Form 501-Corp Declaration Of Directors And Officers

Form 501-Corp Declaration Of Directors And Officers - Protect your nonprofit from scam notices masquerading as official forms, and learn how to identify, avoid, and report fraudulent solicitations effectively. Corporations code section 501 neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders ( section 166 ) if the corporation. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. You can file the form and pay the. California law requires that corporations update their records with the secretary of state’s office. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Although this manual is useful to any organization seeking to incorporate, the emphasis is on organizations that want to incorporate as public benefit corporations and who want to seek. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Statements of information, common interest development statements and publicly traded disclosure statements can be filed online at bizfileonline.sos.ca.gov. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. See details in the link. If your nonprofit receives an official looking letter from corporate processing service, 836 57th st ste 490, sacramento ca, offering to file a form 501. Simple questionnairefast & simple formationlegal protectionservice in all 50 states Corporations code section 501 neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders ( section 166 ) if the corporation. You can file the form and pay the. Protect your nonprofit from scam notices masquerading as official forms, and learn how to identify, avoid, and report fraudulent solicitations effectively. Every year, your california corporation must file an annual statement of. This form is considered filed the date it is. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. For state candidates, this form is considered. Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third party to file a. (please refer to the form for ordering information and fees.) filings and information contained in filings you submit to the secretary of state are public record, including names, phone. See. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Simple questionnairefast & simple formationlegal protectionservice in all 50 states This form is considered filed the date it is. File the form 501 before you solicit or receive any contributions or before you make expenditures. If your nonprofit receives an official looking letter from corporate processing service, 836 57th st ste 490, sacramento ca, offering to file a form 501. Statements of information, common interest development statements and publicly traded disclosure statements can be filed online at bizfileonline.sos.ca.gov. Simple questionnairefast & simple formationlegal protectionservice in all 50 states You can file the form and pay. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. File the form 501 before you solicit or receive any contributions or. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Protect your nonprofit from scam notices masquerading as official forms, and learn how to identify, avoid, and report fraudulent solicitations effectively. You can file the form and pay the. Although this manual is useful to. The form asks for basic information about the corporation such as the names and addresses of the directors and officers, and the filing fee usually is $25. (please refer to the form for ordering information and fees.) filings and information contained in filings you submit to the secretary of state are public record, including names, phone. For state candidates, this. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. This form is considered filed the date it is. File the. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. This form is considered filed the date it is. The form asks for basic information about the corporation such as the names and addresses of the directors and officers, and the filing fee usually is. Every corporation shall file, within 90 days after the filing of its original articles and annually thereafter during the applicable filing period, on a form prescribed by the secretary of. This form is considered filed the date it is. Learn how to start a 501(c)(3) nonprofit organization with expert guidance from business & financial solutions. File the form 501 before. Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third party to file a. California law requires that corporations update their records with the secretary of state’s office. Although this manual is useful to any organization seeking to incorporate, the emphasis is on organizations. If your nonprofit receives an official looking letter from corporate processing service, 836 57th st ste 490, sacramento ca, offering to file a form 501. The form asks for basic information about the corporation such as the names and addresses of the directors and officers, and the filing fee usually is $25. Every corporation shall file, within 90 days after the filing of its original articles and annually thereafter during the applicable filing period, on a form prescribed by the secretary of. File the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Learn how to start a 501(c)(3) nonprofit organization with expert guidance from business & financial solutions. Although this manual is useful to any organization seeking to incorporate, the emphasis is on organizations that want to incorporate as public benefit corporations and who want to seek. For state candidates, this form is considered. (please refer to the form for ordering information and fees.) filings and information contained in filings you submit to the secretary of state are public record, including names, phone. See details in the link. Protect your nonprofit from scam notices masquerading as official forms, and learn how to identify, avoid, and report fraudulent solicitations effectively. I should say it clearly says it’s an offer not made by an agency of the government however they are asking $243 for filling out a form you can submit online for $20. Every year, your california corporation must file an annual statement of. California law requires that corporations update their records with the secretary of state’s office. This form is considered filed the date it is. Simple questionnairefast & simple formationlegal protectionservice in all 50 states Certain business entities have reported receiving misleading solicitations like this sample (pdf) urging the business to submit an order form and processing fee to a third party to file a.IRS For 501c4 Form14449 Irs Tax Forms 501(C) Organization

501 C 3 Document Form

Form 501N ≡ Fill Out Printable PDF Forms Online

Form DFI/CORP/501 Fill Out, Sign Online and Download Fillable PDF

501 llc Fill out & sign online DocHub

501 corp Fill out & sign online DocHub

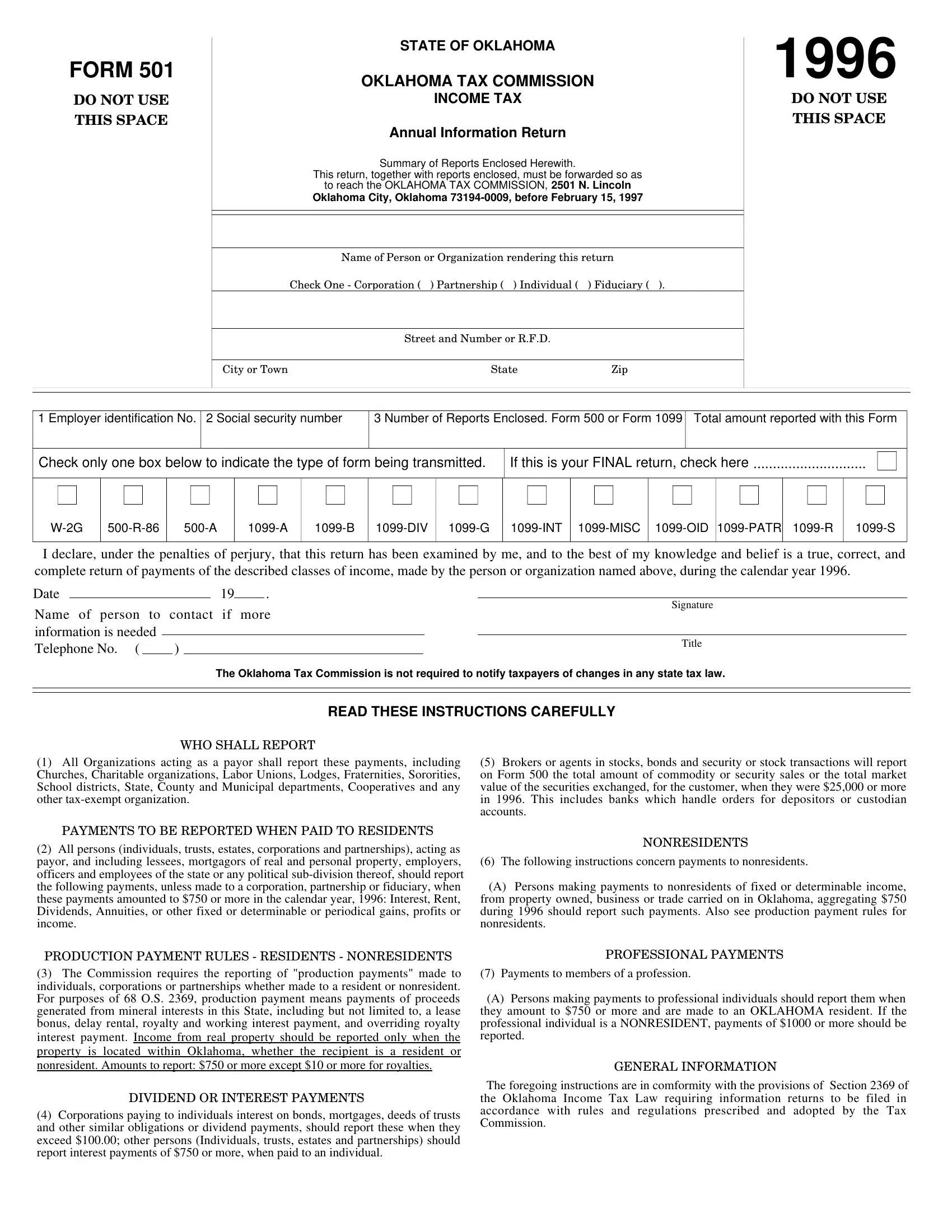

Form 501 ≡ Fill Out Printable PDF Forms Online

Fillable Form 501 Annual Information Return 2015 printable pdf download

501C3 Bylaws Template

FREE 12+ Business Declaration Form Samples, PDF, MS Word, Google Docs

Corporations Code Section 501 Neither A Corporation Nor Any Of Its Subsidiaries Shall Make Any Distribution To The Corporation’s Shareholders ( Section 166 ) If The Corporation.

This Form Is Considered Filed The Date It Is.

File The Form 501 Before You Solicit Or Receive Any Contributions Or Before You Make Expenditures From Personal Funds On Behalf Of Your Candidacy.

Statements Of Information, Common Interest Development Statements And Publicly Traded Disclosure Statements Can Be Filed Online At Bizfileonline.sos.ca.gov.

Related Post: