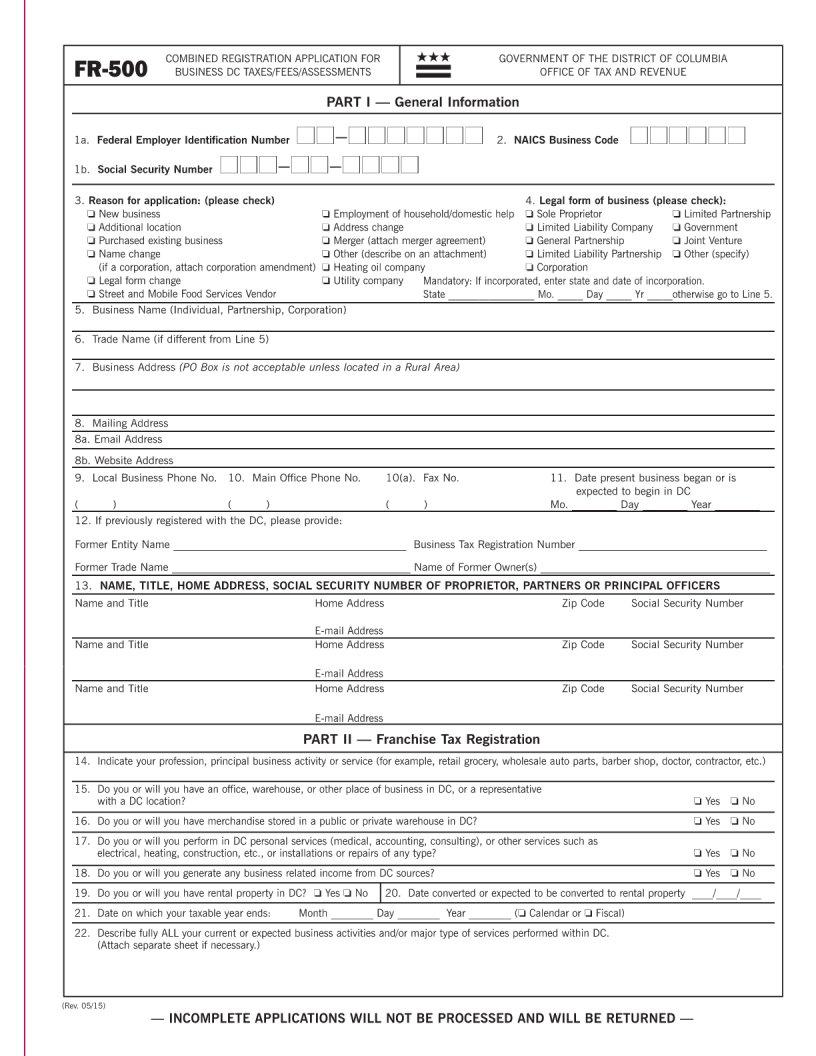

Form Fr 500

Form Fr 500 - To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. Or rated, enter state and date of incorporation. Go here to start the form: Taxpayers who wish to register a new business in the district of columbia can conveniently complete the “”register a new business: In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. Do you need to register your business and apply for a business license in the district of columbia? What should i do to register as an employer with the district's unemployment compensation program? The purpose of this form is to gather information on the business, such as ownership, location,. How do i file a fr 500? 4/5 (62 reviews) Do you need to register your business and apply for a business license in the district of columbia? St ee and mobile food services vendor state __ es name. Trade names must be first registered with the department of consumer and. Employers who pay wages for services performed in the district of columbia are required to register for an essp account number. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. 4/5 (62 reviews) Or rated, enter state and date of incorporation. Legal form of business (please check): Go here to start the form: If the employer is liable under district unemployment. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. District of columbia office of tax and revenue register for a tax registration number. Go to the dc business licensing portal to get more information about corporate. 4/5 (62 reviews) The purpose of this form is to gather information on the business, such as ownership, location,. St ee and mobile food services vendor state __ es name. What should i do to register as an employer with the district's unemployment compensation program? 4/5 (62 reviews) In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. What should i do to register as an employer with the district's unemployment compensation program? State withholding income tax tax agency: The purpose of this form is to gather information on the business, such as ownership, location,. Go here to start the form: Employers who pay wages for services performed in the district of columbia are required to register for an essp account number. Legal form of business (please check): District of columbia office of tax and revenue register for a. Legal form of business (please check): Do you need to register your business and apply for a business license in the district of columbia? In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. If the employer is liable under district. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. 4/5 (62 reviews) St ee and mobile food services vendor state __ es name. Do you need to register your business and apply for a business license in the district of columbia? The purpose of this form is to gather information on. Legal form of business (please check): St ee and mobile food services vendor state __ es name. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. Trade names must be first registered with the department of consumer and. Taxpayers who wish to register a new business in the district of columbia can. State withholding income tax tax agency: Employers who pay wages for services performed in the district of columbia are required to register for an essp account number. In order to submit taxes, businesses in the district of columbia must complete a fr500 dc form. If the employer is liable under district unemployment. To report sales and use tax receipts to. To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. State withholding income tax tax agency: Legal form of business (please check): St ee and mobile food services vendor state __ es name. What should i do to register as an employer with the district's unemployment compensation program? Do you need to register your business and apply for a business license in the district of columbia? State withholding income tax tax agency: Go here to start the form: Go to the dc business licensing portal to get more information about corporate. District of columbia office of tax and revenue register for a tax registration number and create a. Go to the dc business licensing portal to get more information about corporate. St ee and mobile food services vendor state __ es name. Or rated, enter state and date of incorporation. Taxpayers who wish to register a new business in the district of columbia can conveniently complete the “”register a new business: District of columbia office of tax and revenue register for a tax registration number and create a username and password go to. Trade names must be first registered with the department of consumer and. In addition to the forms available below, the district of columbia offers several electronic filing services to make filing your taxes simpler, faster, safer, while also providing a faster. The purpose of this form is to gather information on the business, such as ownership, location,. State withholding income tax tax agency: To report sales and use tax receipts to the dc office of tax and revenue, utilize this form. How do i file a fr 500? What should i do to register as an employer with the district's unemployment compensation program? If the employer is liable under district unemployment. Do you need to register your business and apply for a business license in the district of columbia? Legal form of business (please check):Fr 500 Fill out & sign online DocHub

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Fillable Form Fr500 Combined Business Tax Registration Application

Form Fr500t Combined Business Tax Registration Application printable

Fillable Form Fr500 Combined Business Tax Registration Application

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Instructions For Form Fr500 Combined Business Tax Registration

Fillable Online FormFR500.pdf DC OAG Fax Email Print pdfFiller

Dc Form Fr500 ≡ Fill Out Printable PDF Forms Online

Go Here To Start The Form:

In Order To Submit Taxes, Businesses In The District Of Columbia Must Complete A Fr500 Dc Form.

Employers Who Pay Wages For Services Performed In The District Of Columbia Are Required To Register For An Essp Account Number.

4/5 (62 Reviews)

Related Post: