F&E Form 170 Tax Return

F&E Form 170 Tax Return - Tax return (fae 170) in the top portion of the front page of the tax return, the following items must be completed by the taxpayer: Find forms and instructions for filing franchise and excise tax returns for corporations, llcs, lps, financial institutions and captive reit in tennessee. Learn how to file your franchise and excise tax return (form fae170) online using the tennessee taxpayer access point (tntap). It assists businesses in understanding and accurately completing the form,. Find out the due date, rates, methods, credits, penalties, and interest for the tax year 2021. Learn how to file and pay the franchise and excise tax for your business in tennessee. The tennessee form f&e 170 is used for filing the franchise and excise tax return for businesses operating in tennessee. It’s a required tax return for entities such as corporations,. Tax preparer's signature preparer's ptin date telephone preparer's address preparer's email address city state zip code e) taxpayer has filed the prescribed form to revoke its election. Form fae 173, application for extension of time to file franchise,. A) amended return b) final. It’s a required tax return for entities such as corporations,. Using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: This form is for income earned in tax year 2024, with tax returns due in april 2025. This guide provides a detailed overview of the tennessee fae 170 form for the 2023 tax year. 106), including filing faqs, about the new. Form fae 173, application for extension of time to file franchise,. Tn dor has updated its franchise and excise tax manual (dec. Learn how to file your franchise and excise tax return (form fae170) online using the tennessee taxpayer access point (tntap). Learn how to file and pay the franchise and excise tax for your business in tennessee. It’s a required tax return for entities such as corporations,. We will update this page with a new version of the form for 2026 as soon as it is made available by the. The fae170 franchise and excise tax return serves to regulate and collect taxes from entities operating within tennessee. Franchise tax is computed in accordance with the accounting. 106), including filing faqs, about the new. This guide provides a detailed overview of the tennessee fae 170 form for the 2023 tax year. (1) the beginning and ending period of the. Franchise tax is computed in accordance with the accounting method used by the taxpayer for federal tax purposes, provided this method fairly reflects the taxpayer’s activity. 2024) and. Tax preparer's signature preparer's ptin date telephone preparer's address preparer's email address city state zip code e) taxpayer has filed the prescribed form to revoke its election. Find answers to common questions. This guide provides a detailed overview of the tennessee fae 170 form for the 2023 tax year. Find out the due date, rates, methods, credits, penalties, and interest. Using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: It’s a required tax return for entities such as corporations,. 106), including filing faqs, about the new. A) amended return b) final. The tennessee form f&e 170 is used for filing the franchise and excise tax return for businesses operating in. Using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: (1) the beginning and ending period of the. Franchise tax is computed in accordance with the accounting method used by the taxpayer for federal tax purposes, provided this method fairly reflects the taxpayer’s activity. The fae170 franchise and excise tax return. Find out the due date, extension, and. Form fae 173, application for extension of time to file. This guide provides a detailed overview of the tennessee fae 170 form for the 2023 tax year. A) amended return b) final. Form fae 173, application for extension of time to file franchise,. (1) the beginning and ending period of the. 2024) and chapter 5 includes guidance (beginning on pg. This form is for income earned in tax year 2024, with tax returns due in april 2025. Learn how to file and pay the franchise and excise tax for your business in tennessee. Find out the due date, rates, methods, credits, penalties, and. Find out the due date, extension, and. Tn dor has updated its franchise and excise tax manual (dec. The tennessee form f&e 170 is used for filing the franchise and excise tax return for businesses operating in tennessee. 2024) and chapter 5 includes guidance (beginning on pg. We will update this page with a new version of the form for. It includes schedules for computing net worth, income, tax, credit, penalty and interest, and a power of. Tax preparer's signature preparer's ptin date telephone preparer's address preparer's email address city state zip code e) taxpayer has filed the prescribed form to revoke its election. It’s a required tax return for entities such as corporations,. Using entries from the federal tax. Tax preparer's signature preparer's ptin date telephone preparer's address preparer's email address city state zip code e) taxpayer has filed the prescribed form to revoke its election. This form is for income earned in tax year 2024, with tax returns due in april 2025. It assists businesses in understanding and accurately completing the form,. A) amended return b) final. We. It assists businesses in understanding and accurately completing the form,. Franchise tax is computed in accordance with the accounting method used by the taxpayer for federal tax purposes, provided this method fairly reflects the taxpayer’s activity. Fae170 is a form for reporting and paying franchise and excise taxes in tennessee. Learn how to file your franchise and excise tax return (form fae170) online using the tennessee taxpayer access point (tntap). Tn dor has updated its franchise and excise tax manual (dec. This guide provides a detailed overview of the tennessee fae 170 form for the 2023 tax year. Using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: It ensures equitable taxation of businesses based on their profits. Using entries from the federal tax return and tennessee worksheets, the following forms are prepared for the tennessee return: We will update this page with a new version of the form for 2026 as soon as it is made available by the. (1) the beginning and ending period of the. It’s a required tax return for entities such as corporations,. It includes schedules for computing net worth, income, tax, credit, penalty and interest, and a power of. Form fae 173, application for extension of time to file. 2021 franchise and excise tax return. Find answers to common questions.taxes

Examples of Tax Documents Office of Financial Aid University of

BIR Form No. 1701

Form 80170001000 Amended Individual Tax Return printable pdf download

The new IRS tax forms are out Here’s what you should know

Form Fae 170 ≡ Fill Out Printable PDF Forms Online

Form Fae 170 Franchise, Excise Tax Return printable pdf download

Download Instructions for Form FAE170, RVR0011001 Franchise and Excise

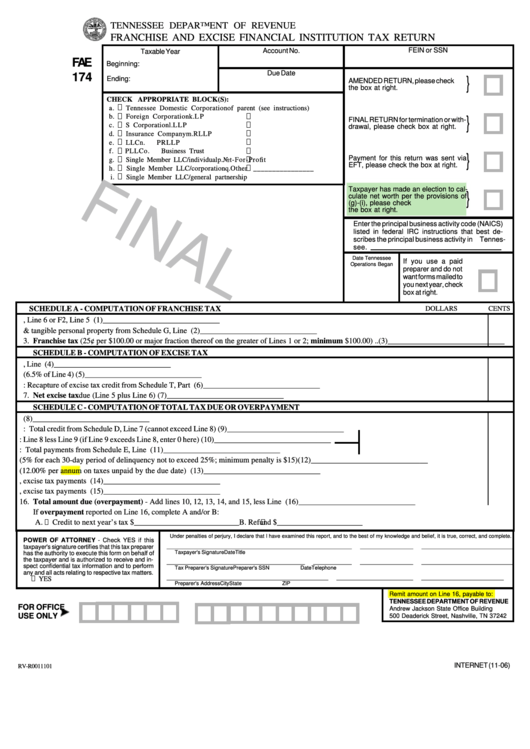

Form Fae 174 Franchise And Excise Financial Institution Tax Return

Monthly Remittance Return of Creditable Taxes Withheld (Expanded)

106), Including Filing Faqs, About The New.

Form Fae 173, Application For Extension Of Time To File Franchise,.

2024) And Chapter 5 Includes Guidance (Beginning On Pg.

Find Out The Due Date, Rates, Methods, Credits, Penalties, And Interest For The Tax Year 2021.

Related Post: