Ct Conveyance Tax Form

Ct Conveyance Tax Form - Real estate conveyance tax information myctrec is now available to town clerks and. Learn about connecticut's conveyance tax exemptions, eligibility requirements,. Complete the conveyance information section by entering the date conveyed and selecting the. This is a pdf form for reporting and paying the state and municipal real estate conveyance tax. This form is used to report and pay the state tax on the transfer of real property in connecticut. The connecticut department of revenue services (drs) has finalized a new ct form op. If the conveyed property is located in more than one municipality, complete a tax return. Real estate conveyance tax forms coming soon: Learn how to calculate and pay connecticut's transfer tax on real property. Visit the drs website at www.ct.gov/drs to preview and download. Real estate conveyance tax information myctrec is now available to town clerks and. Download and print the official form for reporting and paying the conveyance tax on real estate. Who must file a real estate conveyance tax return. Learn about connecticut's conveyance tax exemptions, eligibility requirements,. Visit the drs website at www.ct.gov/drs to preview and download. This is a pdf form for reporting and paying the state and municipal real estate conveyance tax. Complete the conveyance information section by entering the date conveyed and selecting the. The connecticut department of revenue services (drs) has finalized a new ct form op. A grantor, grantor’s attorney or grantor’s. Learn how to calculate and pay connecticut's transfer tax on real property. Complete the conveyance information section by entering the date conveyed and selecting the. Any document that registers a transfer of property is subject to a conveyance tax to the state of. Download and print the official form for reporting and paying the conveyance tax on real estate. This is a pdf form for reporting and paying the conveyance tax on. Complete the conveyance information section by entering the date conveyed and selecting the. Download and print the official form for reporting and paying real estate conveyance tax in. This is a pdf form for reporting and paying the state and municipal real estate conveyance tax. Download and print the official form for reporting and paying the conveyance tax on real. Any document that registers a transfer of property is subject to a conveyance tax to the state of. Learn how to calculate and pay connecticut's transfer tax on real property. This is a pdf form for reporting and paying the state and municipal real estate conveyance tax. This form is used to report and pay the state tax on the. If the conveyed property is located in more than one municipality, complete a tax return. Download and print the official form for reporting and paying real estate conveyance tax in. Any document that registers a transfer of property is subject to a conveyance tax to the state of. A grantor, grantor’s attorney or grantor’s. Learn how to calculate and pay. Visit the drs website at www.ct.gov/drs to preview and download. Download and print the official form for reporting and paying real estate conveyance tax in. This is a pdf form for reporting and paying the state and municipal real estate conveyance tax. The connecticut department of revenue services (drs) has finalized a new ct form op. Complete the conveyance information. Learn about connecticut's conveyance tax exemptions, eligibility requirements,. The connecticut department of revenue services (drs) has finalized a new ct form op. Download and print the official form for reporting and paying real estate conveyance tax in. This form is used to report and pay the state tax on the transfer of real property in connecticut. Real estate conveyance tax. The connecticut department of revenue services (drs) has finalized a new ct form op. Real estate conveyance tax forms coming soon: Learn about connecticut's conveyance tax exemptions, eligibility requirements,. Complete the conveyance information section by entering the date conveyed and selecting the. If the conveyed property is located in more than one municipality, complete a tax return. Real estate conveyance tax information myctrec is now available to town clerks and. If the conveyed property is located in more than one municipality, complete a tax return. Real estate conveyance tax forms coming soon: Any document that registers a transfer of property is subject to a conveyance tax to the state of. Who must file a real estate conveyance. Complete the conveyance information section by entering the date conveyed and selecting the. This is a pdf form for reporting and paying the conveyance tax on the sale or transfer of real. Visit the drs website at www.ct.gov/drs to preview and download. Real estate conveyance tax forms coming soon: Who must file a real estate conveyance tax return. If the conveyed property is located in more than one municipality, complete a tax return. Visit the drs website at www.ct.gov/drs to preview and download. If the conveyed property is located in more than one municipality, complete a tax return. Download and print the official form for reporting and paying the conveyance tax on real estate. The connecticut department of. Download and print the official form for reporting and paying the conveyance tax on real estate. Learn about connecticut's conveyance tax exemptions, eligibility requirements,. Any document that registers a transfer of property is subject to a conveyance tax to the state of. Real estate conveyance tax information myctrec is now available to town clerks and. Visit the drs website at www.ct.gov/drs to preview and download. This is a pdf form for reporting and paying the conveyance tax on the sale or transfer of real. This form is used to report and pay the state tax on the transfer of real property in connecticut. If the conveyed property is located in more than one municipality, complete a tax return. A grantor, grantor’s attorney or grantor’s. This is a pdf form for reporting and paying the state and municipal real estate conveyance tax. Real estate conveyance tax forms coming soon: Download and print the official form for reporting and paying real estate conveyance tax in. Who must file a real estate conveyance tax return.Fillable Form P64a Conveyance Tax Certificate printable pdf download

Form Op236 Real Estate Conveyance Tax Return printable pdf download

Connecticut Real Estate Conveyance Tax Statement DocHub

Form OP236 Fill Out, Sign Online and Download Fillable PDF

Download Instructions for Form OP236 Connecticut Real Estate

Download Instructions for Form OP236 Connecticut Real Estate

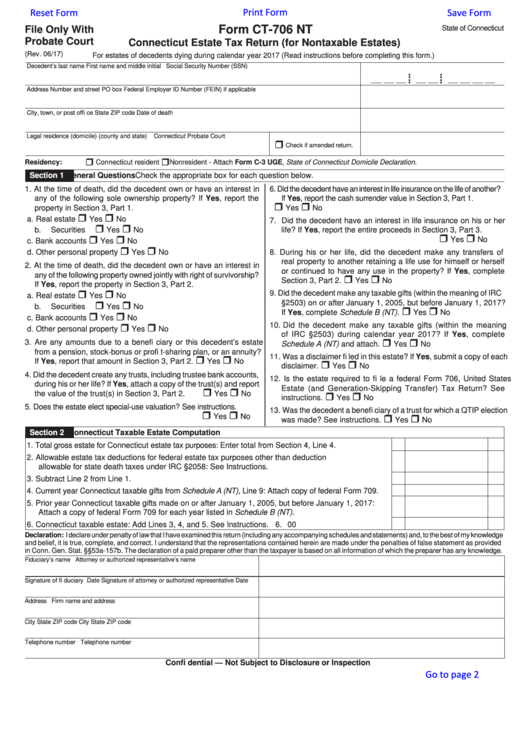

Ct 706 Nt Fillable Form Printable Forms Free Online

Line Instructions For Form Op236 Real Estate Conveyance Tax Return

Ct Conveyance Tax Form Printable Form, Templates and Letter

FREE 22 Sample Tax Forms In PDF Excel MS Word

Learn How To Calculate And Pay Connecticut's Transfer Tax On Real Property.

The Connecticut Department Of Revenue Services (Drs) Has Finalized A New Ct Form Op.

If The Conveyed Property Is Located In More Than One Municipality, Complete A Tax Return.

Complete The Conveyance Information Section By Entering The Date Conveyed And Selecting The.

Related Post: