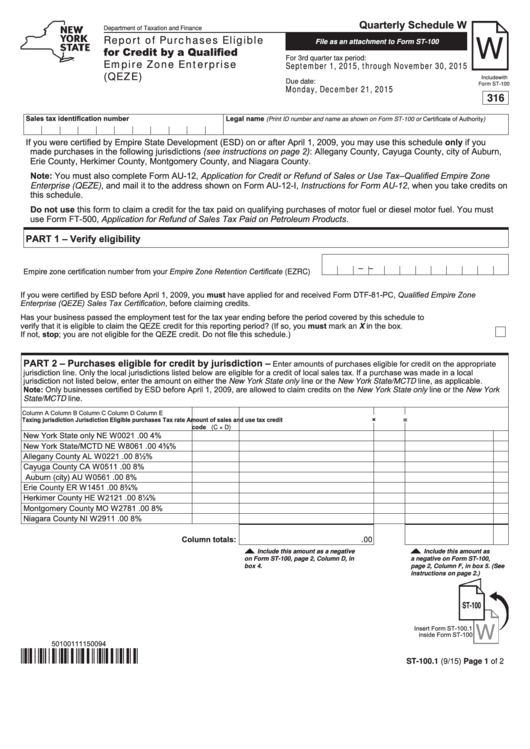

Form St100

Form St100 - Nearly 90% of businesses use sales tax web. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. If you need further assistance, see need help? This form can be completed electronically using your computer and adobe. Find quarterly sales tax filer forms and instructions. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. This guide includes important information about filing requirements, deadlines, and exemptions for. Filing your return electronically, when available, is the. You do not need to complete this form if you did not claim credits on these lines or schedules. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. If you need further assistance, see need help? This form can be completed electronically using your computer and adobe. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. This guide includes important information about filing requirements, deadlines, and exemptions for. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. Filing your return electronically, when available, is the. Nearly 90% of businesses use sales tax web. You do not need to complete this form if you did not claim credits on these lines or schedules. Find quarterly sales tax filer forms and instructions. This guide includes important information about filing requirements, deadlines, and exemptions for. Nearly 90% of businesses use sales tax web. You do not need to complete this form if you did not claim credits on these lines or schedules. If you sell or discontinue your business, or change the form of your business, you are required to file a final. Nearly 90% of businesses use sales tax web. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. Filing your return electronically, when available, is the. This guide includes important information about filing requirements, deadlines, and exemptions. You do not need to complete this form if you did not claim credits on these lines or schedules. This guide includes important information about filing requirements, deadlines, and exemptions for. Nearly 90% of businesses use sales tax web. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county. Find quarterly sales tax filer forms and instructions. Filing your return electronically, when available, is the. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. Nearly 90% of businesses use sales tax web. This form can be completed. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. You do not need to complete this form if you did not claim credits on these lines or schedules. This guide includes important information about filing requirements,. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed. Find quarterly sales tax filer forms and instructions. This guide includes important information about filing requirements, deadlines, and exemptions for. If you need further assistance, see need help? Nearly 90% of businesses use sales tax web. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. This form can be completed electronically using your computer and adobe. If you need further assistance, see need help? Nearly 90% of businesses use sales tax web.. This guide includes important information about filing requirements, deadlines, and exemptions for. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. This form can be completed electronically using your computer and adobe. You do not need. You do not need to complete this form if you did not claim credits on these lines or schedules. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. Filing your return electronically, when available, is the. This form. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below. Find quarterly sales tax filer forms and instructions. If you need further assistance, see need help? Filing your return electronically, when available, is the. Effective june 1, 2011, the local tax on motor fuel and diesel motor fuel sold as qualified fuel in suffolk county is no longer computed using a percentage rate method and is instead. This guide includes important information about filing requirements, deadlines, and exemptions for. This form can be completed electronically using your computer and adobe. If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in step 2 below.Form ST100.5 Schedule N 2024 Fill Out, Sign Online and Download

Nys 100 form Fill out & sign online DocHub

Fillable Online Tax Form St 100Fill Out and Use This PDF Fax Email

Printable Nys Sales Tax Form St100

Form St100 New York State And Local Quarterly Sales And Use Tax

Fillable Online Form ST100.99/07 Report of Sales to a Qualified

Fillable Online Instructions for Form ST100 Tax.NY.gov Fax Email

Fillable Form St 100 Printable Forms Free Online

Form st100 Fill out & sign online DocHub

Form St100 Quarterly Sales And Use Tax Return Form printable pdf

Nearly 90% Of Businesses Use Sales Tax Web.

You Do Not Need To Complete This Form If You Did Not Claim Credits On These Lines Or Schedules.

Related Post: