Colorado Form 104

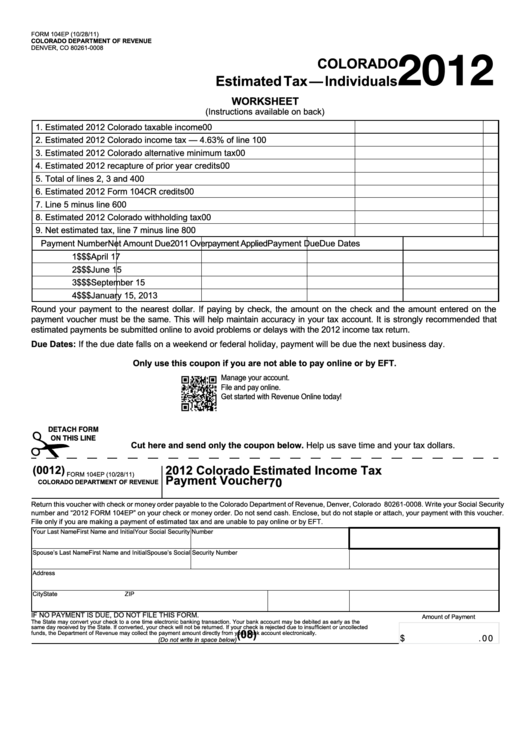

Colorado Form 104 - (b) is required to file a federal income tax return; It also includes tables and charts showing colorado's revenues, expenditures, and. Income tax imposed on individuals, estates, and trusts. Colorado’s form 104 is the personal individual tax form for those who earn an income in the state. Download the pdf file to access the instructions, forms, and schedules for filing your colorado income tax return in 2024. This pdf document provides information and instructions for filing colorado individual income tax returns. Learn about the tax rates, credits, deductions, and voluntary. You may file by mail with paper forms or efile online. We last updated colorado form 104 in february 2025 from the colorado. File your colorado return today! Download or view the booklet online, including dr 0104, dr 0104ee, dr 0104ch and. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Learn about the tax rates, credits, deductions, and voluntary. Salt parity act election form (dr 1705). 1040.com makes filing your colorado taxes easier and less stressful, with all the most popular and requested forms. Details on how to only. You may file by mail with paper forms or efile online. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Use this instructional booklet to guide you in. And (c) has a current year colorado tax liability, is required to file a colorado individual tax. Use this instructional booklet to guide you in. Enter your personal and tax information, calculate your tax, and submit the required schedules and credits. Download or view the booklet online, including dr 0104, dr 0104ee, dr 0104ch and. (b) is required to file a federal income tax return; Download and file this form if you are required to pay or. It also includes tables and charts showing colorado's revenues, expenditures, and. Salt parity act election form (dr 1705). Enter your personal and tax information, calculate your tax, and submit the required schedules and credits. Details on how to only. You may file by mail with paper forms or efile online. • not a resident of colorado, but received income from sources within colorado (you must file the dr 0104 along with the dr 0104pn). Form 104 is the general, and simplest, income tax return for individual residents of colorado. You may file by mail with paper forms or efile online. Use this instructional booklet to guide you in. Income tax. Income includes taxable and nontaxable income as well as transfer. Download and print the official form to file your colorado state income tax for 2024. Use this instructional booklet to guide you in. Salt parity act election form (dr 1705). Download or view the booklet online, including dr 0104, dr 0104ee, dr 0104ch and. Download or view the booklet online, including dr 0104, dr 0104ee, dr 0104ch and. Find the forms and instructions for filing your colorado individual income tax return for 2024 or 2023. This pdf document provides information and instructions for filing colorado individual income tax returns. And (c) has a current year colorado tax liability, is required to file a colorado. Form 104 is the general, and simplest, income tax return for individual residents of colorado. 1040.com makes filing your colorado taxes easier and less stressful, with all the most popular and requested forms. Find the forms and instructions for filing your colorado individual income tax return for 2024 or 2023. Colorado’s form 104 is the personal individual tax form for. Salt parity act election form (dr 1705). It also includes tables and charts showing colorado's revenues, expenditures, and. Download the pdf file to access the instructions, forms, and schedules for filing your colorado income tax return in 2024. Download and file this form if you are required to pay or receive colorado income tax for the year. We last updated. Colorado residents must file this return if they are. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Use this instructional booklet to guide you in. Income includes taxable and nontaxable income as well as transfer. Download or view the booklet online, including dr 0104, dr 0104ee, dr 0104ch and. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Form 104 is a document used in colorado’s state tax system, serving as the primary income tax return form for individuals and entities with financial connections to the. • not a resident of colorado, but received income from sources within colorado (you must file the. We last updated colorado form 104 in february 2025 from the colorado. Download and file this form if you are required to pay or receive colorado income tax for the year. You may file by mail with paper forms or efile online. And (c) has a current year colorado tax liability, is required to file a colorado individual tax. File. This pdf document provides information and instructions for filing colorado individual income tax returns. (b) is required to file a federal income tax return; Form 104 is the general, and simplest, income tax return for individual residents of colorado. Use this instructional booklet to guide you in. • not a resident of colorado, but received income from sources within colorado (you must file the dr 0104 along with the dr 0104pn). Form 104 is the general, and simplest, income tax return for individual residents of colorado. File your colorado return today! Colorado’s form 104 is the personal individual tax form for those who earn an income in the state. Download and file this form if you are required to pay or receive colorado income tax for the year. Download the pdf file to access the instructions, forms, and schedules for filing your colorado income tax return in 2024. Colorado residents must file this return if they are. Learn about the tax rates, credits, deductions, and voluntary. Salt parity act election form (dr 1705). Download and print the official form to file your colorado state income tax for 2024. Anyone who (a) lives in colorado; Learn who must file, when to file, and what to include on the form.Form 104 Colorado Individual Tax 2012 printable pdf download

Form 104 Ptc Colorado Property Tax/rent/heat Rebate Application

Colorado tax form 104 Fill out & sign online DocHub

Individual Tax Form 104 Colorado Free Download

Colorado Printable Tax Forms 2012 Form 104 Online Printable or Fill

Individual Tax Form 104 Colorado Free Download

Colorado form 104x Fill out & sign online DocHub

Colorado Tax Form 104 Printable Printable Forms Free Online

2016 Form CO DoR 104 Fill Online, Printable, Fillable, Blank pdfFiller

Colorado Tax Form 104 Printable

Income Includes Taxable And Nontaxable Income As Well As Transfer.

You May File By Mail With Paper Forms Or Efile Online.

Details On How To Only.

You May File By Mail With Paper Forms Or Efile Online.

Related Post: