Harris County Homestead Exemption Form

Harris County Homestead Exemption Form - General residence homestead exemption (tax code section 11.13 (a)(b)): Download and fill out this form to apply for a residence homestead exemption in texas. You need to provide information about yourself, your property, and the exemption(s) you are requesting. Find out the requirements, forms, deadlines and contact. Navigating this landscape effectively requires access to reliable. Learn how to file your residential homestead exemption online using the hcad mobile app. Choose the appropriate affidavit for your situation, such as age 65 or older, disability,. Download and print the affidavit form for claiming residence homestead exemptions in texas. Download and fill out this form to claim residence homestead exemptions for tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. General residence homestead exemption (tax code section 11.13): If your property is located in harris county, you can download the app and file online or print out the harris county application for residential homestead exemption form ,. Learn how to apply for homestead exemptions and deferrals to reduce your property tax obligations in harris county. Choose the appropriate affidavit for your situation, such as age 65 or older, disability,. General residence homestead exemption (tax code section 11.13 (a)(b)): This application is for use in claiming general homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. Download and complete this form to apply for a residence homestead exemption in texas. You must meet certain qualifications and deadlines to apply for exemptions such as. You need to provide information about yourself, your property, and the exemption(s) you are requesting. Navigating this landscape effectively requires access to reliable. You may qualify for this exemption if for the current year and, if filing a late application, for the year for which. Download and print the affidavit form for claiming residence homestead exemptions in texas. Download and complete this form to apply for residential homestead exemption in harris county, texas. Download and fill out this form to claim residence homestead exemptions for tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Navigating this landscape effectively requires access to reliable. Check the. Download and fill out this form to claim residence homestead exemptions for tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Learn how to apply for homestead exemption and other tax breaks in harris county, texas. Download and complete this form to. Learn how to apply for homestead exemptions and deferrals to reduce your property tax obligations in harris county. Choose the appropriate affidavit for your situation, such as age 65 or older, disability,. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office generally between. It also more than doubled the homestead. You will need your date of occupancy, tx drivers license and a smartphone. Download and fill out this form to claim residence homestead exemptions for tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. General residence homestead exemption (tax code section 11.13): You must meet certain qualifications and deadlines to apply for exemptions such as. If your property is. Texas has some of the highest. Download and complete this form to apply for a residence homestead exemption in texas. Check the exemptions you qualify for and attach the required documents. Learn how to apply for homestead exemption and other tax breaks in harris county, texas. You will need your date of occupancy, tx drivers license and a smartphone. General residence homestead exemption (tax code section 11.13): Download and fill out this form to apply for a residence homestead exemption in texas. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. You need to provide information about yourself, your property, and the exemption(s) you are requesting. The exemptions apply to your. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. You may qualify for a general, disabled person, age 65 or older, or surviving spouse exemption. General residence homestead exemption (tax code section 11.13): You may qualify for this exemption if for the current year and, if filing a late application, for the. You may qualify for this exemption if for the current year and, if filing a late application, for the year for. Download and fill out this form to apply for a residence homestead exemption in texas. Learn how to apply for homestead exemption and other tax breaks in harris county, texas. Texas has some of the highest. The exemptions apply. General residence homestead exemption (tax code section 11.13 (a)(b)): You may qualify for this exemption if for the current year and, if filing a late application, for the year for which. Learn how to apply for homestead exemptions and deferrals to reduce your property tax obligations in harris county. This application is for use in claiming general homestead exemptions pursuant. This application is for use in claiming general homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. Download and print the affidavit form for claiming residence homestead exemptions in texas. You may qualify for this exemption if for the current year and, if filing a late application, for the year for which. Check the exemptions you. Download and complete this form to apply for a residence homestead exemption in texas. Choose the appropriate affidavit for your situation, such as age 65 or older, disability,. Download and fill out this form to apply for a residence homestead exemption in texas. If your property is located in harris county, you can download the app and file online or print out the harris county application for residential homestead exemption form ,. Learn how to apply for homestead exemption and other tax breaks in harris county, texas. Download and fill out this form to claim general homestead exemptions for your property in harris county. This application is for use in claiming general homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133 and 11.432. General residence homestead exemption (tax code section 11.13): Learn how to file your residential homestead exemption online using the hcad mobile app. Navigating this landscape effectively requires access to reliable. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Learn how to apply for homestead exemptions and deferrals to reduce your property tax obligations in harris county. Find out the requirements, forms and contact information for the h… Texas has some of the highest. You need to provide information about yourself, your property, and the exemption(s) you are requesting. You will need your date of occupancy, tx drivers license and a smartphone.Hcad homestead exemption form Fill out & sign online DocHub

Time to File Your Residential Homestead Exemption

Homestead Exemption

Fillable Form T 1058 Homestead Exemption Update 1996 Printable Pdf

Homestead exemption Fill out & sign online DocHub

Homestead exemption form

Homestead Exemption

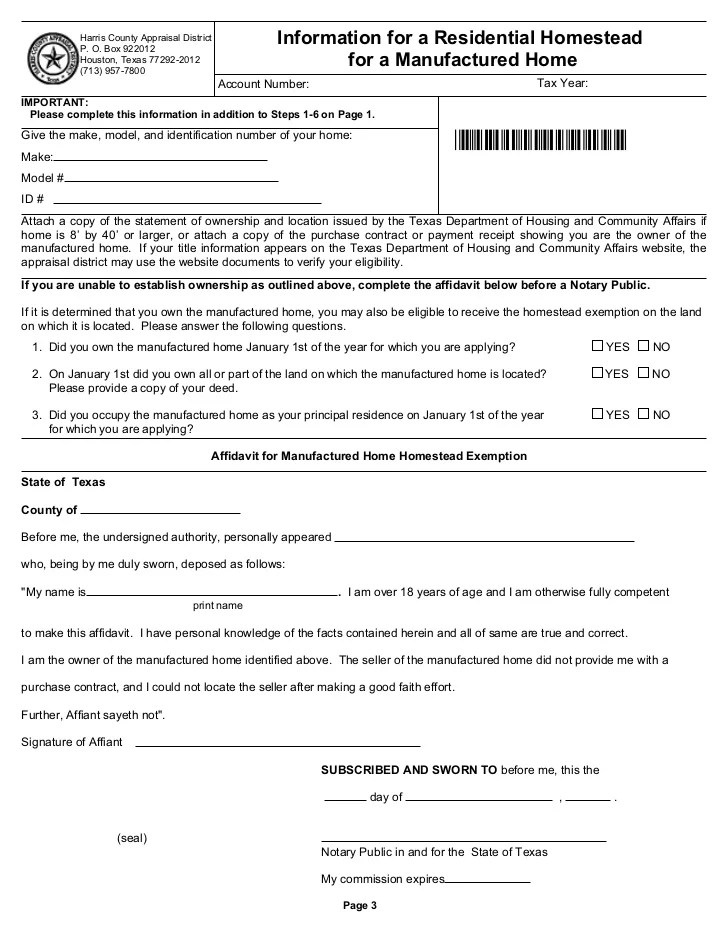

Harris Co TX Homestead Exemption PDF

Harris County Homestead Exemption Form Printable Pdf Download

Fillable Application For Homestead Exemption Template printable pdf

It Also More Than Doubled The Homestead Exemption On School District Taxes, Increasing It From $40,000 To $100,000.

You Must Meet Certain Qualifications And Deadlines To Apply For Exemptions Such As.

You Must Provide Required Documentation.

Download And Fill Out This Form To Claim Residence Homestead Exemptions For Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134 And 11.432.

Related Post: