Form I10

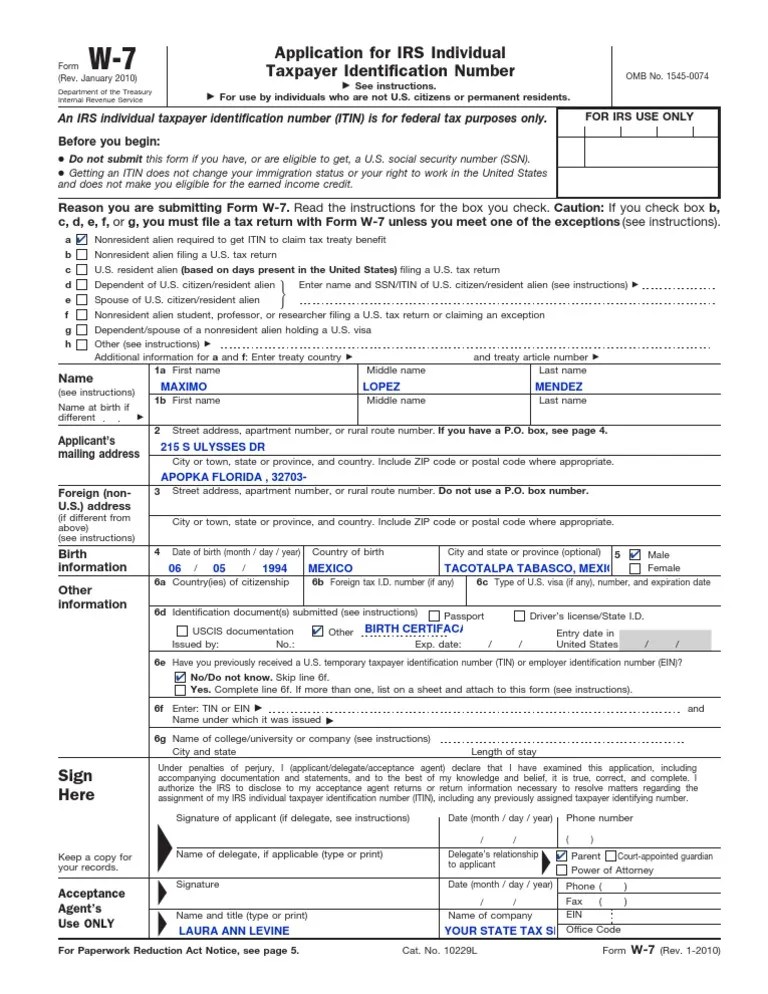

Form I10 - Use this form to appeal a uscis. You will not be filing a us federal tax return using the itin. Nonresident alien income tax return. You need an itin number since you can’t get a social security number yet. Determine if you should file an application to receive an individual taxpayer identification number (itin). Name and address of the person on whom the patient is dependent and his relationship with the patient. Renew an itin if it expired and you need to file a u.s. Access irs forms, instructions and publications in electronic and print media. Apply for an itin by mail or in person. Having an itin enables you. You need an itin number since you can’t get a social security number yet. Form fees, eligibility requirements, fee waiver eligibility, required documents and mailing addresses vary depending on the form you are filing and why you are filing. Individuals who wish to file an itin must have a valid federal income tax return unless they meet certain requirements for an exception. Getting an itin does not change your immigration status or your right to work in the united states. You will not be filing a us federal tax return using the itin. Having an itin enables you. Leave the area for ssn blank for each itin applicant listed on the. Apply for an itin by mail or in person. Find what you need in your itin application package. Itin is only being used on information returns filed with the irs by third parties such as on form 1099. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. Individuals who meet eligibility requirements can file an itin application themselves. Name and address of the person on whom the patient is dependent and his relationship with the patient. Form fees, eligibility requirements, fee waiver. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. You will not be filing a us federal tax return using the itin. Find what you need in your itin application package. Former president joe biden has been diagnosed with prostate cancer, his personal office. Nonresident alien income tax return. Form fees, eligibility requirements, fee waiver eligibility, required documents and mailing addresses vary depending on the form you are filing and why you are filing. Leave the area for ssn blank for each itin applicant listed on the. For more information on this topic, read immigrants rising’s itin guide: “last week, president joe biden was. Apply for an itin by mail or in person. Nonresident alien income tax return. Renew an itin if it expired and you need to file a u.s. Former president joe biden has been diagnosed with prostate cancer, his personal office announced sunday. Form 10 shall be used for registration pursuant to section 12(b) or (g) of the securities exchange act. For details of isro centres/units, please visit isro centres. “last week, president joe biden was seen for a new. Apply for an itin by mail or in person. Former president joe biden has been diagnosed with prostate cancer, his personal office announced sunday. Individuals who meet eligibility requirements can file an itin application themselves. Track important business tax dates and. Itin is only being used on information returns filed with the irs by third parties such as on form 1099. Form 10 shall be used for registration pursuant to section 12(b) or (g) of the securities exchange act of 1934 of classes of securities of issuers for which no other form is prescribed. Having. For details of isro centres/units, please visit isro centres. Getting an itin does not change your immigration status or your right to work in the united states. Form 10 shall be used for registration pursuant to section 12(b) or (g) of the securities exchange act of 1934 of classes of securities of issuers for which no other form is prescribed.. Nonresident alien income tax return. Use this form to appeal a uscis. All aliens in the united states must report a change of address to uscis within 10 days (except a and g visa holders and visa waiver visitors) of moving. There are 3 ways you can apply for an itin number: Leave the area for ssn blank for each. There are 3 ways you can apply for an itin number: Name and address of the person on whom the patient is dependent and his relationship with the patient. Renew an itin if it expired and you need to file a u.s. Having an itin enables you. Form fees, eligibility requirements, fee waiver eligibility, required documents and mailing addresses vary. “last week, president joe biden was seen for a new. Renew an itin if it expired and you need to file a u.s. Form fees, eligibility requirements, fee waiver eligibility, required documents and mailing addresses vary depending on the form you are filing and why you are filing. Individuals who wish to file an itin must have a valid federal. Individuals who meet eligibility requirements can file an itin application themselves. For details of isro centres/units, please visit isro centres. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. Renew an itin if it expired and you need to file a u.s. Apply for an itin by mail or in person. Getting an itin does not change your immigration status or your right to work in the united states. Individuals who wish to file an itin must have a valid federal income tax return unless they meet certain requirements for an exception. “last week, president joe biden was seen for a new. Use this form to appeal a uscis. Form fees, eligibility requirements, fee waiver eligibility, required documents and mailing addresses vary depending on the form you are filing and why you are filing. All aliens in the united states must report a change of address to uscis within 10 days (except a and g visa holders and visa waiver visitors) of moving. Form 10 shall be used for registration pursuant to section 12(b) or (g) of the securities exchange act of 1934 of classes of securities of issuers for which no other form is prescribed. Having an itin enables you. Former president joe biden has been diagnosed with prostate cancer, his personal office announced sunday. Determine if you should file an application to receive an individual taxpayer identification number (itin). Itin is only being used on information returns filed with the irs by third parties such as on form 1099.Form I10 10 Fillable Printable Forms and Tips

Form I 13 Receipt Notice The Modern Rules Of Form I 13 Receipt Notice

Perfect Work Order Request Letter National Honor Society Resume Format

Ultimate Guide to Use The I 130 Form PDF WPS PDF Blog

I9 2025 Form Pdf Finn Lovekin

Form I485 Step by Step Instructions SimpleCitizen

I10 FORM

Uscis Processing Times 2024 For I130 Oliy Tillie

Fillable Online ftp txdot Species Analysis Form. I10 From FM 2434 to

Completable En línea plans dot state tx Comment Form. I10 from Heights

You Will Not Be Filing A Us Federal Tax Return Using The Itin.

Nonresident Alien Income Tax Return.

Leave The Area For Ssn Blank For Each Itin Applicant Listed On The.

Track Important Business Tax Dates And.

Related Post: