How To Report Form 8986 On 1040

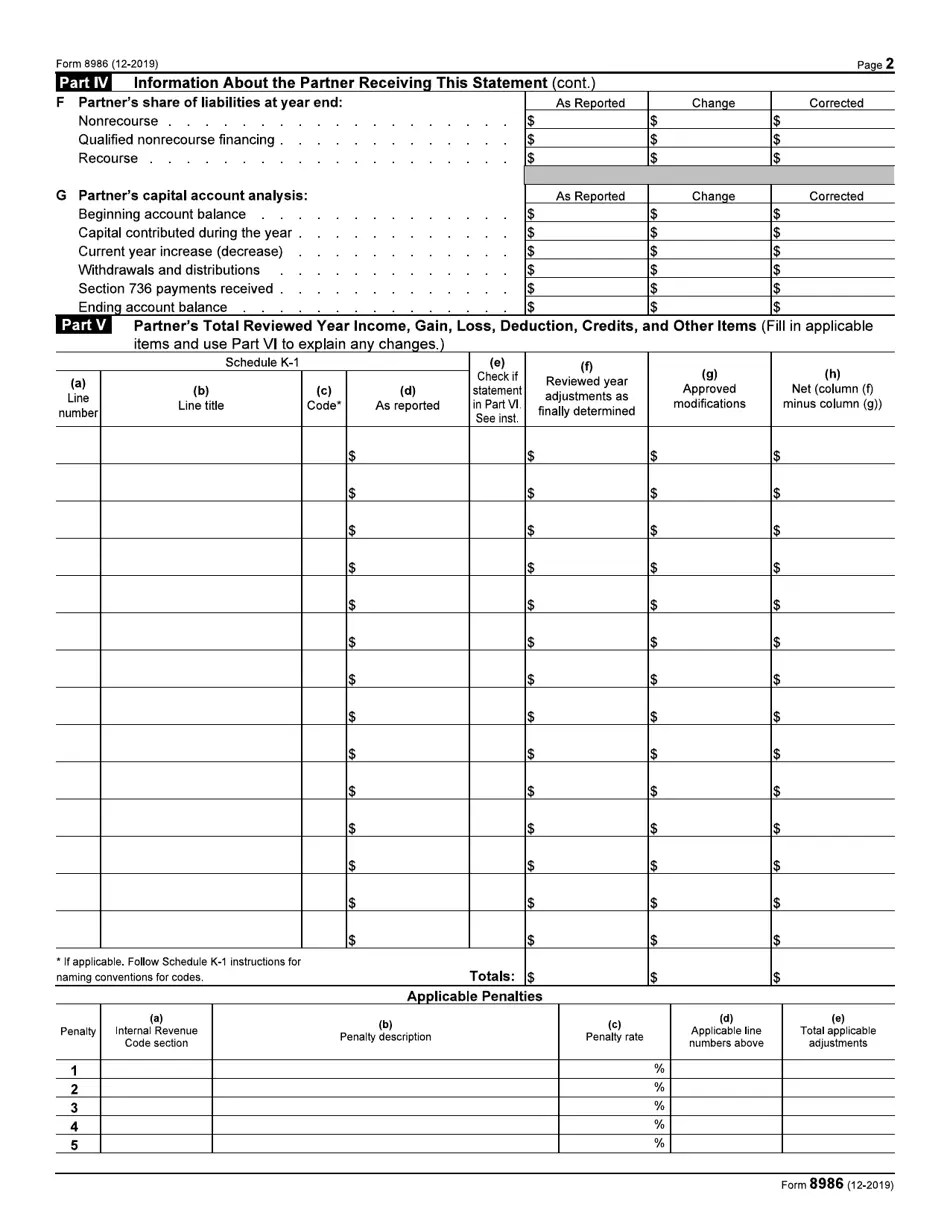

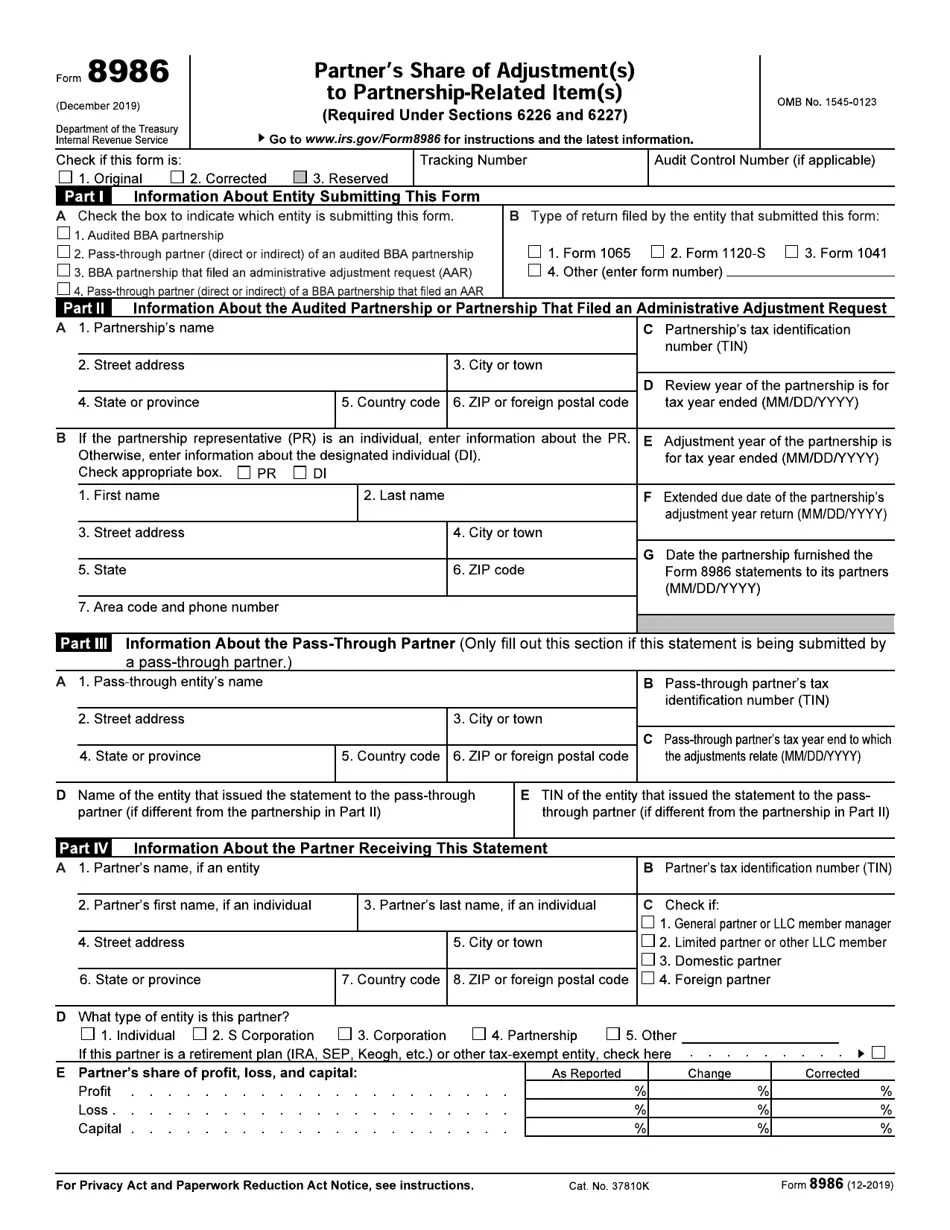

How To Report Form 8986 On 1040 - How do i fill out form 8986? Where to submit form 8986. Reporting amounts from form 8986. All adjustments (positive and negative) from a form 8986 should be shown as reported on that form. Who should prepare form 8986. Instructions for partners that receive form 8986. When entering adjustments from a form 8986,. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections. The purpose of form 8986 is to report each partner’s share of adjustments resulting from irs audits or administrative adjustment requests. This form ensures transparency and compliance. The purpose of form 8986 is to report each partner’s share of adjustments resulting from irs audits or administrative adjustment requests. All adjustments (positive and negative) from a form 8986 should be shown as reported on that form. Reporting amounts from form 8986. Who should prepare form 8986. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections. When entering adjustments from a form 8986,. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Typically, this amount will flow into your form 1040 on schedule 1, which reports additional income and adjustments to income. Form 8986 is necessary under the. Instructions for partners that receive form 8986. This form ensures transparency and compliance. Form 8986, you will need to submit two corrected forms: Form 8986 is necessary under the. Who should prepare form 8986. The purpose of form 8986 is to report each partner’s share of adjustments resulting from irs audits or administrative adjustment requests. When entering adjustments from a form 8986,. All adjustments (positive and negative) from a form 8986 should be shown as reported on that form. This form ensures transparency and compliance. How do i fill out form 8986? Reporting amounts from form 8986. Who should prepare form 8986. Instructions for partners that receive form 8986. This form ensures transparency and compliance. When entering adjustments from a form 8986,. Who should prepare form 8986. The purpose of form 8986 is to report each partner’s share of adjustments resulting from irs audits or administrative adjustment requests. Form 8986 is a bba form used by a partnership to report each partner’s allocable share of partnership adjustments. How do i fill out form 8986? Reporting amounts from form 8986. Typically, this amount will flow into your form. Form 8986, you will need to submit two corrected forms: (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections. Who should prepare form 8986. Specifically, you will likely report the $40,000 on schedule. Who should prepare form 8986. Specifically, you will likely report the $40,000 on schedule. Who should prepare form 8986. Who should prepare form 8986. All adjustments (positive and negative) from a form 8986 should be shown as reported on that form. Typically, this amount will flow into your form 1040 on schedule 1, which reports additional income and adjustments to income. All adjustments (positive and negative) from a form 8986 should be shown as reported on that form. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections. The bba ofss is an online system created by the irs for audited partnerships and passthrough partners to. Reporting amounts from form 8986. Form 8986 is a bba form used by a partnership to report each partner’s allocable share of partnership adjustments. Typically, this amount will flow into your form 1040 on schedule 1, which reports additional income and adjustments to income. Basically, the partnership sends form 8986 to the individual, and the individual needs to proforma amend. Form 8986 is necessary under the. Where to submit form 8986. Reporting amounts from form 8986. Who should prepare form 8986. Basically, the partnership sends form 8986 to the individual, and the individual needs to proforma amend the year affected and report the increase or decrease in tax. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections. Form 8986 is necessary under the. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners. Who should prepare form 8986. The purpose of form 8986 is to report. Who should prepare form 8986. When entering adjustments from a form 8986,. Specifically, you will likely report the $40,000 on schedule. Instructions for partners that receive form 8986. Form 8986 is a bba form used by a partnership to report each partner’s allocable share of partnership adjustments. How do i fill out form 8986? All adjustments (positive and negative) from a form 8986 should be shown as reported on that form. Reporting amounts from form 8986. Instructions for partners that receive form 8986. The purpose of form 8986 is to report each partner’s share of adjustments resulting from irs audits or administrative adjustment requests. Where to submit form 8986. (1) a corrected form 8986 with the correct tin, and (2) a corrected form 8986 with the incorrect tin and zeros in part iv sections. Typically, this amount will flow into your form 1040 on schedule 1, which reports additional income and adjustments to income. Form 8986 is necessary under the. The bba ofss is an online system created by the irs for audited partnerships and passthrough partners to electronically submit the forms needed to request a modification or to. This form ensures transparency and compliance.IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

Cómo llenar el formulario 1040 del IRS (con imágenes)

How To Report Rollovers On Your Tax Return » STRATA Trust Company

IRS Form 8986 Partner Adjustment Instructions

8986 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8986 Instructions for Partner Adjustments

Form 540 California Resident Tax Return YouTube

Are qualified dividends included in total (1040 line 6)? r/tax

IRS Form 8986 Fill Out, Sign Online and Download Fillable PDF

Is Disability Taxable? Find Out with Collins Price

Where To Submit Form 8986.

Form 8986 Is Used By The Audited Partnership To Push Out Imputed Underpayments To Its Partners.

Basically, The Partnership Sends Form 8986 To The Individual, And The Individual Needs To Proforma Amend The Year Affected And Report The Increase Or Decrease In Tax.

Who Should Prepare Form 8986.

Related Post: