Form 433-F Irs Allowed Expenses

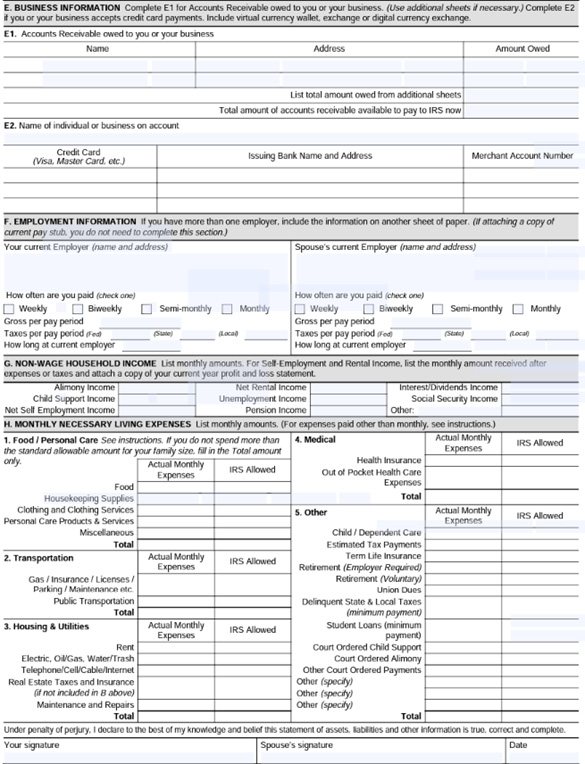

Form 433-F Irs Allowed Expenses - By providing financial disclosure and detailing their income,. It asks for details about the taxpayer’s income,. Up to 90% debt reduction. Taxpayers can use the miscellaneous allowance to pay for expenses that exceed the standards, or for other expenses such as credit card payments, bank fees and charges, reading material. It includes key details like your income, expenses, and assets. Here’s a look at the most common scenarios. This form helps the irs assess your financial situation, determining eligibility for payment. For expenses claimed in boxes 1 and 4, you should provide the irs allowable standards, or the actual amount you pay if the amount exceeds the irs allowable standards. When you cannot afford to pay the. The allowed expenses are the number that the irs deems to be sufficient for a given category and the actual expenses are what you spend on those expenses. It lets them explain their situation clearly to request tax relief. The allowed expenses are the number that the irs deems to be sufficient for a given category and the actual expenses are what you spend on those expenses. By providing financial disclosure and detailing their income,. The irs uses this information to determine their ability to pay and eligibility for payment plans or. Up to 90% debt reduction. For expenses claimed in boxes 1 and 4, you should provide the irs allowable standards, or the actual amount you pay if the amount exceeds the irs allowable standards. Here’s a look at the most common scenarios. It asks for details about the taxpayer’s income,. This form helps the irs assess your financial situation, determining eligibility for payment. Expenses that do not provide for the health and welfare of you or your family or for the production of income are generally not considered. Up to 90% debt reduction. It includes key details like your income, expenses, and assets. The allowed expenses are the number that the irs deems to be sufficient for a given category and the actual expenses are what you spend on those expenses. This form is used to: The irs uses this information to determine their ability to pay and. It lets them explain their situation clearly to request tax relief. Taxpayers can use the miscellaneous allowance to pay for expenses that exceed the standards, or for other expenses such as credit card payments, bank fees and charges, reading material. The allowed expenses are the number that the irs deems to be sufficient for a given category and the actual. The form gathers key financial. It includes key details like your income, expenses, and assets. Up to 90% debt reduction. Taxpayers can use the miscellaneous allowance to pay for expenses that exceed the standards, or for other expenses such as credit card payments, bank fees and charges, reading material. By providing financial disclosure and detailing their income,. Expenses that do not provide for the health and welfare of you or your family or for the production of income are generally not considered. This form helps the irs assess your financial situation, determining eligibility for payment. The form gathers key financial. It lets them explain their situation clearly to request tax relief. Here’s a look at the most. It includes key details like your income, expenses, and assets. The irs uses this information to determine their ability to pay and eligibility for payment plans or. Here’s a look at the most common scenarios. When you cannot afford to pay the. The allowed expenses are the number that the irs deems to be sufficient for a given category and. Here’s a look at the most common scenarios. By providing financial disclosure and detailing their income,. This form is used to: Expenses that do not provide for the health and welfare of you or your family or for the production of income are generally not considered. The form gathers key financial. When you cannot afford to pay the. This form helps the irs assess your financial situation, determining eligibility for payment. Expenses that do not provide for the health and welfare of you or your family or for the production of income are generally not considered. The allowed expenses are the number that the irs deems to be sufficient for a. The irs uses this information to determine their ability to pay and eligibility for payment plans or. It shows the irs the taxpayer's ability to pay. When you cannot afford to pay the. It lets them explain their situation clearly to request tax relief. Taxpayers can use the miscellaneous allowance to pay for expenses that exceed the standards, or for. Expenses that do not provide for the health and welfare of you or your family or for the production of income are generally not considered. When you cannot afford to pay the. It includes key details like your income, expenses, and assets. The irs uses this information to determine their ability to pay and eligibility for payment plans or. The. For expenses claimed in boxes 1 and 4, you should provide the irs allowable standards, or the actual amount you pay if the amount exceeds the irs allowable standards. It lets them explain their situation clearly to request tax relief. Expenses that do not provide for the health and welfare of you or your family or for the production of. For expenses claimed in boxes 1 and 4, you should provide the irs allowable standards, or the actual amount you pay if the amount exceeds the irs allowable standards. It includes key details like your income, expenses, and assets. The irs uses this information to determine their ability to pay and eligibility for payment plans or. The allowed expenses are the number that the irs deems to be sufficient for a given category and the actual expenses are what you spend on those expenses. This form is used to: It asks for details about the taxpayer’s income,. It shows the irs the taxpayer's ability to pay. Expenses that do not provide for the health and welfare of you or your family or for the production of income are generally not considered. This form helps the irs assess your financial situation, determining eligibility for payment. Up to 90% debt reduction. By providing financial disclosure and detailing their income,. It lets them explain their situation clearly to request tax relief.IRS Form 433F Instructions The Collection Information Statement

Printable Irs Form 433 F

How To Complete a Form 433F YouTube

IRS Form 433F Who Should Use It?

IRS Form 433F Instructions The Collection Information Statement

Irs Form 433 F Fillable & Printable PDF Templates

Printable Irs Form 433 F

Formulaire IRS 433F Remplissezle avec style

Form 433F Printable Form 433F blank, sign forms online — PDFliner

IRS Form 433F Instructions The Collection Information Statement

Here’s A Look At The Most Common Scenarios.

The Form Gathers Key Financial.

When You Cannot Afford To Pay The.

Taxpayers Can Use The Miscellaneous Allowance To Pay For Expenses That Exceed The Standards, Or For Other Expenses Such As Credit Card Payments, Bank Fees And Charges, Reading Material.

Related Post: