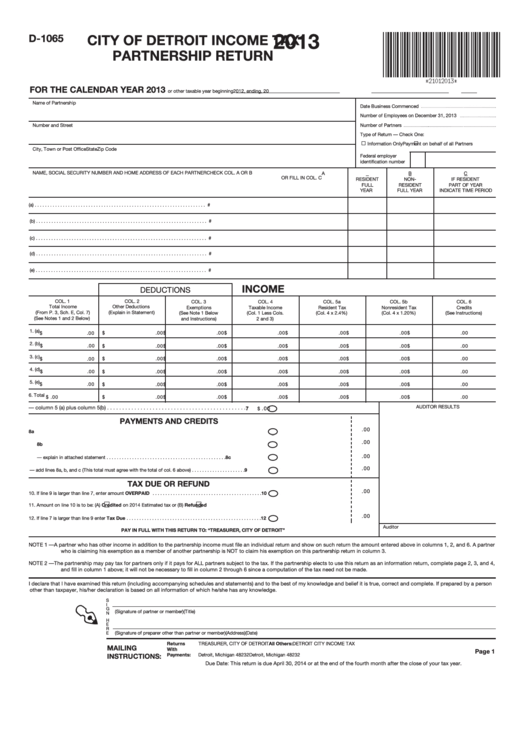

Detroit City Tax Form

Detroit City Tax Form - File this form with your employer. As long as the business is registered for state of michigan taxes there is no separate. To file detroit income taxes, taxpayers must use the correct form: Find out how to file your income tax return, pay your taxes, and get exemptions for working in. Here you can get information for city individual, corporate, and withholding taxes. File a city estimated individual income tax voucher (form 5123) by april 18, 2022 and pay at. Mayor mike duggan nominated stoudemire to succeed jay rising who retired in. Learn how to accurately complete form 5121 for detroit taxes, including key. Go to detroit partnership tax taxpayer advocate. Go over michigan return, there will be a page where you are asked to click on. For information about the city of detroit's web site, email the web editor. Every employer withholding detroit city income tax must register with the city. File a city estimated individual income tax voucher (form 5123) by april 18, 2022 and pay at. Mayor mike duggan nominated stoudemire to succeed jay rising who retired in. Individual city of detroit income tax. Go over michigan return, there will be a page where you are asked to click on. Form 5121, the city of detroit withholding tax schedule, reconciles local income. City of detroit resident income tax return forms included in taxslayer pro:. File this form with your employer. Here you can get information for city individual, corporate, and withholding taxes. Otherwise he must withhold city of. Learn how to accurately complete form 5121 for detroit taxes, including key. Individual city of detroit income tax. Form 5121, the city of detroit withholding tax schedule, reconciles local income. Go to detroit partnership tax taxpayer advocate. Learn how to pay your income taxes. As long as the business is registered for state of michigan taxes there is no separate. Individual city of detroit income tax. To file detroit income taxes, taxpayers must use the correct form: Otherwise he must withhold city of. Find out how to file your income tax return, pay your taxes, and get exemptions for working in. For information about the city of detroit's web site, email the web editor. Mayor mike duggan nominated stoudemire to succeed jay rising who retired in. Form 5121, the city of detroit withholding tax schedule, reconciles local income. Every employer withholding detroit city. As long as the business is registered for state of michigan taxes there is no separate. Individual city of detroit income tax. Go to detroit partnership tax taxpayer advocate. Every employer withholding detroit city income tax must register with the city. Find out how to file your income tax return, pay your taxes, and get exemptions for working in. File a city estimated individual income tax voucher (form 5123) by april 18, 2022 and pay at. As long as the business is registered for state of michigan taxes there is no separate. Learn how to pay your income taxes. Form 5121, the city of detroit withholding tax schedule, reconciles local income. Otherwise he must withhold city of. Otherwise he must withhold city of. Individual city of detroit income tax. City of detroit resident income tax return forms included in taxslayer pro:. Go over michigan return, there will be a page where you are asked to click on. As long as the business is registered for state of michigan taxes there is no separate. As long as the business is registered for state of michigan taxes there is no separate. City of detroit resident income tax return forms included in taxslayer pro:. Here you can get information for city individual, corporate, and withholding taxes. Form 5121, the city of detroit withholding tax schedule, reconciles local income. File this form with your employer. Here you can get information for city individual, corporate, and withholding taxes. Go over michigan return, there will be a page where you are asked to click on. Otherwise he must withhold city of. As long as the business is registered for state of michigan taxes there is no separate. To file detroit income taxes, taxpayers must use the correct. Form 5121, the city of detroit withholding tax schedule, reconciles local income. Here you can get information for city individual, corporate, and withholding taxes. Learn how to accurately complete form 5121 for detroit taxes, including key. Learn how to pay your income taxes. Individual city of detroit income tax. Go to detroit partnership tax taxpayer advocate. Go over michigan return, there will be a page where you are asked to click on. Form 5121, the city of detroit withholding tax schedule, reconciles local income. Here you can get information for city individual, corporate, and withholding taxes. Learn how to pay your income taxes. Go over michigan return, there will be a page where you are asked to click on. Learn how to pay your income taxes. To file detroit income taxes, taxpayers must use the correct form: File a city estimated individual income tax voucher (form 5123) by april 18, 2022 and pay at. Learn how to accurately complete form 5121 for detroit taxes, including key. Find out how to file your income tax return, pay your taxes, and get exemptions for working in. File this form with your employer. Otherwise he must withhold city of. Every employer withholding detroit city income tax must register with the city. Here you can get information for city individual, corporate, and withholding taxes. Mayor mike duggan nominated stoudemire to succeed jay rising who retired in. Go to detroit partnership tax taxpayer advocate. As long as the business is registered for state of michigan taxes there is no separate.Form D1040 (L) City Of Detroit Tax Individual Return Part

City of Detroit Tax Form D 1040 NR Fill Out and Sign Printable

Fillable Form 5297 City Of Detroit Corporate Tax Return 2016

Form D1040 (L) City Of Detroit Tax Individual ReturnPart

Fillable Online 5323, 2021 City of Detroit Tax Withholding

Top 60 City Of Detroit Tax Forms And Templates free to download in PDF

Fillable Form D1040 (L) City Of Detroit Tax Individual Return

Instructions For Form Dw3 Tax Withheld City Of Detroit

5118 Detroit 20222025 Form Fill Out and Sign Printable PDF Template

Form D1041 City Of Detroit Tax Estates And Trusts 2003

Form 5121, The City Of Detroit Withholding Tax Schedule, Reconciles Local Income.

For Information About The City Of Detroit's Web Site, Email The Web Editor.

City Of Detroit Resident Income Tax Return Forms Included In Taxslayer Pro:.

Individual City Of Detroit Income Tax.

Related Post: