Form C 3 Texas

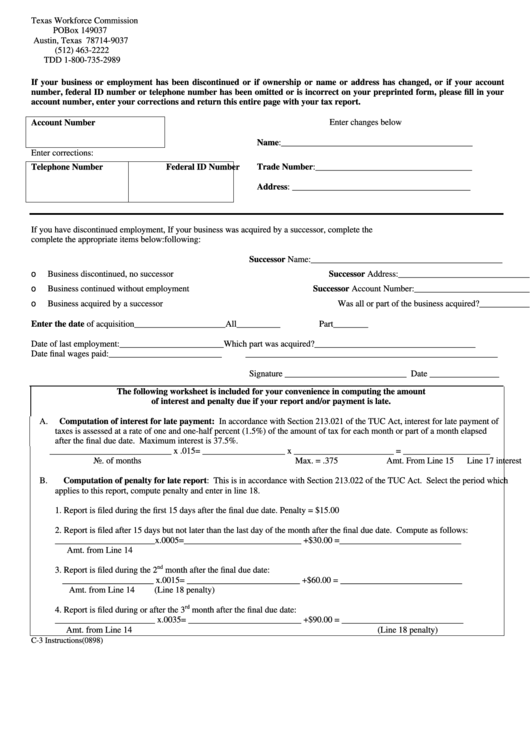

Form C 3 Texas - Determinations are based on the employee’s work situation and not the. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. 37 texas workforce commission forms and templates are collected for any of your needs. In this section, you can find the different employer’s quarterly wage report filing options. If you need additional continuation. These forms can only be used if the employer has tx set as the. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. The state of texas requires all employers to report unemployment insurance wages and pay their quarterly taxes electronically. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. 37 texas workforce commission forms and templates are collected for any of your needs. In this section, you can find the different employer’s quarterly wage report filing options. Its primary purpose is to ensure compliance with state. The state of texas requires all employers to report unemployment insurance wages and pay their quarterly taxes electronically. 519 texas tax forms and templates are collected for any of your needs. These forms can only be used if the employer has tx set as the. If you need additional continuation. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. Determinations are based on the employee’s work situation and not the. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. Determinations are based on the employee’s work situation and not the. 519 texas tax forms and templates are collected for any of your needs. 37 texas workforce commission forms and templates are collected for any of your needs. To calculate the tax due,. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. If you need additional continuation. Determinations are based on the employee’s work situation and not the. These forms can only be used if the employer has tx set as the. Determinations are based on the employee’s work situation and not the. 37 texas workforce commission forms and templates are collected for any of your needs. If you need additional continuation. If your address has changed, please update your account. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. 519 texas tax forms and templates are collected for any of your needs. Its primary purpose is to ensure compliance with state. These forms can only be used if the employer has tx set as the. Options include unemployment tax services (uts) system, quickfile, intuit. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. 37 texas workforce commission forms and templates are collected for any of your needs. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first. 519 texas tax forms and templates are collected for any of your needs. Twc uses the location of services checklist to determine whether an employee’s wages are taxable in texas. Its primary purpose is to ensure compliance with state. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. Texas requires all employers to report. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. If your address has changed, please update your account. These forms can only be used if the employer has tx set as the. Determinations are based on the employee’s work situation and not the. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. The state of texas requires all employers to report unemployment insurance wages and pay their quarterly taxes electronically. If your address has changed, please update your account.. 37 texas workforce commission forms and templates are collected for any of your needs. Its primary purpose is to ensure compliance with state. If your address has changed, please update your account. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. These forms can only be used if the. 519 texas tax forms and templates are collected for any of your needs. If you need additional continuation. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. Its primary purpose is to ensure compliance with state. Its primary purpose is to ensure compliance with state. 37 texas workforce commission forms and templates are collected for any of your needs. In this section, you can find the different employer’s quarterly wage report filing options. Texas requires all employers to report unemployment insurance (ui) wages and pay their quarterly ui taxes electronically beginning first quarter 2014. To expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. 519 texas tax forms and templates are collected for any of your needs. Determinations are based on the employee’s work situation and not the. Options include unemployment tax services (uts) system, quickfile, intuit easyacct. To calculate the tax due, enter the tax rate (item 4), taxable wages (item 14),. Enter the total amount of remuneration before deductions (including wages, commissions, bonuses and reported tips) paid to each texas employee. The state of texas requires all employers to report unemployment insurance wages and pay their quarterly taxes electronically. These forms can only be used if the employer has tx set as the.Form C3 Employer'S Quarterly Report 2004 Texas Workforce

Top C3 Form Templates free to download in PDF format

Form C3Scf ≡ Fill Out Printable PDF Forms Online

Form C3 Employer'S Quarterly Report Instructions printable pdf download

Form C3 Employer'S Quarterly Report Texas Workforce Commission

501c Fill Online, Printable, Fillable, Blank pdfFiller

Form C3 Employer'S Quarterly Report Texas Workforce Commission

Texas C 5 Form ≡ Fill Out Printable PDF Forms Online

Employee Claim Form C3 US Legal Forms

3 Uge 20112025 Form Fill Out and Sign Printable PDF Template

If Your Address Has Changed, Please Update Your Account.

Twc Uses The Location Of Services Checklist To Determine Whether An Employee’s Wages Are Taxable In Texas.

If You Need Additional Continuation.

Related Post: