Form Ol 3

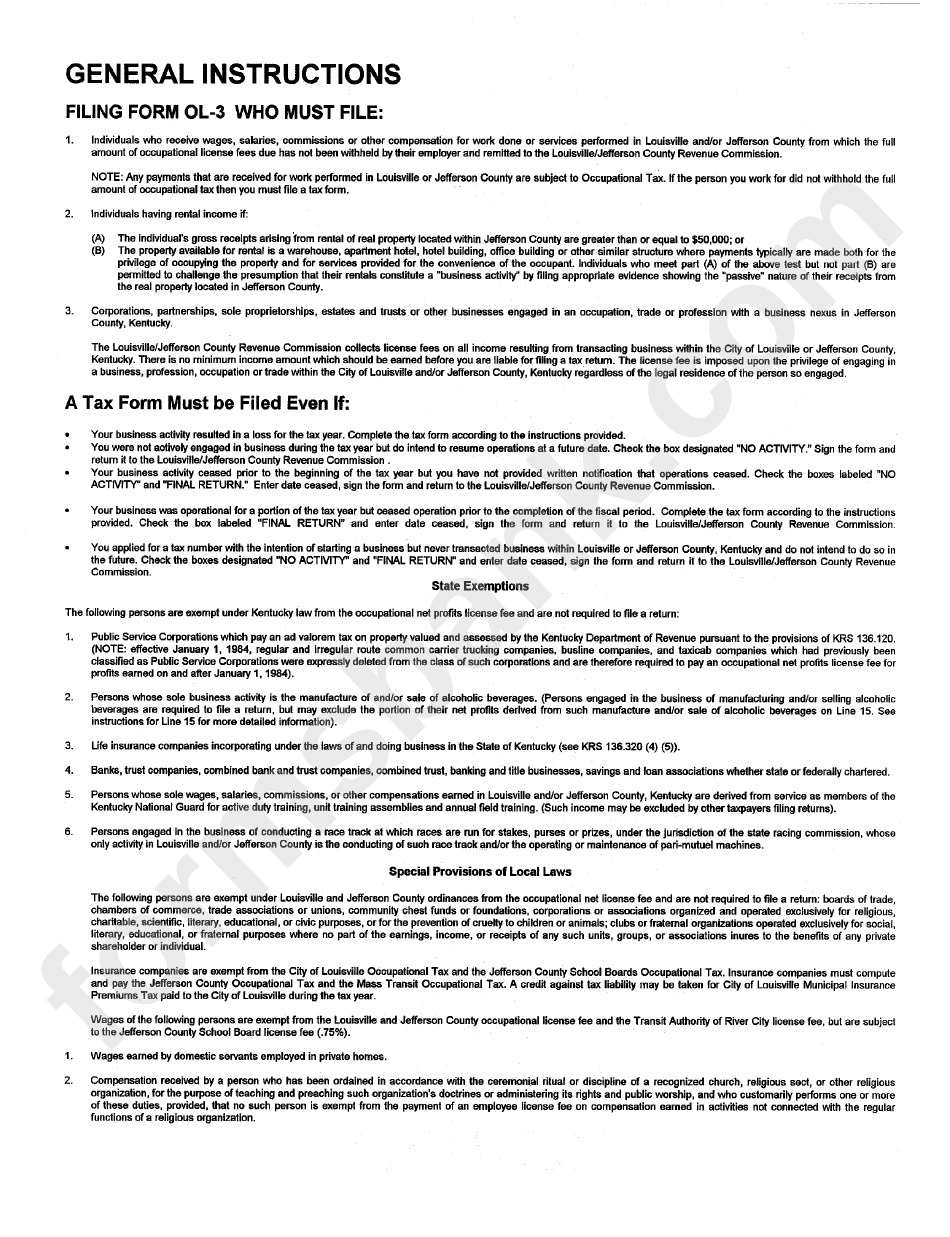

Form Ol 3 - Corporations, partnerships, sole proprietorships, estates and trusts, or other businesses engaged in an occupation, trade,. You may file a paper return, which is available at the following link: Louisville metro revenue commission form: Do not staple forms for official use only louisville metro revenue commission form: Fill out the annual occupational fee & The return and payment of taxes. Your business activity resulted in a loss for the tax year. Complete the tax return according to the specific instructions. Access forms and publications from the louisville metro revenue commission for tax filing and payments. The return and payment of taxes due must be received or postmarked by april. Access forms and publications from the louisville metro revenue commission for tax filing and payments. Complete the tax return according to the specific instructions. The return and payment of taxes. The return and payment of taxes due must be received or postmarked by april. Your business activity resulted in a loss for the tax year. Do not staple forms for official use only louisville metro revenue commission form: Louisville metro revenue commission form: You may file a paper return, which is available at the following link: Fill out the annual occupational fee & You may also file electronically, using the following link: The return and payment of taxes. Louisville metro revenue commission form: Your business activity resulted in a loss for the tax year. Fill out the annual occupational fee & Access forms and publications from the louisville metro revenue commission for tax filing and payments. The return and payment of taxes. You may also file electronically, using the following link: Complete the tax return according to the specific instructions. Your business activity resulted in a loss for the tax year. You may file a paper return, which is available at the following link: The return and payment of taxes. Your business activity resulted in a loss for the tax year. Access forms and publications from the louisville metro revenue commission for tax filing and payments. Do not staple forms for official use only louisville metro revenue commission form: Corporations, partnerships, sole proprietorships, estates and trusts, or other businesses engaged in an occupation, trade,. You may also file electronically, using the following link: You may file a paper return, which is available at the following link: Louisville metro revenue commission form: Corporations, partnerships, sole proprietorships, estates and trusts, or other businesses engaged in an occupation, trade,. Do not staple forms for official use only louisville metro revenue commission form: You may also file electronically, using the following link: Do not staple forms for official use only louisville metro revenue commission form: You may file a paper return, which is available at the following link: The return and payment of taxes. Corporations, partnerships, sole proprietorships, estates and trusts, or other businesses engaged in an occupation, trade,. You may also file electronically, using the following link: Access forms and publications from the louisville metro revenue commission for tax filing and payments. The return and payment of taxes due must be received or postmarked by april. Do not staple forms for official use only louisville metro revenue commission form: Fill out the annual occupational fee & The return and payment of taxes due must be received or postmarked by april. Your business activity resulted in a loss for the tax year. Access forms and publications from the louisville metro revenue commission for tax filing and payments. The return and payment of taxes. Complete the tax return according to the specific instructions. Fill out the annual occupational fee & Your business activity resulted in a loss for the tax year. Louisville metro revenue commission form: Do not staple forms for official use only louisville metro revenue commission form: Access forms and publications from the louisville metro revenue commission for tax filing and payments. Your business activity resulted in a loss for the tax year. Corporations, partnerships, sole proprietorships, estates and trusts, or other businesses engaged in an occupation, trade,. Do not staple forms for official use only louisville metro revenue commission form: The return and payment of taxes. Complete the tax return according to the specific instructions. Complete the tax return according to the specific instructions. Fill out the annual occupational fee & Access forms and publications from the louisville metro revenue commission for tax filing and payments. The return and payment of taxes due must be received or postmarked by april. You may file a paper return, which is available at the following link: Access forms and publications from the louisville metro revenue commission for tax filing and payments. You may file a paper return, which is available at the following link: The return and payment of taxes. Fill out the annual occupational fee & Corporations, partnerships, sole proprietorships, estates and trusts, or other businesses engaged in an occupation, trade,. Complete the tax return according to the specific instructions. Do not staple forms for official use only louisville metro revenue commission form: Louisville metro revenue commission form:Fillable Form Ol3ez Occupational License Fees Return printable pdf

Fillable Form Ol3 Occupational License Tax Return printable pdf download

Form OL3 Fill Out, Sign Online and Download Fillable PDF, City of

Form OL3 Fill Out, Sign Online and Download Fillable PDF, City of

Ky form ol 3 Fill out & sign online DocHub

Laurel County Occupational Tax Forms

Form Ol3a Occupational License Return 1999 printable pdf download

Form OL3 ≡ Fill Out Printable PDF Forms Online

Form Ol3 Occupational License Return printable pdf download

Form Ol3 Filing Instructions Occupational License Tax Return

You May Also File Electronically, Using The Following Link:

The Return And Payment Of Taxes Due Must Be Received Or Postmarked By April.

Your Business Activity Resulted In A Loss For The Tax Year.

Related Post: