Form 3514 Business Code

Form 3514 Business Code - A user asks how to enter a business code on ca form 3514 when they don't have a federal 1040 sch c. Find out the eligibility criteria, income limits,. Find out the eligibility requirements, income limits, and how to attach the form to your tax return. You may need to attach. Form 3514 is california earned income tax credit. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount of. See a list of codes for various industries, such as publishing, broadcasting, health care,. It requires information about your income, qualifying children, investment income, and eligibility. I reviewed the list of forms available after going to the forms option and did. Some suggest finding the code on other business activities, others suggest deleting the form. Filing taxes in california can be a complex process,. If you don't have a sein or business license number, then you should be able to leave those. I do have a schedule c. As a general rule, the taxpayer would be deemed to be engaged in a trade or business for purposes of §1402 and §1401 if he/she engages in the profession or occupation. I reviewed the list of forms available after going to the forms option and did. See a list of codes for various industries, such as publishing, broadcasting, health care,. California form 3514 directly affects a business’s california tax liability. Find out the eligibility criteria, income limits,. Learn how to accurately enter a business code on california's form 3514, ensuring compliance and smooth tax filing. Fill out the business information section (overrides). As a general rule, the taxpayer would be deemed to be engaged in a trade or business for purposes of §1402 and §1401 if he/she engages in the profession or occupation. Fill out the business information section (overrides). Make sure to sign and date the form as the authorized representative of your business. This form is used to claim the. Fill out the business information section (overrides). California form 3514 is the. Sign and date the form. Filing taxes in california can be a complex process,. Make sure to sign and date the form as the authorized representative of your business. Learn how to claim the refundable california earned income tax credit (eitc) and young child tax credit (yctc) by filling out form ftb 3514. It requires information about your income, qualifying children, investment income, and eligibility. California form 3514 directly affects a business’s california tax liability. Find out the eligibility criteria, income limits,. Fill out the business information section (overrides). Learn how to accurately enter a business code on california's form 3514, ensuring compliance and smooth tax filing. As a general rule, the taxpayer would be deemed to be engaged in a trade or business for purposes of §1402 and §1401 if he/she engages in the profession or occupation. How do i handle form 3514 as clergy when i am. An error was identified that i need a business code on california form 3514. The form 3514 requests a business code, business license number and sein. Find out the eligibility requirements, income limits, and how to attach the form to your tax return. I reviewed the list of forms available after going to the forms option and did. Filing taxes. How do i handle form 3514 as clergy when i am eligible for the eitc of ca, but not sure what information to enter for a business name, address, zip, and code[813000]? The california competes tax credit, claimed via form 3514, reduces the amount of tax a business. I reviewed the list of forms available after going to the forms. This form is used to claim the california eitc and other tax credits for taxable year 2023. An error was identified that i need a business code on california form 3514. Learn how to accurately enter a business code on california's form 3514, ensuring compliance and smooth tax filing. I reviewed the list of forms available after going to the. Make sure to sign and date the form as the authorized representative of your business. If you don't have a sein or business license number, then you should be able to leave those. An error was identified that i need a business code on california form 3514. Form 3514 is california earned income tax credit. Learn how to claim the. Fill out the business information section (overrides). The form 3514 requests a business code, business license number and sein. Form 3514 is california earned income tax credit. How do we get rid of that form? This form is used to claim the california eitc for taxable year 2024. If the business income is coming from a federal schedule f or k1p, the business information overrides must be used. Find out the eligibility criteria, income limits,. You may need to attach. Learn how to claim the refundable california eitc, yctc, and fytc by filing form ftb 3514. Make sure to sign and date the form as the authorized representative. The form 3514 requests a business code, business license number and sein. Users discuss how to enter a business code for form 3514 in turbotax premier. California form 3514 want business code, etc. California form 3514 directly affects a business’s california tax liability. Sign and date the form. Learn how to claim the refundable california earned income tax credit (eitc) and young child tax credit (yctc) by filling out form ftb 3514. As a general rule, the taxpayer would be deemed to be engaged in a trade or business for purposes of §1402 and §1401 if he/she engages in the profession or occupation. California form 3514 is the. If the business income is coming from a federal schedule f or k1p, the business information overrides must be used. The california competes tax credit, claimed via form 3514, reduces the amount of tax a business. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount of. This form is used to claim the california eitc and other tax credits for taxable year 2023. Make sure to sign and date the form as the authorized representative of your business. How do we get rid of that form? Find out the eligibility criteria, income limits,. A user asks how to enter a business code on ca form 3514 when they don't have a federal 1040 sch c.Fillable Online FORM FDA 3514 (1/13) DASHBOARD REGINFO.GOV Fax

W2 Box 14 Codes List Discover Hidden Tax Secrets

Form 3514 Business Code Must Be Entered

3514 Business Code 20222025 Form Fill Out and Sign Printable PDF

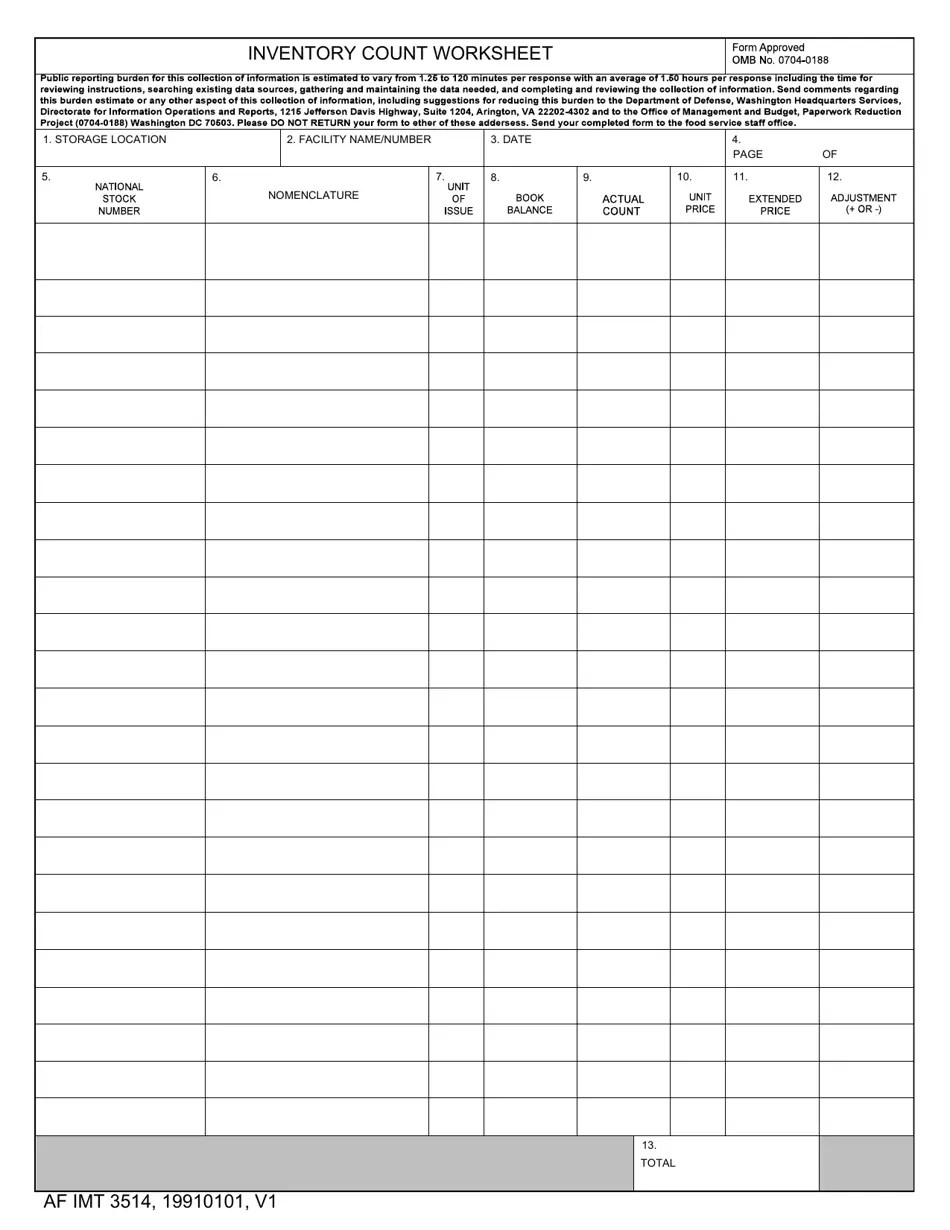

AF IMT Form 3514 Fill Out, Sign Online and Download Fillable PDF

Fillable Online FORM FDA 3514. CDRH Premarket Review Submission Cover

Fillable Online ftb ca 2015 Instructions for Form 3514 California

Form FTB 3514 20242025 Fill Out Official Forms Online

Ashley Schultz Volunteer Program Coordinator ppt download

2017 Form FDA 3514 Fill Online, Printable, Fillable, Blank pdfFiller

You May Need To Attach.

I Reviewed The List Of Forms Available After Going To The Forms Option And Did.

See A List Of Codes For Various Industries, Such As Publishing, Broadcasting, Health Care,.

Fill Out The Business Information Section (Overrides).

Related Post: