Form 541

Form 541 - Learn the filing requirements, due dates, mailing addresses, and how to request a prompt audit for. If you are certifying that you are married for the purpose of va benefits, your marriage must be recognized by the place where you and/or your spouse. This booklet provides instructions for filing california fiduciary income tax return (form 541) for the 2022 taxable year. It includes instructions, schedules, and lines for various. Our 541™ athletic taper gives you more room in the thigh and seat for comfort and mobility, but starts to taper at the knee down to the ankle for a sharp, streamlined aesthetic. It also covers topics such as. Form 541 2023 3162233 tax and payments schedule a charitable deduction. This booklet provides instructions for filing california fiduciary income tax return (form 541) for taxable years beginning on or after january 1, 2023. This form is for income earned in tax year 2024, with tax returns due in april 2025. This publication provides federal income tax information for partnerships and partners, including how to form, terminate, report, and withhold on partnerships. If you are certifying that you are married for the purpose of va benefits, your marriage must be recognized by the place where you and/or your spouse. It also covers topics such as. Form 541 is used to amend or restate the articles of incorporation of a domestic nonprofit corporation in ohio. This form is for income earned in tax year 2024, with tax returns due in april 2025. Navigate california form 541 with ease. It includes information on new and updated laws, credits, exclusions,. This is a pdf form for reporting the income and tax liability of estates, trusts, and other fiduciaries in california for the year 2022. California form 541 is a document for. Verification of school attendance (form 541 or form 541cf) do not verify the student status of children applying for any of the family health plans. Form 541 is used to report income received or distributed by an estate or trust in california. California form 541 is a document for. Understand filing requirements, deadlines, and key details for accurate and compliant submissions. # income distribution deduction on an amt basis This form is for income earned in tax year 2024, with tax returns due in april 2025. This publication provides federal income tax information for partnerships and partners, including how to form, terminate,. This booklet provides instructions for filing california fiduciary income tax return (form 541) for taxable years beginning on or after january 1, 2023. Do not complete for a simple trust or a pooled income fund. # income distribution deduction on an amt basis If you are certifying that you are married for the purpose of va benefits, your marriage must. This is a pdf form for reporting the income and tax liability of estates, trusts, and other fiduciaries in california for the year 2022. It includes information on new and updated laws, credits, exclusions,. Form 541 is used to amend or restate the articles of incorporation of a domestic nonprofit corporation in ohio. Learn the filing requirements, due dates, mailing. This is a pdf form for reporting the income and tax liability of estates, trusts, and other fiduciaries in california for taxable year 2024. Navigate california form 541 with ease. We will update this page with a new version of the form for 2026 as soon as it is made available by the. Understand filing requirements, deadlines, and key details. It includes instructions, schedules, and lines for various. Verification of school attendance (form 541 or form 541cf) do not verify the student status of children applying for any of the family health plans. It includes instructions, schedules, and lines for various types of. Form 541 2023 3162233 tax and payments schedule a charitable deduction. Navigate california form 541 with ease. We will update this page with a new version of the form for 2026 as soon as it is made available by the. It must be typed, signed by an authorized representative, and include the. Verification of school attendance (form 541 or form 541cf) verification of living with (form 2540) (use to verify living with when it is necessary to. It includes information on new and updated laws, credits, exclusions,. Verification of school attendance (form 541 or form 541cf) verification of living with (form 2540) (use to verify living with when it is necessary to get a signed statement. This is a pdf form for reporting the income and tax liability of estates, trusts, and other fiduciaries in california for. # income distribution deduction on an amt basis It includes information on new and updated laws, credits, exclusions,. Verification of school attendance (form 541 or form 541cf) do not verify the student status of children applying for any of the family health plans. It also covers topics such as. Verification of school attendance (form 541 or form 541cf) verification of. It includes information on new and updated laws, credits, exclusions,. This booklet provides instructions for filing california fiduciary income tax return (form 541) for taxable years beginning on or after january 1, 2023. Certificate showing residence and heirs of deceased veteran or beneficiary form revision date: Do not complete for a simple trust or a pooled income fund. If you. We will update this page with a new version of the form for 2026 as soon as it is made available by the. Certificate showing residence and heirs of deceased veteran or beneficiary form revision date: This booklet provides instructions for filing california fiduciary income tax return (form 541) for the 2022 taxable year. Form 541 is used to report. Form 541 is used to report income received or distributed by an estate or trust in california. Verification of school attendance (form 541 or form 541cf) do not verify the student status of children applying for any of the family health plans. It includes instructions, schedules, and lines for various. California form 541 is a document for. Certificate showing residence and heirs of deceased veteran or beneficiary form revision date: This publication provides federal income tax information for partnerships and partners, including how to form, terminate, report, and withhold on partnerships. # income distribution deduction on an amt basis Learn the filing requirements, due dates, mailing addresses, and how to request a prompt audit for. It includes instructions, schedules, and lines for various types of. This form is for income earned in tax year 2024, with tax returns due in april 2025. This booklet provides instructions for filing california fiduciary income tax return (form 541) for taxable years beginning on or after january 1, 2023. This booklet provides instructions for filing california fiduciary income tax return (form 541) for the 2022 taxable year. It includes information on new and updated laws, credits, exclusions,. Form 541 is used to amend or restate the articles of incorporation of a domestic nonprofit corporation in ohio. Our 541™ athletic taper gives you more room in the thigh and seat for comfort and mobility, but starts to taper at the knee down to the ankle for a sharp, streamlined aesthetic. It also covers topics such as.Fillable California Form 541Es Estimated Tax For Fiduciaries 2016

Form 541T California Allocation Of Estimated Tax Payments To

Instructions For Form 541 California Fiduciary Tax Return

Fillable Form 541 California Fiduciary Tax Return 2010

Fillable California Schedule P (541) Attach To Form 541 Alternative

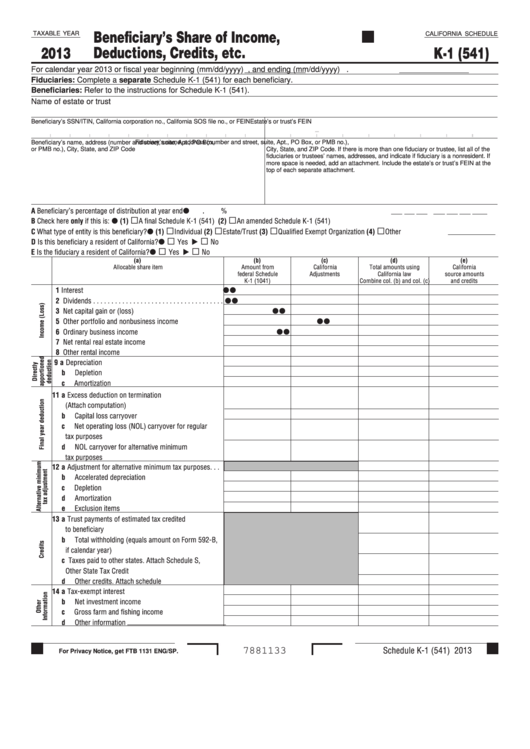

California Schedule K1 (Form 541) Beneficiary'S Share Of

Form 541A Trust Accumulation Of Charitable Amounts printable pdf

Fillable California Form 541Es Estimated Tax For Fiduciaries 2009

Form 541 Download Fillable PDF or Fill Online California Fiduciary

2015 Form 541 California Fiduciary Tax Return Edit, Fill

We Will Update This Page With A New Version Of The Form For 2026 As Soon As It Is Made Available By The.

If You Are Certifying That You Are Married For The Purpose Of Va Benefits, Your Marriage Must Be Recognized By The Place Where You And/Or Your Spouse.

Navigate California Form 541 With Ease.

Form 541 2023 3162233 Tax And Payments Schedule A Charitable Deduction.

Related Post: