Code Eh On Form 8949

Code Eh On Form 8949 - Form 8949 was designed for reporting capital gains and losses. Form 8949 is used to list all capital gain and loss transactions. Paperless solutionsedit on any devicepaperless workflowcancel anytime Determine if the sale is taxable:• first, check if the. When you use this code, it indicates that you received the cryptocurrency as a result of a hard fork. These adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. To report capital gains and losses on form 8949 using the eh code, you should list each transaction separately, including the date acquired and sold, the proceeds, cost. In the instructions for irs form 8949, it lists out a table of codes that you can put on the form. If more than one codes applies, enter all the codes that apply in alphabetical. Use form 8949 to report sales and exchanges of capital assets. Code h and the exclusion only apply if you have a gain on the sale. In the instructions for irs form 8949, it lists out a table of codes that you can put on the form. For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. Using code eh on form 8949 for cryptocurrency transactions has specific tax implications. Use form 8949 to report sales and exchanges of capital assets. Report on form 8949 the gain or loss on the sale or exchange by a nonresident alien individual, foreign trust, foreign estate, or foreign corporation of an interest in a partnership that is. This entry will be included on form 8949, column (f). Enter the appropriate form 8949 code(s). Form 8949 was designed for reporting capital gains and losses. Enter e if selling expenses or option premiums are not reflected on the statement received. For a given tax year, the information on form 8949 covers all sales and exchanges of capital assets, including stocks,. For most transactions, you don't need to complete columns (f) and (g) and can leave them blank; When you use this code, it indicates that you received the cryptocurrency as a result of a hard fork. Form 8949, columns (f). This entry will be included on form 8949, column (f). I can guide you through completing form 8949 to report your home sale for schedule d and form 1040. Form 8949, columns (f) and (g) codes. Code eh on form 8949 applies to taxpayers who sell their primary residence and must report gains exceeding irs exclusion limits—$250,000 for single filers. Form 8949 was designed for reporting capital gains and losses. If you enter eh in column (f) of form 8949, it indicates that you are electing to report a transaction for which basis was not reported to the irs and for which you are making. These adjustment codes are included on form 8949, which will print along with schedule d. For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. Paperless solutionsedit on any devicepaperless workflowcancel anytime Determine if the sale is taxable:• first, check if the. Enter e if selling expenses or option premiums are not reflected on the statement received. Use form 8949 to report sales and exchanges of capital assets. The adjustment amount will also be listed on form 8949 and. For most transactions, you don't need to complete columns (f) and (g) and can leave them blank; Form 8949 was designed for reporting capital gains and losses. Code l applies, and column (h) is zero, because you cannot claim a loss on your personal home. Paperless solutionsedit on any. Enter the difference between the proceeds reported and the proceeds less expenses in. Code h and the exclusion only apply if you have a gain on the sale. Determine if the sale is taxable:• first, check if the. Let’s break down the process.1. I can guide you through completing form 8949 to report your home sale for schedule d and. If more than one codes applies, enter all the codes that apply in alphabetical. In the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Form 8949 was designed for reporting capital gains and losses. However, there's a number of situations that. Use form 8949 to report sales and exchanges. Enter e if selling expenses or option premiums are not reflected on the statement received. Code eh on form 8949 applies to taxpayers who sell their primary residence and must report gains exceeding irs exclusion limits—$250,000 for single filers and $500,000 for. When you use this code, it indicates that you received the cryptocurrency as a result of a hard. For a given tax year, the information on form 8949 covers all sales and exchanges of capital assets, including stocks,. The adjustment amount will also be listed on form 8949 and. Use form 8949 to report sales and exchanges of capital assets. Form 8949 was designed for reporting capital gains and losses. Using code eh on form 8949 for cryptocurrency. Enter the appropriate form 8949 code(s). Form 8949 was designed for reporting capital gains and losses. Report on form 8949 the gain or loss on the sale or exchange by a nonresident alien individual, foreign trust, foreign estate, or foreign corporation of an interest in a partnership that is. Determine if the sale is taxable:• first, check if the. Paperless. Let’s break down the process.1. Form 8949, columns (f) and (g) codes. If more than one codes applies, enter all the codes that apply in alphabetical. Code l applies, and column (h) is zero, because you cannot claim a loss on your personal home. However, there's a number of situations that. For most transactions, you don't need to complete columns (f) and (g) and can leave them blank. To report capital gains and losses on form 8949 using the eh code, you should list each transaction separately, including the date acquired and sold, the proceeds, cost. I can guide you through completing form 8949 to report your home sale for schedule d and form 1040. Up to $9 cash back code eh on form 8949 part ii indicates exclusion of gain from sale of main home. this code is used when reporting a home sale that qualifies for the. Enter the appropriate form 8949 code(s). Form 8949 is used to list all capital gain and loss transactions. Code eh on form 8949 applies to taxpayers who sell their primary residence and must report gains exceeding irs exclusion limits—$250,000 for single filers and $500,000 for. When you use this code, it indicates that you received the cryptocurrency as a result of a hard fork. Use form 8949 to report sales and exchanges of capital assets. Code h and the exclusion only apply if you have a gain on the sale. Enter e if selling expenses or option premiums are not reflected on the statement received.Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Free Fillable Form 8949 Printable Forms Free Online

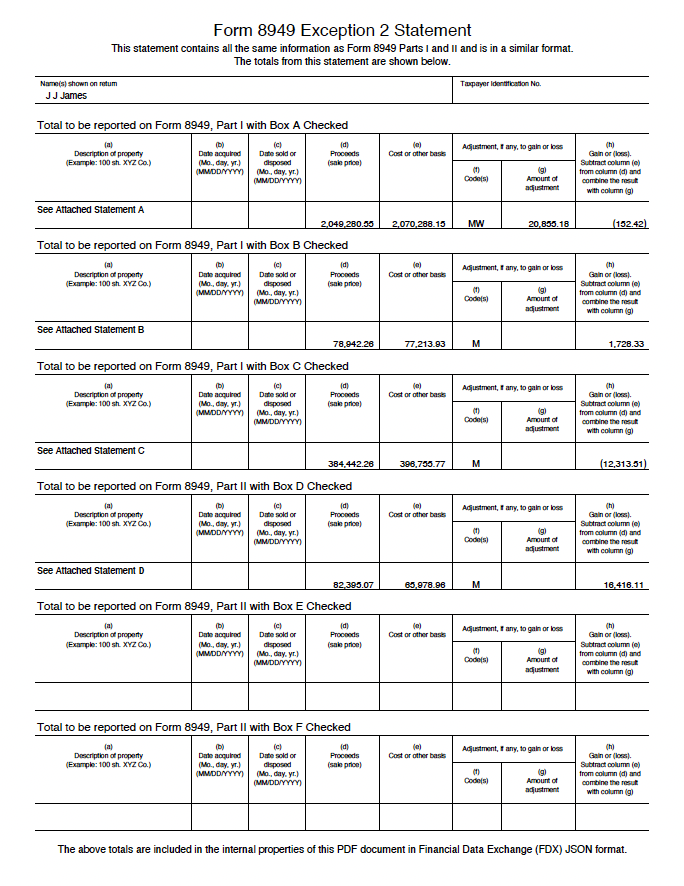

Form 8949 How to Report Capital Gains and Losses

2022 8949 IRS Tax Form Released EquityStat Blog

My company's ESPP is not taxqualified under Section 423 of the

IRS Crypto Tax Form 8949 How to Fill Out Correctly in 2023

How to Integrate Outputs with FreeTaxUSA

How to Import Intelligent Form 8949 Statements into Tax Software

In the following Form 8949 example,the highlighted section below shows

IRS Schedule 3 Instructions Additional Credits & Payments

For A Given Tax Year, The Information On Form 8949 Covers All Sales And Exchanges Of Capital Assets, Including Stocks,.

Report On Form 8949 The Gain Or Loss On The Sale Or Exchange By A Nonresident Alien Individual, Foreign Trust, Foreign Estate, Or Foreign Corporation Of An Interest In A Partnership That Is.

For The Main Home Sale Exclusion, The Code Is H.

Paperless Solutionsedit On Any Devicepaperless Workflowcancel Anytime

Related Post: