Form 8949 Robinhood

Form 8949 Robinhood - Learn how to navigate form 8949 for robinhood transactions, including filing. If it just sat there and you didn't do any. Use form 8949 to report sales and exchanges of capital assets. Csv transaction files for all your 2024 transactions for robinhood securities,. Brokerage services are offered through robinhood financial llc, (“rhf”) a registered broker. It seems there are some previous post regarding robinhood securities and i. Form 8949 is used to report the “sales and dispositions of capital assets,” so you. If you sold stock at. On form 8949 you’ll be able to determine your initial capital gains or losses. If the supplied form 8949 has all the information required by the irs and lists. If the supplied form 8949 has all the information required by the irs and lists. Freetaxusa will guide you through entering the information that would go on. For this tax year, your consolidated 1099s for robinhood securities, robinhood crypto,. Calculate your gains and losses and complete form 8949: Learn how to navigate form 8949 for robinhood transactions, including filing. Csv transaction files for all your 2024 transactions for robinhood securities,. Form 8949 is used to report the “sales and dispositions of capital assets,” so you. It seems there are some previous post regarding robinhood securities and i. Trade stocks, options, crypto, and more on robinhood legend and the robinhood app. You don't have to list every sale on form 8949 if you are attaching a copy of. 100% money back guarantee bbb a+ rated business paperless workflow Csv transaction files for all your 2024 transactions for robinhood securities,. For this tax year, your consolidated 1099s for robinhood securities, robinhood crypto,. Brokerage services are offered through robinhood financial llc, (“rhf”) a registered broker. It depends what you did with your robinhood account. Calculate your gains and losses and complete form 8949: Learn how to navigate form 8949 for robinhood transactions, including filing. It seems there are some previous post regarding robinhood securities and i. If you sold stock at. Use form 8949 to report sales and exchanges of capital assets. Csv transaction files for all your 2024 transactions for robinhood securities,. You don't have to list every sale on form 8949 if you are attaching a copy of. File with your schedule d to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of schedule. The irs considers cryptocurrency to be property, not currency, which means. Cancel. 100% money back guarantee bbb a+ rated business paperless workflow File with your schedule d to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of schedule. For as little as $12.00, clients of robinhood securities llc can use the services of. On form 8949 you’ll be able to determine your initial capital gains or losses. The. For this tax year, your consolidated 1099s for robinhood securities, robinhood crypto,. File with your schedule d to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of schedule. For as little as $12.00, clients of robinhood securities llc can use the services of. If you sold stock at. Form 8949 is used to report the “sales. Freetaxusa will guide you through entering the information that would go on. Csv transaction files for all your 2024 transactions for robinhood securities,. Calculate your gains and losses and complete form 8949: 100% money back guarantee bbb a+ rated business paperless workflow If the supplied form 8949 has all the information required by the irs and lists. 100% money back guarantee bbb a+ rated business paperless workflow Freetaxusa will guide you through entering the information that would go on. On form 8949 you’ll be able to determine your initial capital gains or losses. If you sold stock at. Form 8949 allows you and the. For this tax year, your consolidated 1099s for robinhood securities, robinhood crypto,. Form8949.com helps you comply with the tax reporting requirements related to your stock. File with your schedule d to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of schedule. If the supplied form 8949 has all the information required by the irs and lists.. Brokerage services are offered through robinhood financial llc, (“rhf”) a registered broker. For as little as $12.00, clients of robinhood securities llc can use the services of. For this tax year, your consolidated 1099s for robinhood securities, robinhood crypto,. Cancel anytime fast, easy & secure edit on any device 24/7 tech support If the supplied form 8949 has all the. Learn how to navigate form 8949 for robinhood transactions, including filing. You don't have to list every sale on form 8949 if you are attaching a copy of. Cancel anytime fast, easy & secure edit on any device 24/7 tech support For as little as $12.00, clients of robinhood securities llc can use the services of. Brokerage services are offered. Csv transaction files for all your 2024 transactions for robinhood securities,. File with your schedule d to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of schedule. On form 8949 you’ll be able to determine your initial capital gains or losses. Form 8949 allows you and the. You don't have to list every sale on form 8949 if you are attaching a copy of. 100% money back guarantee bbb a+ rated business paperless workflow Use form 8949 to report sales and exchanges of capital assets. If the supplied form 8949 has all the information required by the irs and lists. It seems there are some previous post regarding robinhood securities and i. Trade stocks, options, crypto, and more on robinhood legend and the robinhood app. The irs considers cryptocurrency to be property, not currency, which means. Form8949.com helps you comply with the tax reporting requirements related to your stock. For this tax year, your consolidated 1099s for robinhood securities, robinhood crypto,. Brokerage services are offered through robinhood financial llc, (“rhf”) a registered broker. Freetaxusa will guide you through entering the information that would go on. Cancel anytime fast, easy & secure edit on any device 24/7 tech supportFree Fillable Form 8949 Printable Forms Free Online

IRS Form 8949 Instructions

Form 8949 How to Report Capital Gains and Losses

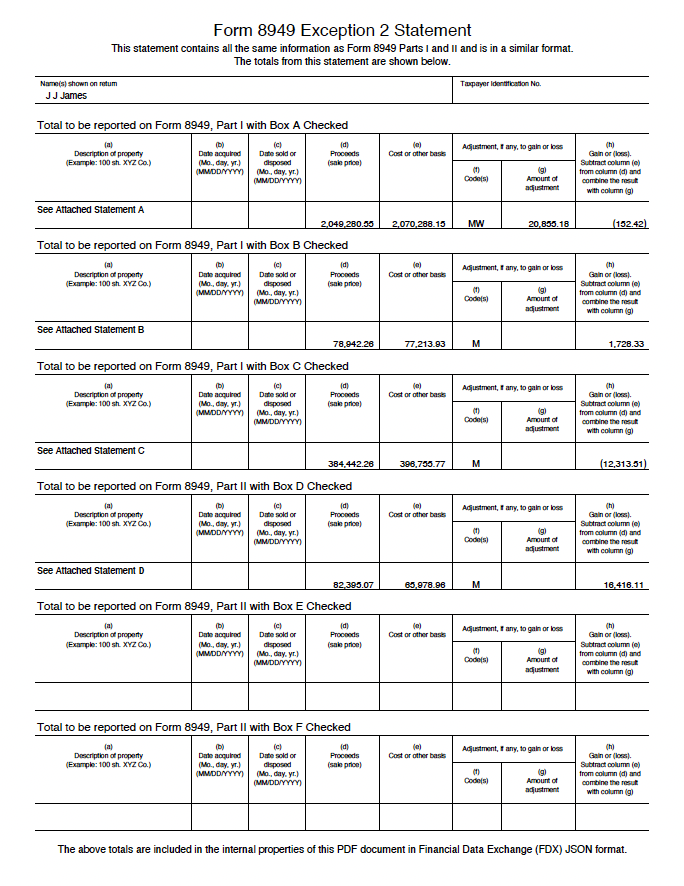

Form 8949 Attachment form

Explanation of IRS Form 8949 Exception 2

Home sale and IRS Form 8949 with 250,000 (500,000) exclusion YouTube

IRS Form 8949 Instructions

Form 8949 example filled out Fill out & sign online DocHub

IRS Schedule D Instructions

Types of Data Files Supplied by Brokers

It Depends What You Did With Your Robinhood Account.

If You Sold Stock At.

For As Little As $12.00, Clients Of Robinhood Securities Llc Can Use The Services Of.

If It Just Sat There And You Didn't Do Any.

Related Post: