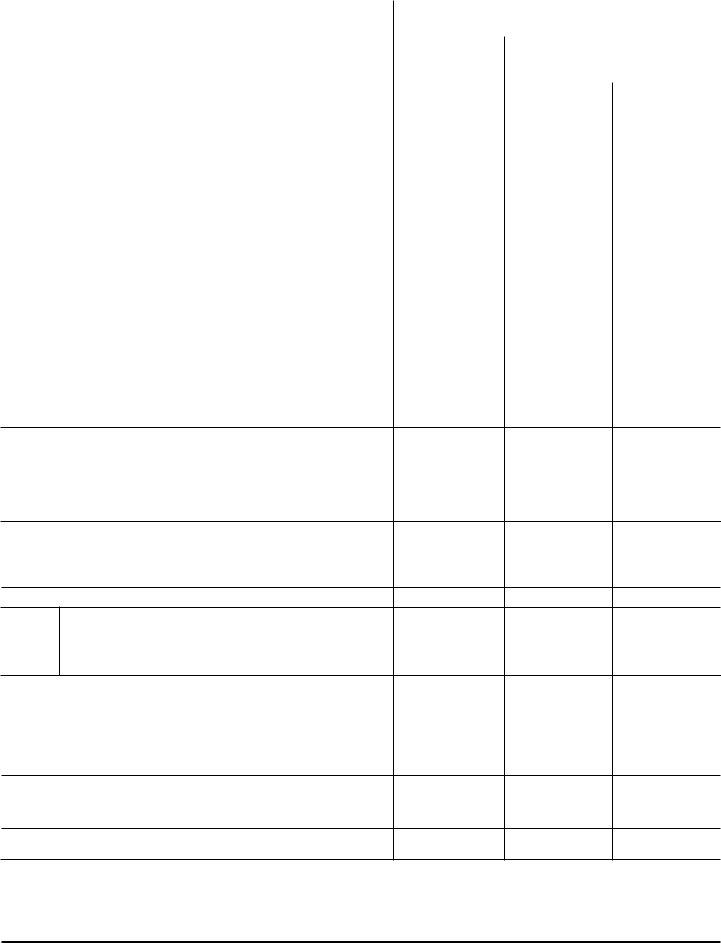

Form 4549

Form 4549 - It also requires the taxpayer's signature and. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Steps in response to form 4549. Learn what to do if you receive a letter from the irs auditing your tax return by mail. Form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Find out the difference between agreed and unagreed. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Form 4549 is issued by the irs after an audit to outline the changes to your tax return. If available, attach a copy of your. Find out how to respond, send documents, and sign form 4549 if you agree with the proposed changes. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. Form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Form 4549 is issued by the irs after an audit to outline the changes to your tax return. 1) to pay the bill, 2) to gather more evidence or law to support your case & respond with form 12661, 3) appeal to the agent's manager, 4). Irs form 4549, also known as the income tax examination changes, is a document used by the internal revenue service (irs) to outline the results of an audit or examination of a. Learn what to do if you receive a letter from the irs auditing your tax return by mail. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Learn what it means, how to respond, and what options you have if you disagree with. If available, attach a copy of your. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. It also requires the taxpayer's signature and. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a. Learn about the format and content of rars, which are reports of adjustments and tax liability computed by examiners. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. As to which changes you want us to consider. Form 4549, or the income tax. Learn what to do if you receive a letter from the irs auditing your tax return by mail. Form 4549, is the basic report form for most individual and corporate income tax cases. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. Irs. In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund. Steps in response to form 4549. Learn about the format and content of rars, which are reports of adjustments and tax liability computed by examiners. It also requires the taxpayer's. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. Form 4549 reflects adjustments to taxable income and the corrected tax liability, and allows for a. Helped over 8mm worldwide 12mm+ questions answered Irs form 4549, also known as the income tax examination changes, is a document used by. Learn what it means, how to respond, and what options you have if you disagree with. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest.. Steps in response to form 4549. Helped over 8mm worldwide 12mm+ questions answered Form 4549 reflects adjustments to taxable income and the corrected tax liability, and allows for a. If available, attach a copy of your. Learn about the format and content of rars, which are reports of adjustments and tax liability computed by examiners. Form 4549 is used by the irs to report the results of an income tax examination, including adjustments, tax liability, penalties, and interest. Learn what to do if you receive a letter from the irs auditing your tax return by mail. Helped over 8mm worldwide 12mm+ questions answered Form 4549, also known as the income tax examination changes form, is. As to which changes you want us to consider. 1) to pay the bill, 2) to gather more evidence or law to support your case & respond with form 12661, 3) appeal to the agent's manager, 4). Irs form 4549, also known as the income tax examination changes, is a document used by the internal revenue service (irs) to outline. Find out the difference between agreed and unagreed. Adjustments to credits under section 6431 for certain state and local bonds created date: It also requires the taxpayer's signature and. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. Form 4549, also known as the income tax examination changes. 1) to pay the bill, 2) to gather more evidence or law to support your case & respond with form 12661, 3) appeal to the agent's manager, 4). Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. As to which changes you want us to consider. In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Learn what it means, how to respond, and what options you have if you disagree with. Find out how to respond, send documents, and sign form 4549 if you agree with the proposed changes. Learn about the format and content of rars, which are reports of adjustments and tax liability computed by examiners. Form 4549 is issued by the irs after an audit to outline the changes to your tax return. Form 4549 reflects adjustments to taxable income and the corrected tax liability, and allows for a. Adjustments to credits under section 6431 for certain state and local bonds created date: Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. Irs form 4549, also known as the income tax examination changes, is a document used by the internal revenue service (irs) to outline the results of an audit or examination of a. If available, attach a copy of your. Form 4549, is the basic report form for most individual and corporate income tax cases. Learn what to do if you receive a letter from the irs auditing your tax return by mail.Irs form 4549 Fill out & sign online DocHub

Form 4668 Employment Tax Examination Changes Report printable pdf

Tax Letters Explained Washington Tax Services

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Form 4549 Tax Examination Changes Internal Revenue Service

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Demystifying Form 4549 Understanding Your IRS Audit Report

Form 4549A Tax Discrepancy Adjustments printable pdf download

Fillable Form 4549E Tax Discrepancy Adjustments Form

Guide to IRS Form 4549 Examination Changes

Form 4549, Or Income Tax Examination Changes, Is A Document The Irs Uses To Propose Adjustments To Your Income Tax Return.

Steps In Response To Form 4549.

Form 4549 Is Used By The Irs To Report The Results Of An Income Tax Examination, Including Adjustments, Tax Liability, Penalties, And Interest.

It Also Requires The Taxpayer's Signature And.

Related Post: