Ea Test Questions

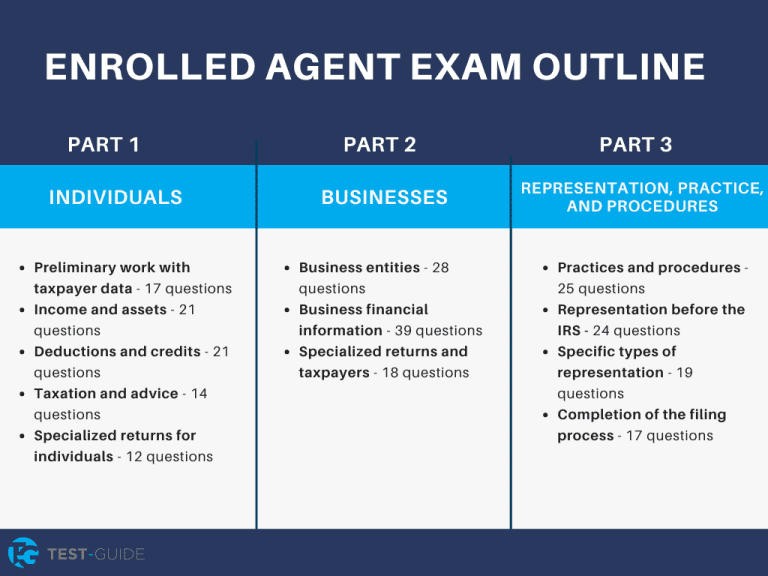

Ea Test Questions - Ea exam prep course, part 3, 2025, filing process. These sample test questions have never been used on any current or prior see. Master your exam prep with challenging enrolled agent test questions tailored for success. Enhance your readiness and mental agility. Becker’s free and downloadable ea exam guide ebook gives you everything you need to understand the exam and the logistics that you need to prepare—so you can focus on. Start your enrolled agent journey today! Focus on the areas where you need the. Discover the ea syllabus with miles! Tackle questions based on actual ea exam topics, from tax preparation to irs representation. We’ve updated our entire ea video library with brand new gleim instruct lecture videos to help you master the ea exam topics. We have compiled a list of free ea exam practice exams, resources, and study guides. Join our community to connect with your peers online and find valuable information to help you prepare and pass the ea exam. Ace the enrolled agent exam with these practice questions! A new client visits an enrolled agent (ea). Discover the ea syllabus with miles! Becker’s free and downloadable ea exam guide ebook gives you everything you need to understand the exam and the logistics that you need to prepare—so you can focus on. Enhance your readiness and mental agility. Tackle questions based on actual ea exam topics, from tax preparation to irs representation. Presented by tom norton cpa, ea. With our course, you get 30+ hours of lecture. Discover the ea syllabus with miles! Get ahead on your enrolled agent exam prep with top questions and answers. So, to prepare to pass the exam, you should learn all the details about these questions. The ea exam syllabus has 3 parts: This is the fourth of 4 videos in the ea tax trai. Ace the enrolled agent exam with these practice questions! This is the fourth of 4 videos in the ea tax trai. Review some of the enrolled agent exam questions below. Each part has 100 enrolled agent exam questions covering tax law, the internal revenue service’s key procedures, and ethics. Start your enrolled agent journey today! Master your exam prep with challenging enrolled agent test questions tailored for success. Review some of the enrolled agent exam questions below. Get detailed insights into the special enrollment exam format and boost your preparation today. What kind of questions are on the ea exam? Ea exam prep course, part 3, 2025, filing process. Get detailed insights into the special enrollment exam format and boost your preparation today. A new client visits an enrolled agent (ea). Start your enrolled agent journey today! This is the fourth of 4 videos in the ea tax trai. We’ve updated our entire ea video library with brand new gleim instruct lecture videos to help you master the ea. Each part of the ea exam has the same number of questions: What kind of questions are on the ea exam? So, to prepare to pass the exam, you should learn all the details about these questions. Join our community to connect with your peers online and find valuable information to help you prepare and pass the ea exam. This. Focus on the areas where you need the. See sample test questions with explanations, enrolled agent practice exams and everything you need to pass the ea exam. This is the fourth of 4 videos in the ea tax trai. Get free ea exam support with becker. These sample test questions have never been used on any current or prior see. So, to prepare to pass the exam, you should learn all the details about these questions. Naea members get part 1 for free. Ace the ea exam by mastering question types and structure for success! The ea exam syllabus has 3 parts: Get ahead on your enrolled agent exam prep with top questions and answers. See sample test questions with explanations, enrolled agent practice exams and everything you need to pass the ea exam. Becker’s free and downloadable ea exam guide ebook gives you everything you need to understand the exam and the logistics that you need to prepare—so you can focus on. Tax system is purely voluntary and filed a return showing no income. Naea members get part 1 for free. Start your enrolled agent journey today! Get free ea exam support with becker. The ea exam syllabus has 3 parts: Review some of the enrolled agent exam questions below. So, to prepare to pass the exam, you should learn all the details about these questions. Becker’s free and downloadable ea exam guide ebook gives you everything you need to understand the exam and the logistics that you need to prepare—so you can focus on. These sample test questions have never been used on any current or prior see. The ea exam syllabus has 3 parts: Visit prometric’s special enrollment examination (see) webpage to schedule your test appointments, review the see candidate information bulletin pdf, sample test questions,. Tackle questions based on actual ea exam topics, from tax preparation to irs representation. We have compiled a list of free ea exam practice exams, resources, and study guides. Ace the ea exam by mastering question types and structure for success! Enhance your readiness and mental agility. Naea members get part 1 for free. Each part has 100 enrolled agent exam questions covering tax law, the internal revenue service’s key procedures, and ethics. This is the fourth of 4 videos in the ea tax trai. Master your exam prep with challenging enrolled agent test questions tailored for success. A new client visits an enrolled agent (ea). Get free ea exam support with becker. Review some of the enrolled agent exam questions below.Enrolled Agent Exam Prep Part 2 questions with correct answers EA

Enrolled Agent Exam Questions Everything You Need to Know Gleim EA

EA Sample Questions Part 1 2021 SEE 1. Sample Test Questions Two

Enrolled Agent Exam Study Guide 202425 & Full EA Exam Online Course

Prometric EA Exam Sample Questions, Explained (PART 1, Individuals

Executive Assessment Free EA Practice Test

Enrolled Agent Exam 500+ Questions

IRS Enrolled Agent Part 3 Unit 3 TEST questions with correct answers

Enrolled Agent Practice Exam Questions Part 1 questions with correct

For Quick Reference, Here Are A Few.

Tax System Is Purely Voluntary And Filed A Return Showing No Income Tax, Requesting All Withholding.

Discover The Ea Syllabus With Miles!

Start Your Enrolled Agent Journey Today!

Related Post: