Form 4136 Instructions

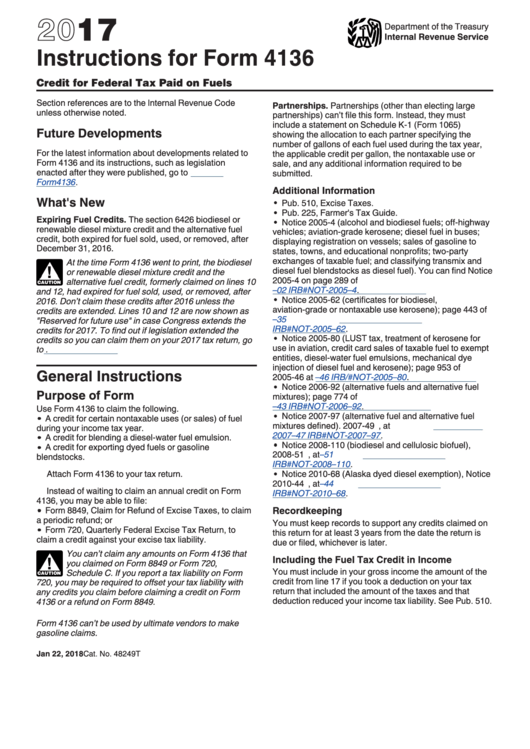

Form 4136 Instructions - Learn how to file form 4136 to claim credits for untaxed or reduced fuel use. Form 4136 is used to claim a credit for certain federal excise taxes paid on fuels. Understand eligibility, instructions, deadlines, and common mistakes to avoid. Get details on excise tax, alternative fuel credits, and filing instructions from a tax professional. Discover how to use form 4136 to claim your federal fuel tax credit. This form allows individuals and businesses to claim a credit for specific. Press f6 to bring up open forms. Get instructions on filing and claiming the credit for diesel and alternative fuels. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. Taxpayers use this form to claim the following: Form 4136 is used to claim a credit for certain federal excise taxes paid on fuels. For the latest information about developments related to form 4136 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form4136. Taxpayers use this form to claim the following: Learn how to claim the tax credit for federal tax paid on fuel using form 4136. The irs letter 4136 informs taxpayers about available fuel tax credits, specifically through form 4136. Type 4136 to highlight the 4136. Discover how to use form 4136 to claim your federal fuel tax credit. This document offers comprehensive guidance on completing form 4136 for 2024, covering the form's purpose, eligibility criteria, credit calculation, and recordkeeping. Instead of waiting to claim an annual credit on form 4136, you may be able to file: If you used gasoline, diesel, or other fuels for farming, off. Taxpayers use this form to claim the following: To generate form 4136 on an individual return: Learn how to file form 4136 to claim federal fuel tax credits. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. Press f6 to bring up open forms. This form allows individuals and businesses to claim a credit for specific. Claimant has attached the certificate for biodiesel and, if applicable, statement of biodiesel reseller, both of which have been edited as discussed in the instructions for line 10. Find out the latest developments,. Press f6 to bring up open forms. If you used gasoline, diesel, or other fuels. Taxpayers use this form to claim the following: If you used gasoline, diesel, or other fuels for farming, off. Attach form 4136 to your tax return. Type 4136 to highlight the 4136. The irs letter 4136 informs taxpayers about available fuel tax credits, specifically through form 4136. Attach form 4136 to your tax return. Get details on excise tax, alternative fuel credits, and filing instructions from a tax professional. Find out the latest developments,. Select ok to open the form. Type 4136 to highlight the 4136. For the latest information about developments related to form 4136 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form4136. Learn how to file form 4136 to claim credits for untaxed or reduced fuel use. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the. Select ok to open the form. The irs letter 4136 informs taxpayers about available fuel tax credits, specifically through form 4136. Attach form 4136 to your tax return. Learn how to file form 4136 to claim federal fuel tax credits. To generate form 4136 on an individual return: Learn how to claim various fuel tax credits on form 4136, including biodiesel, renewable diesel, alternative fuel, sustainable aviation fuel, and more. Claimant has attached the certificate for biodiesel and, if applicable, statement of biodiesel reseller, both of which have been edited as discussed in the instructions for line 10. Instead of waiting to claim an annual credit on form. Form 4136 is used to claim a credit for certain federal excise taxes paid on fuels. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. This form allows individuals and businesses to claim a credit for specific. To generate form 4136 on an individual return: The biodiesel or renewable diesel mixture credit the. If you used gasoline, diesel, or other fuels for farming, off. Type 4136 to highlight the 4136. Learn how to file form 4136 to claim federal fuel tax credits. Learn how to claim various fuel tax credits on form 4136, including biodiesel, renewable diesel, alternative fuel, sustainable aviation fuel, and more. This document offers comprehensive guidance on completing form 4136. Find out the latest developments,. The biodiesel or renewable diesel mixture credit the. Form 4136 is used to claim a credit for certain federal excise taxes paid on fuels. To generate form 4136 on an individual return: Find out which fuels are eligible, how to calculate the credits, and how they reduce you… Learn how to file form 4136 to claim federal fuel tax credits. Get details on excise tax, alternative fuel credits, and filing instructions from a tax professional. Find out the latest developments,. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. Learn how to claim various fuel tax credits on form 4136, including biodiesel, renewable diesel, alternative fuel, sustainable aviation fuel, and more. The irs letter 4136 informs taxpayers about available fuel tax credits, specifically through form 4136. Type 4136 to highlight the 4136. This document offers comprehensive guidance on completing form 4136 for 2024, covering the form's purpose, eligibility criteria, credit calculation, and recordkeeping. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. Form 4136 is used to claim a credit for certain federal excise taxes paid on fuels. If you used gasoline, diesel, or other fuels for farming, off. Instead of waiting to claim an annual credit on form 4136, you may be able to file: Select ok to open the form. Understand eligibility, instructions, deadlines, and common mistakes to avoid. Attach form 4136 to your tax return. Press f6 to bring up open forms.Instructions For Form 4136 2005 printable pdf download

Fillable Online 2022 Instructions for Form 4136. Instructions for Form

IRS Form 4136 Instructions Credits For Federal Tax Paid on Fuels

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Fillable Form 4136 Credit For Federal Tax Paid On Fuels printable pdf

IRS Form 4136 Instructions Credits For Federal Tax Paid on Fuels

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Fillable Online 2022 Instructions for Form 4136 Fax Email Print pdfFiller

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

The Biodiesel Or Renewable Diesel Mixture Credit The.

Discover How To Use Form 4136 To Claim Your Federal Fuel Tax Credit.

Get Instructions On Filing And Claiming The Credit For Diesel And Alternative Fuels.

Taxpayers Use This Form To Claim The Following:

Related Post: