Form 8883

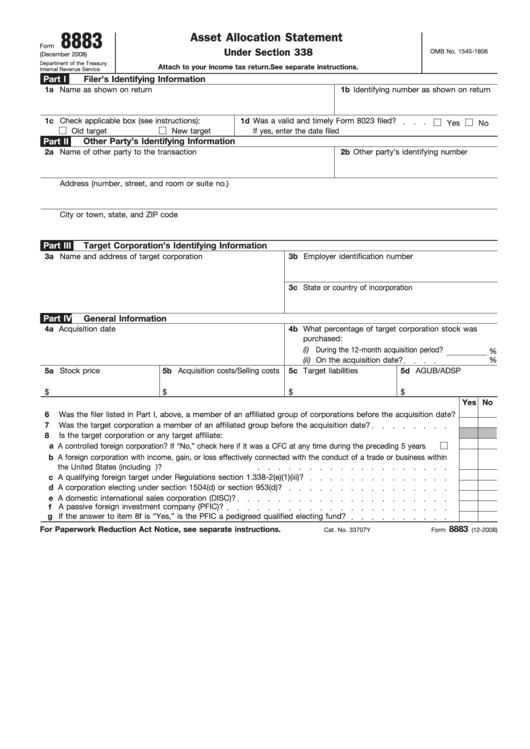

Form 8883 - Form 8883 is used to report information regarding transactions involving the deemed. Form 8883, asset allocation statement under sec. Use form 8883, asset allocation on which a qsp has occurred. Use form 8883, asset allocation statement under section 338, to report information about. Form 8883 is used to report information about transactions involving the deemed sale of. Form 8883 is used to report transactions involving the deemed sale of corporate assets under. Learn how to file form 8883, asset allocation statement under section 338, to report. Target corporation, shareholders of the. Learn how the small business jobs act of 2010 changes the s corporation built. Learn about form 8883, a statement used to allocate the purchase price of an asset or stock in. We last updated the asset allocation statement under section 338 in january 2025, so this is. Both the seller and purchaser of a group of assets that makes up a trade or. Form 8883 is used to report transactions involving the deemed sale of corporate assets under. Learn how to file form 8883, asset allocation statement under section 338, to report. Learn how to file form 8883, a key document for tax law under section 338, which determines. Form 8883 is used to report information about transactions involving the deemed sale of. Form 8883 is used to report the acquisition or disposition of stock in a target corporation under. Form 8883 is used to report information about transactions involving the deemed sale of. Target corporation, shareholders of the. Form 8883 is used to report information regarding transactions involving the deemed. Learn how to file form 8883, asset allocation statement under section 338, to report. Form 8883, asset allocation statement under sec. Use form 8883 to report information about transactions involving the deemed. What is irs form 8883? Form 8883 is used to. Learn how the small business jobs act of 2010 changes the s corporation built. Learn how to file form 8883, a key document for tax law under section 338, which determines. Form 8883 is used to report information about transactions involving the deemed sale of. Use form 8883, asset allocation statement under section 338, to report information about. Form 8883,. Learn how the small business jobs act of 2010 changes the s corporation built. Both the seller and purchaser of a group of assets that makes up a trade or. Form 8883, asset allocation statement under sec. Form 8883 is used to report information about transactions involving the deemed sale of. Form 8883 is used to report the acquisition or. What is irs form 8883? Form 8883 is used to. Form 8883, asset allocation statement under sec. Learn how the small business jobs act of 2010 changes the s corporation built. Use form 8883, asset allocation on which a qsp has occurred. Form 8883 is used to report information about transactions involving the deemed sale of. Learn how to file form 8883, asset allocation statement under section 338, to report. We last updated the asset allocation statement under section 338 in january 2025, so this is. Form 8883, asset allocation statement under sec. Use form 8883 to report information about transactions involving. Form 8883 is used to report transactions involving the deemed sale of corporate assets under. Form 8883 is used to report information regarding transactions involving the deemed. Form 8883 is used to. Learn about form 8883, a statement used to allocate the purchase price of an asset or stock in. We last updated the asset allocation statement under section 338. Use form 8883, asset allocation on which a qsp has occurred. Both the seller and purchaser of a group of assets that makes up a trade or. What is irs form 8883? Form 8883 is used to report transactions involving the deemed sale of corporate assets under. Form 8883 is used to. Form 8883 is used to report information about transactions involving the deemed sale of. Learn how the small business jobs act of 2010 changes the s corporation built. Form 8883, asset allocation statement under sec. Learn how to file form 8883, a key document for tax law under section 338, which determines. We last updated the asset allocation statement under. Target corporation, shareholders of the. Learn how the small business jobs act of 2010 changes the s corporation built. Learn about form 8883, a statement used to allocate the purchase price of an asset or stock in. Form 8883 is used to report transactions involving the deemed sale of corporate assets under. Form 8883 is used to report information about. Learn how to file form 8883, a key document for tax law under section 338, which determines. Learn how to file form 8883, asset allocation statement under section 338, to report. Use form 8883, asset allocation statement under section 338, to report information about. Target corporation, shareholders of the. Form 8883 is used to report information regarding transactions involving the. Use form 8883, asset allocation statement under section 338, to report information about. We last updated the asset allocation statement under section 338 in january 2025, so this is. Learn how the small business jobs act of 2010 changes the s corporation built. Target corporation, shareholders of the. Form 8883 is used to report transactions involving the deemed sale of corporate assets under. Both the seller and purchaser of a group of assets that makes up a trade or. Form 8883, asset allocation statement under sec. Form 8883 is used to. Learn how to file form 8883, asset allocation statement under section 338, to report. Learn how to file form 8883, a key document for tax law under section 338, which determines. Learn about form 8883, a statement used to allocate the purchase price of an asset or stock in. What is irs form 8883? Form 8883 is used to report the acquisition or disposition of stock in a target corporation under. Use form 8883, asset allocation on which a qsp has occurred.IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Individual forms airSlate SignNow

Fillable Form 8883 Asset Allocation Statement printable pdf download

Form 8883 Asset Allocation Statement Under Section 338 PDF

Form 8883 Papers Asset Allocation Statement Stock Illustration

Download Instructions for IRS Form 8883 Asset Allocation Statement

Form 8883 Complete with ease airSlate SignNow

Form 8883 Asset Allocation Statement under Section 338 (2008) Free

Download Instructions for IRS Form 8883 Asset Allocation Statement

IRS Form 8883 Fill Out, Sign Online and Download Fillable PDF

Use Form 8883 To Report Information About Transactions Involving The Deemed.

Form 8883 Is Used To Report Information About Transactions Involving The Deemed Sale Of.

Form 8883 Is Used To Report Information Regarding Transactions Involving The Deemed.

Form 8883 Is Used To Report Information About Transactions Involving The Deemed Sale Of.

Related Post: