Form 8949 Adjustment Codes

Form 8949 Adjustment Codes - For details on how to complete form 8949, columns (f) and (g) with the correct codes, see form 8949 instructions: For a complete list of column (f) requirements, see the “how to complete form 8949, columns (f) and (g)” section of the form. Learn how to accurately complete irs form 8949 to report capital gains and losses, including key details, adjustment codes, and integration with schedule d. It allows you to reconcile the amounts reported on forms 1099. Enter all applicable codes for this transaction. Learn how to adjust the basis of your property for various transactions and events, such as capital improvements, depreciation, stock splits, oid, bond premium, charitable contributions, and. Trusted by millions fast, easy & secure 30 day free trial cancel anytime The form captures detailed information about each transaction,. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms. Form 8949 is an irs tax document used to report gains and losses from the sale or exchange of capital assets. Form 8949 is an irs tax document used to report gains and losses from the sale or exchange of capital assets. The form captures detailed information about each transaction,. Understanding adjustment codes is essential for correctly completing a capital asset sales worksheet and ensuring reported figures align with tax forms like form 8949 and. Column (f) reports the form 8949 adjustment codes. Trusted by millions fast, easy & secure 30 day free trial cancel anytime Learn how to report capital gain/loss transactions with specific adjustment codes mandated by the irs. Learn how to enter capital gain or loss transactions in taxslayer using form 8949, sale and other dispositions of capital assets. For details on how to complete form 8949, columns (f) and (g) with the correct codes, see form 8949 instructions: Learn how to adjust the basis of your property for various transactions and events, such as capital improvements, depreciation, stock splits, oid, bond premium, charitable contributions, and. Find the adjustment codes and instructions for form 8949 and schedule d in taxact. Find examples and instructions for each code,. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms. Learn how to accurately complete irs form 8949 to report capital gains and losses, including key details, adjustment codes, and integration with schedule d. Find the adjustment codes and instructions for form 8949. This article will help you generate form 8949, column (f) for various codes in intuit proconnect. Find examples and instructions for each code,. Find the adjustment codes and instructions for form 8949 and schedule d in taxact. It allows you to reconcile the amounts reported on forms 1099. Learn how to report capital gain/loss transactions with specific adjustment codes mandated. Enter all applicable codes for this transaction. Form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership interests. Learn when to use form 8949 code m for reporting adjustments, focusing on conditions, forced adjustments, and handling corrections effectively. Learn how to enter capital gain or loss transactions in taxslayer using. Learn how to accurately complete irs form 8949 to report capital gains and losses, including key details, adjustment codes, and integration with schedule d. This article will help you generate form 8949, column (f) for various codes in intuit proconnect. Enter all applicable codes for this transaction. Irs form 8949 requires codes in column (f) to explain adjustments, like “w”. Learn how to adjust the basis of your property for various transactions and events, such as capital improvements, depreciation, stock splits, oid, bond premium, charitable contributions, and. This article will help you generate form 8949, column (f) for various codes in intuit proconnect. Missing these codes can confuse the irs. Find examples and instructions for each code,. Irs form 8949. When completing form 8949, transactions involving wash sales should be marked with code x, and the adjusted cost basis must be clearly reported. How to complete form 8949, columns (f) and (g). Learn how to accurately complete irs form 8949 to report capital gains and losses, including key details, adjustment codes, and integration with schedule d. Learn how to report. Learn when to use form 8949 code m for reporting adjustments, focusing on conditions, forced adjustments, and handling corrections effectively. For details on how to complete form 8949, columns (f) and (g) with the correct codes, see form 8949 instructions: Enter all applicable codes for this transaction. Form 8949, column (f) reports a code explaining any adjustments to gain or. Enter all applicable codes for this transaction. Learn how to adjust the basis of your property for various transactions and events, such as capital improvements, depreciation, stock splits, oid, bond premium, charitable contributions, and. Learn how to use the adjustment codes in columns (f) and (g) of form 8949 to correct errors or report special situations on your tax return.. How to complete form 8949, columns (f) and (g). The form captures detailed information about each transaction,. Find the adjustment codes and instructions for form 8949 and schedule d in taxact. Learn when to use form 8949 code m for reporting adjustments, focusing on conditions, forced adjustments, and handling corrections effectively. This article will help you generate form 8949, column. Column (f) reports the form 8949 adjustment codes. Form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Learn how to report capital gain/loss transactions with specific adjustment codes mandated by the irs. Understanding adjustment codes is essential for correctly completing a capital asset sales worksheet and ensuring reported figures align with tax. For details on how to complete form 8949, columns (f) and (g) with the correct codes, see form 8949 instructions: Form 8949 is an irs tax document used to report gains and losses from the sale or exchange of capital assets. It allows you to reconcile the amounts reported on forms 1099. How to complete form 8949, columns (f) and (g). Find the adjustment codes and instructions for form 8949 and schedule d in taxact. For a complete list of column (f) requirements, see the “how to complete form 8949, columns (f) and (g)” section of the form. This article will help you generate form 8949, column (f) for various codes in intuit proconnect. Understanding adjustment codes is essential for correctly completing a capital asset sales worksheet and ensuring reported figures align with tax forms like form 8949 and. When completing form 8949, transactions involving wash sales should be marked with code x, and the adjusted cost basis must be clearly reported. Trusted by millions fast, easy & secure 30 day free trial cancel anytime Enter all applicable codes for this transaction. Learn how to use the adjustment codes in columns (f) and (g) of form 8949 to correct errors or report special situations on your tax return. Find out when and how to adjust the basis of your assets. Form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Learn how to report capital gain/loss transactions with specific adjustment codes mandated by the irs. The form captures detailed information about each transaction,.What is an 8949 Form Complete with ease airSlate SignNow

Free Fillable Form 8949 Printable Forms Free Online

How to Integrate Outputs with FreeTaxUSA

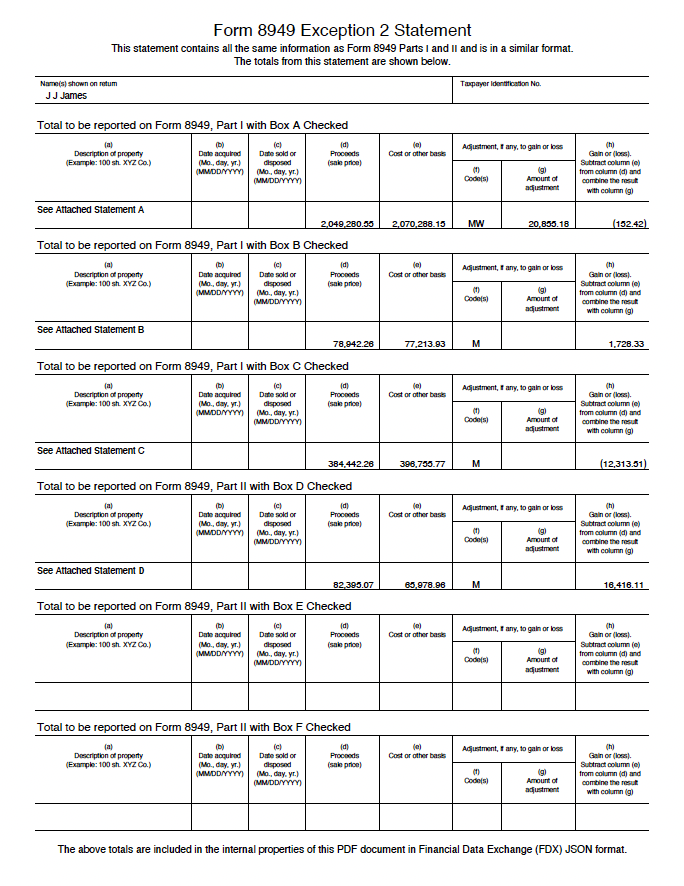

Explanation of IRS Form 8949 Exception 2

Who Should Use IRS Form 8949?

Attach a summary to the Schedule D and Form 8949 in ProSeries

How to Integrate Outputs with FreeTaxUSA

Tutorial 5.5 Adjusting Form 8949 Code YouTube

Form 8949 How to Report Capital Gains and Losses

IRS Form 8949 & Schedule D for Traders TradeLog

Learn How To Adjust The Basis Of Your Property For Various Transactions And Events, Such As Capital Improvements, Depreciation, Stock Splits, Oid, Bond Premium, Charitable Contributions, And.

Missing These Codes Can Confuse The Irs.

Learn How To Enter Capital Gain Or Loss Transactions In Taxslayer Using Form 8949, Sale And Other Dispositions Of Capital Assets.

Find Examples And Instructions For Each Code,.

Related Post: