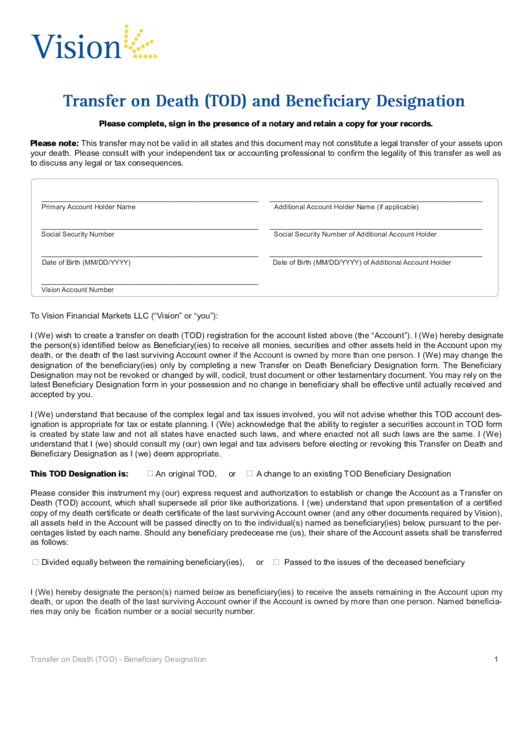

Fillable Transfer On Death (Tod) And Beneficiary Designation printable

Fillable Online What Does "Payable on Death" (POD) Mean? Fax Email

Free Printable Transfer On Death Deed Form Printable vrogue.co

Fillable Online How to Set Up a Payable On Death Account Fax Email

These Accounts Name A Beneficiary.

A Certified Copy Of The Death Certificate Is Generally Available From The Funeral Director Who Handled The Deceased Customer’s Funeral Arrangements, Or From The Registry Of Births, Deaths And.

This Designation Applies Only To The Account Identified Below.

For Example, Someone Can Be Designated As A Beneficiary In A Will Or On A Bank Account (E.g.,.

Related Post:

:max_bytes(150000):strip_icc()/payableondeath.asp_Final-666832193d1445b19aa1f3b2e9347ae3.png)