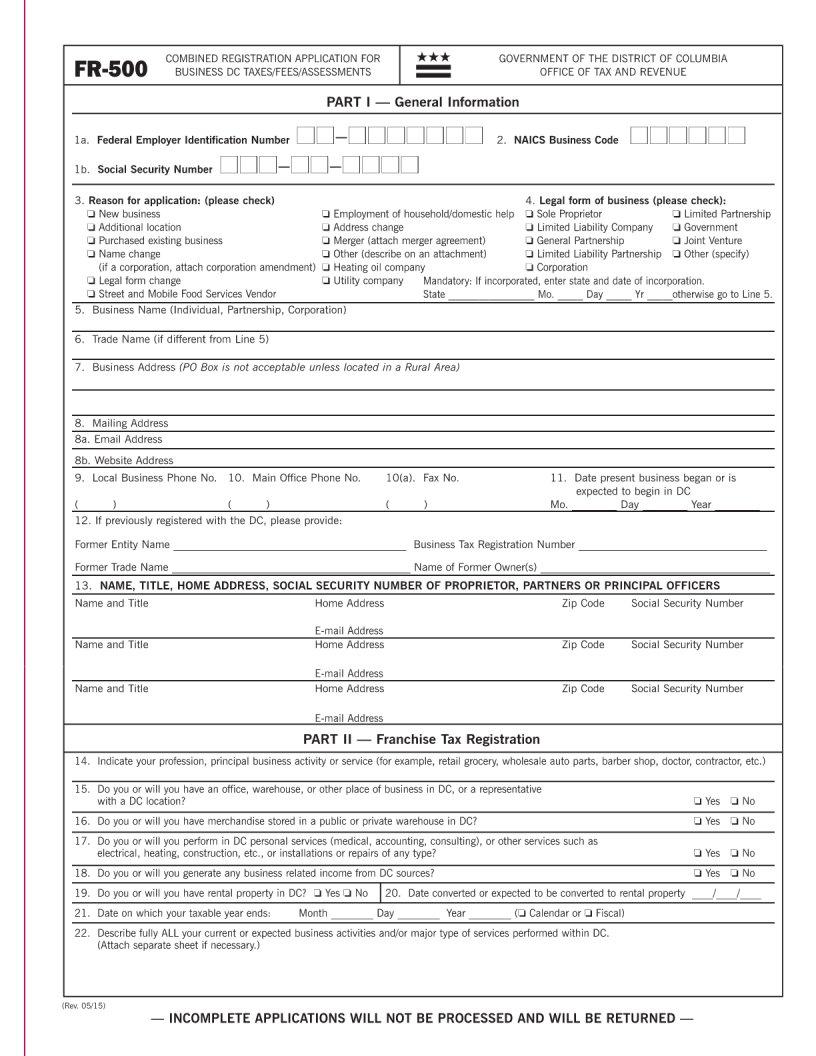

Dc Form Fr 500

Dc Form Fr 500 - You will need the following information to complete the online tax registration form: The office of tax and revenue. What should i do to register as an employer with the district's unemployment compensation program? There are a few things you should be aware of before you begin the relatively simple procedure of. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. Trade names must be first registered with the department of consumer and. On the mytax.dc.gov homepage, locate the business section. Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you. Go to the dc business licensing portal to get more information about corporate registration and business licensing requirements. The office of tax and revenue. Trade names must be first registered with the department of consumer and. There is no charge for registering. You will need the following information to complete the online tax registration form: Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you. On the mytax.dc.gov homepage, locate the business section. What should i do to register as an employer with the district's unemployment compensation program? Review items needed to register and click next. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. Go to the dc business licensing portal to get more information about corporate registration and business licensing requirements. For information on sales by street vendors.) you may. Trade names must be first registered with the department of consumer and. There is no charge for registering. The office of tax and revenue. Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you. There is no charge for registering. Trade names must be first registered with the department of consumer and. Review items needed to register and click next. There are a few things you should be aware of before you begin the relatively simple procedure of. Businesses in dc are required to submit the fr 500 tax registration form. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. Businesses in dc are required to submit the fr 500 tax registration form. The office of tax and revenue. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. Your federal employer identification number (fein),. Review items needed to register and click next. The purpose of this form is to gather information on the business, such as ownership, location,. There is no charge for registering. What should i do to register as an employer with the district's unemployment compensation program? Businesses in dc are required to submit the fr 500 tax registration form. On the mytax.dc.gov homepage, locate the business section. For information on sales by street vendors.) you may. Businesses in dc are required to submit the fr 500 tax registration form. There are a few things you should be aware of before you begin the relatively simple procedure of. The office of tax and revenue. For information on sales by street vendors.) you may. The office of tax and revenue. Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you. There are a few things you should be aware of before you begin the relatively simple procedure of. In addition. Trade names must be first registered with the department of consumer and. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. The office of tax and revenue. Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you.. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. Businesses in dc are required to submit the fr 500 tax registration form. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster.. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. There is no charge for registering. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. Go to the dc business licensing portal. There are a few things you should be aware of before you begin the relatively simple procedure of. Review items needed to register and click next. Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you. You will need the following information to complete the. The purpose of this form is to gather information on the business, such as ownership, location,. The office of tax and revenue. Review items needed to register and click next. Businesses in dc are required to submit the fr 500 tax registration form. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. Go to the dc business licensing portal to get more information about corporate registration and business licensing requirements. Update your eddy account with your district of columbia department of employment services registration numbers (both unemployment and paid family and medical leave) when you. There is no charge for registering. There are a few things you should be aware of before you begin the relatively simple procedure of. For information on sales by street vendors.) you may. Your federal employer identification number (fein), ind victual taxpayer identification number (itin). In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. You will need the following information to complete the online tax registration form:Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

DC FR500 20152021 Fill out Tax Template Online US Legal Forms

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Fr 500 Fill out & sign online DocHub

FR500 Visual Guide Owner Knowledge Base

District of Columbia LLC Tax Registration (FR500) LLCU®

Fillable Form Fr500 Combined Business Tax Registration Application

FR500 Visual Guide Owner Knowledge Base

Form Fr500 Combined Registration Application For Business printable

What Should I Do To Register As An Employer With The District's Unemployment Compensation Program?

To Report Sales And Use Tax Receipts To The Dc Office Of Tax And Revenue, Utilize This Form.

Trade Names Must Be First Registered With The Department Of Consumer And.

On The Mytax.dc.gov Homepage, Locate The Business Section.

Related Post: