Form 4549 Refund

Form 4549 Refund - It includes adjustments to income, deductions, credits, and the resulting tax liability or refund. In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. A taxpayer must file a timely refund. At the end of an audit, irs sends the taxpayer a letter along with form 4549, explaining the proposed changes to the audited tax return. Form 4549 includes detailed explanations for each adjustment made to the taxpayer's return. Normally, the irs will use the form for the initial report only, and the irs reasonably. This form serves as a detailed report of what the irs believes should be corrected on your return, including any additional taxes owed or refunds due. In the notice the irs might list all the documents upon which they rely to charge you the. How long after i signed and sent back form 4549 will i receive my check. If after taking a closer look at your return they find things that need changing, they’ll send this form your way. How long after i signed and sent back form 4549 will i receive my check. Examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: This form serves as a detailed report of what the irs believes should be corrected on your return, including any additional taxes owed or refunds due. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. On (date) you filed a claim. Form 4549 includes detailed explanations for each adjustment made to the taxpayer's return. If the irs reviews your return and decides to make a change, the. It essentially lists any extra taxes you need to pay or any refunds you. In the notice the irs might list all the documents upon which they rely to charge you the. Based on irs procedural guidelines per irm 4.4.12, after receipt of your signed form 4549 (income tax examination changes), the examiner typically processes the case. This form means the irs is questioning your tax return. A taxpayer must file a timely refund. It includes adjustments to income, deductions, credits, and the resulting tax liability or refund. It essentially lists any. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Form 4549, also known as the income tax examination changes form, is utilized. Paperless workflow cancel anytime 30 day free trial money back guarantee Normally, the irs will use the form for the initial report only, and the irs reasonably. It essentially lists any extra taxes you need to pay or any refunds you. Form 4549 includes detailed explanations for each adjustment made to the taxpayer's return. In this case, you have the. If after taking a closer look at your return they find things that need changing, they’ll send this form your way. Examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: So my tax refund was delayed over and over again, some problems with the filing, regardless. If after taking a closer look at your return they find things that need changing, they’ll send this form your way. Form 4549, income tax examination changes, is used for cases that result in: In the notice the irs might list all the documents upon which they rely to charge you the. In this case, you have the choice of. Examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. This form serves as a detailed report of what the irs believes should be corrected on. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. So my tax refund was delayed over and over again, some problems with the filing, regardless i received a form 4549 stating that my refund amount was changed, and asking if i agree with. A taxpayer must file a timely refund.. Form 4549 includes detailed explanations for each adjustment made to the taxpayer's return. Form 4549, income tax examination changes, is used for cases that result in: So my tax refund was delayed over and over again, some problems with the filing, regardless i received a form 4549 stating that my refund amount was changed, and asking if i agree with.. Normally, the irs will use the form for the initial report only, and the irs reasonably. Form 4549, income tax examination changes, is used for cases that result in: So my tax refund was delayed over and over again, some problems with the filing, regardless i received a form 4549 stating that my refund amount was changed, and asking if. Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. This form serves as a detailed report of what the irs believes should be corrected on your return, including any additional taxes owed or refunds due. So my tax refund was delayed over and over again, some problems with the filing, regardless i received. Paperless workflow cancel anytime 30 day free trial money back guarantee Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. In the notice the irs might list all the documents upon which they rely to charge you the. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. If after taking a closer look at your return they find things that need changing, they’ll send this form your way. If the irs reviews your return and decides to make a change, the. On (date) you filed a claim. It includes adjustments to income, deductions, credits, and the resulting tax liability or refund. Form 4549, income tax examination changes, is used for cases that result in: The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. A taxpayer must file a timely refund. Examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: How long after i signed and sent back form 4549 will i receive my check. This form means the irs is questioning your tax return.Formulario 4549 del IRS. Auditorías ¡No se de por vencido! TaxHelpLaw

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Form 4549 Fill Online, Printable, Fillable, Blank pdfFiller

Form 4549A Tax Examination Changes printable pdf download

Demystifying Form 4549 Understanding Your IRS Audit Report

Demystifying Form 4549 Understanding Your IRS Audit Report

Guide to IRS Form 4549 Examination Changes

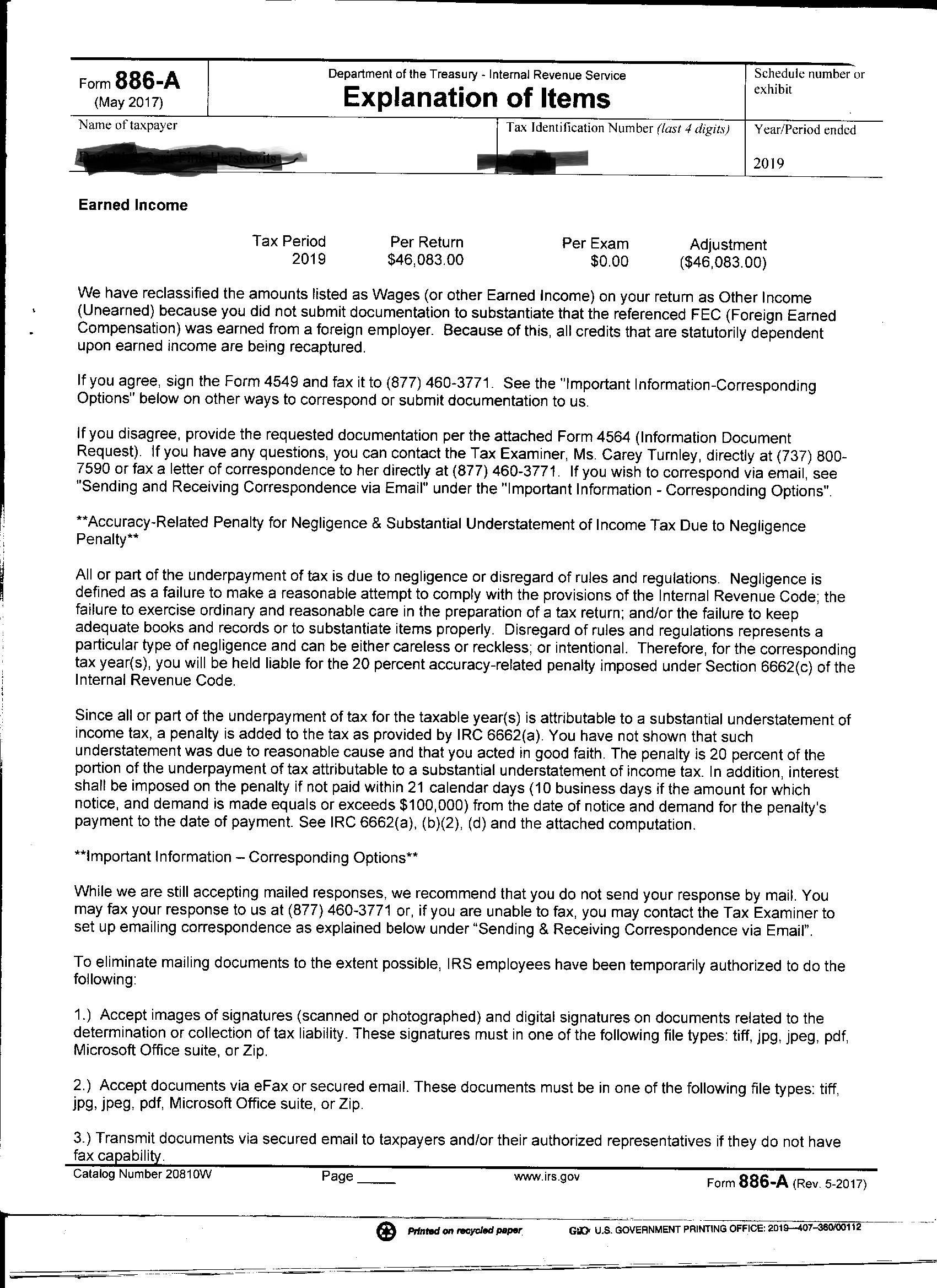

taxes How to resolve my unearned issue with the IRS

Form 4549 Tax Examination Changes Internal Revenue Service

Form 4549 Response to IRS Determination

Normally, The Irs Will Use The Form For The Initial Report Only, And The Irs Reasonably.

So My Tax Refund Was Delayed Over And Over Again, Some Problems With The Filing, Regardless I Received A Form 4549 Stating That My Refund Amount Was Changed, And Asking If I Agree With.

This Form Serves As A Detailed Report Of What The Irs Believes Should Be Corrected On Your Return, Including Any Additional Taxes Owed Or Refunds Due.

Based On Irs Procedural Guidelines Per Irm 4.4.12, After Receipt Of Your Signed Form 4549 (Income Tax Examination Changes), The Examiner Typically Processes The Case.

Related Post: