Federal Form 8949

Federal Form 8949 - Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs. Form 8949 is necessary for reporting sales and exchanges of stocks and bonds. This form is the cornerstone for. Use form 8949 to report sales and exchanges of capital assets. Use form 8949 to report sales and exchanges of capital assets. The taxpayers who must file. Use form 8949 to report sales and exchanges of capital assets. This is an irs form used by individuals, partnerships, and corporations to report. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. Learn how to file form 8949, get instructions,. It details the purchase and sale dates for each. The taxpayers who must file. Use form 8949 to report sales and exchanges of capital assets. Irs form 8949, sales and other dispositions of capital assets, is a tax form used to report capital gains and losses from transactions involving investments. Learn how to file form 8949, get instructions,. Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs. Key elements include cost basis adjustments, wash sale rules, and short sales. Form 8949 is necessary for reporting sales and exchanges of stocks and bonds. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. This form is the cornerstone for. Use form 8949 to report sales and exchanges of capital assets. Every time you sell stocks, bonds, cryptocurrency, or even a rental property, this. Use form 8949 to report sales and exchanges of capital assets. Use form 8949 to report sales and exchanges of capital assets. Irs form 8949, sales and other dispositions of capital assets, is a tax form. Use form 8949 to report sales and exchanges of capital assets. First, you use form 8949 to report the sale of individual assets and calculate the related gains or losses. Form 8949, officially titled “sales and other dispositions of capital assets,” is a pivotal document in the realm of tax reporting for investors. Paid federal products starting at $36,. It. Paid federal products starting at $36,. This form is the cornerstone for. Use form 8949 to report sales and exchanges of capital assets. Form 8949, officially titled “sales and other dispositions of capital assets,” is a pivotal document in the realm of tax reporting for investors. Every time you sell stocks, bonds, cryptocurrency, or even a rental property, this. Use form 8949 to report sales and exchanges of capital assets. Form 8949, officially titled “sales and other dispositions of capital assets,” is a pivotal document in the realm of tax reporting for investors. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. Use form 8949 to report. Irs form 8949, sales and other dispositions of capital assets, is a tax form used to report capital gains and losses from transactions involving investments. Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs. Use form 8949 to report sales and exchanges of capital assets. The. Learn how to file form 8949, get instructions,. Use form 8949 to report sales and exchanges of capital assets. Use form 8949 to report sales and exchanges of capital assets. Form 8949, officially titled “sales and other dispositions of capital assets,” is a pivotal document in the realm of tax reporting for investors. Every time you sell stocks, bonds, cryptocurrency,. First, you use form 8949 to report the sale of individual assets and calculate the related gains or losses. Form 8949 is necessary for reporting sales and exchanges of stocks and bonds. It details the purchase and sale dates for each. If you must report capital gains and losses from an investment in the past year, you’ll need to file. Key elements include cost basis adjustments, wash sale rules, and short sales. Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs. Every time you sell stocks, bonds, cryptocurrency, or even a rental property, this. It details the purchase and sale dates for each. The taxpayers who. This is an irs form used by individuals, partnerships, and corporations to report. Use form 8949 to report sales and exchanges of capital assets. Every time you sell stocks, bonds, cryptocurrency, or even a rental property, this. Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs.. Use form 8949 to report sales and exchanges of capital assets. Use form 8949 to report sales and exchanges of capital assets. The taxpayers who must file. Use form 8949 to report sales and exchanges of capital assets. First, you use form 8949 to report the sale of individual assets and calculate the related gains or losses. Irs form 8949, sales and other dispositions of capital assets, is a tax form used to report capital gains and losses from transactions involving investments. It details the purchase and sale dates for each. Every time you sell stocks, bonds, cryptocurrency, or even a rental property, this. This form is the cornerstone for. Form 8949 is necessary for reporting sales and exchanges of stocks and bonds. Use form 8949 to report sales and exchanges of capital assets. Form 8949 is the irs’s way of tracking capital gains and losses from investments, real estate, or other assets. This is an irs form used by individuals, partnerships, and corporations to report. Form 8949 is used to report the sale or exchange of capital assets, such as stocks, real estate, or cryptocurrencies to the irs. If you must report capital gains and losses from an investment in the past year, you’ll need to file form 8949. Key elements include cost basis adjustments, wash sale rules, and short sales. Use form 8949 to report sales and exchanges of capital assets. First, you use form 8949 to report the sale of individual assets and calculate the related gains or losses. Paid federal products starting at $36,. Irs form 8949 is a tax form used by individuals, corporations, partnerships, and trusts to report sales and exchanges of capital assets. Use form 8949 to report sales and exchanges of capital assets.What Is IRS Form 8949?

Download Instructions for IRS Form 8949 Sales and Other Dispositions of

irs form 8949 instructions 2022 Fill Online, Printable, Fillable

Irs Form 8949 Printable Printable Forms Free Online

Printable Irs Form 8949 Printable Forms Free Online

Form 8949 Attachment form

Understanding IRS Form 8949 Instructions

2024 8949 IRS Tax Form Released EquityStat Blog

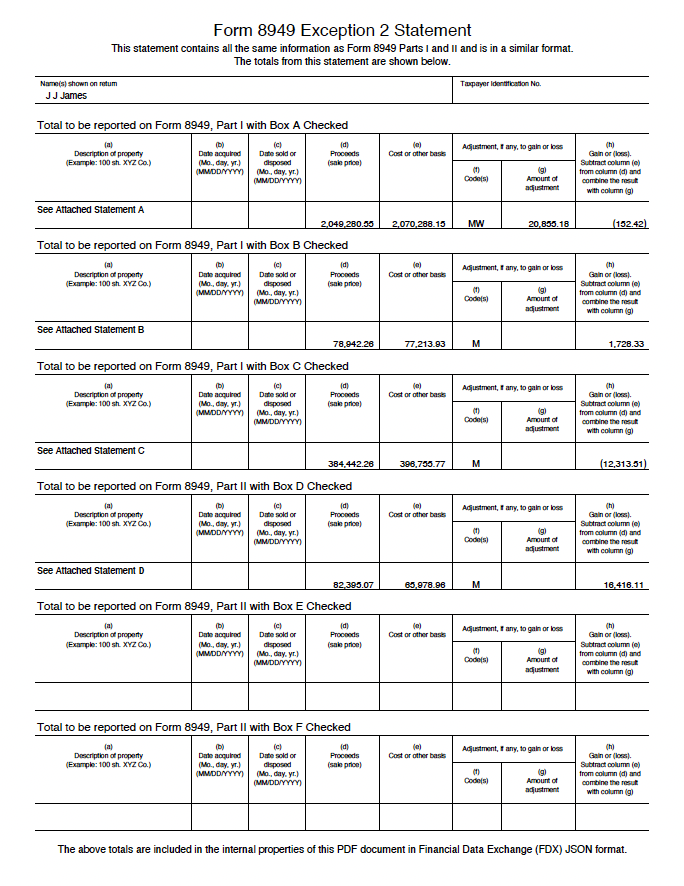

Explanation of IRS Form 8949 Exception 2

Free Fillable Form 8949 Printable Forms Free Online

Learn How To File Form 8949, Get Instructions,.

Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

The Taxpayers Who Must File.

Form 8949, Officially Titled “Sales And Other Dispositions Of Capital Assets,” Is A Pivotal Document In The Realm Of Tax Reporting For Investors.

Related Post:

:max_bytes(150000):strip_icc()/Form8949TaxYear2021-6b44bba4ee5b4768af6d978a61bcb165.png)