I10 Form

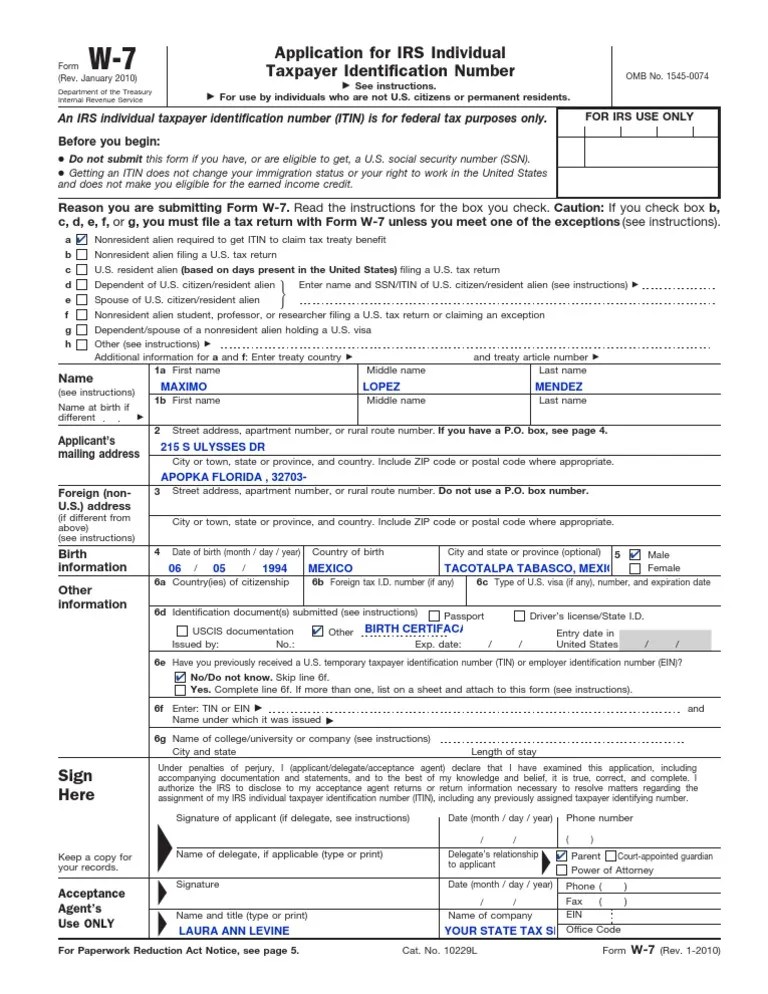

I10 Form - With an itin, you can report. Internal revenue service go to www.irs.gov/formw7 for instructions and the latest information. File your form online for a more convenient and secure experience. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. What are individual taxpayer identification numbers? Determine if you should file an application to receive an individual taxpayer identification number (itin). Find requirements, documents we accept and. An individual taxpayer identification number (itin) is a tax processing number the internal revenue service (irs) issues to an individual who needs to report income but is ineligible to. Citizen and do not have a social security number. People who are ineligible for a social security number can apply for an individual tax identification number (itin), regardless of immigration status. Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. How to apply for an itin. Internal revenue service go to www.irs.gov/formw7 for instructions and the latest information. An irs individual taxpayer identification number (itin) is for u.s. People who are ineligible for a social security number can apply for an individual tax identification number (itin), regardless of immigration status. Nonresident alien income tax return. An individual taxpayer identification number (itin) is a tax processing number the internal revenue service (irs) issues to an individual who needs to report income but is ineligible to. Getting an itin does not change your immigration status or your right to work in the united states. Find requirements, documents we accept and. Determine if you should file an application to receive an individual taxpayer identification number (itin). An individual taxpayer identification number (itin) is a tax processing number the internal revenue service (irs) issues to an individual who needs to report income but is ineligible to. File your form online for a more convenient and secure experience. People who are ineligible for a social security number can apply for an individual tax identification number (itin), regardless of. Leave the area for ssn blank for each itin applicant listed on the. Citizen and do not have a social security number. An individual taxpayer identification number (itin) is a tax processing number the internal revenue service (irs) issues to an individual who needs to report income but is ineligible to. What are individual taxpayer identification numbers? Having an itin. Find out how to apply for an. When you apply for or renew an individual taxpayer identification number (itin), you’ll need to submit supporting documents. Individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service (irs). You must also submit your completed and signed federal tax return.to. An individual taxpayer identification number (itin) is. What are individual taxpayer identification numbers? Find requirements, documents we accept and. Determine if you should file an application to receive an individual taxpayer identification number (itin). With an itin, you can report. People who are ineligible for a social security number can apply for an individual tax identification number (itin), regardless of immigration status. Determine if you should file an application to receive an individual taxpayer identification number (itin). With an itin, you can report. Individual taxpayer identification numbers (itins) are tax processing numbers available to certain resident and. Citizen and do not have a social security number. For forms available only in paper, select the form details button to download the form and. What are individual taxpayer identification numbers? Find out how to apply for an. File your form online for a more convenient and secure experience. People who are ineligible for a social security number can apply for an individual tax identification number (itin), regardless of immigration status. Determine if you should file an application to receive an individual taxpayer identification number. Learn how to get and use an individual taxpayer identification number (itin) if you are not a u.s. With an itin, you can report. What are individual taxpayer identification numbers? Citizen and do not have a social security number. Having an itin enables you. Getting an itin does not change your immigration status or your right to work in the united states. What are individual taxpayer identification numbers? Individual taxpayer identification numbers (itins) are tax processing numbers available to certain resident and. Individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service (irs). How to apply for an. People who are ineligible for a social security number can apply for an individual tax identification number (itin), regardless of immigration status. For forms available only in paper, select the form details button to download the form and instructions. Internal revenue service go to www.irs.gov/formw7 for instructions and the latest information. Nonresident alien income tax return. An individual taxpayer identification. Leave the area for ssn blank for each itin applicant listed on the. With an itin, you can report. Getting an itin does not change your immigration status or your right to work in the united states. Learn how to get and use an individual taxpayer identification number (itin) if you are not a u.s. Having an itin enables you. Internal revenue service go to www.irs.gov/formw7 for instructions and the latest information. How to apply for an itin. Find out how to apply for an. An irs individual taxpayer identification number (itin) is for u.s. An individual taxpayer identification number (itin) is a tax processing number the internal revenue service (irs) issues to an individual who needs to report income but is ineligible to. Having an itin enables you. Find requirements, documents we accept and. Learn how to get and use an individual taxpayer identification number (itin) if you are not a u.s. For forms available only in paper, select the form details button to download the form and instructions. With an itin, you can report. Nonresident alien income tax return. Determine if you should file an application to receive an individual taxpayer identification number (itin). Anyone who needs to file a tax return and doesn’t have a social security number needs to obtain an individual tax identification number, or itin. When you apply for or renew an individual taxpayer identification number (itin), you’ll need to submit supporting documents. Individual taxpayer identification numbers (itins) are tax processing numbers available to certain resident and. You must also submit your completed and signed federal tax return.to.I10 FORM

Irs Form 1040Sr Instructions 2025 Jorja Dwyer

Printable I9 Form 2024

Form I10 10 Fillable Printable Forms and Tips

2022 Form IRS 1095A Fill Online, Printable, Fillable, Blank pdfFiller

Free Printable Irs Forms Printable Form 2024

IRS Form W10 Instructions Care Provider Identification

Completing Form 1040 The Face of your Tax Return US Expat Taxes

I 10 Form No Longer Required Seven Mind Numbing Facts About I 10 Form

I 9 Form

Leave The Area For Ssn Blank For Each Itin Applicant Listed On The.

People Who Are Ineligible For A Social Security Number Can Apply For An Individual Tax Identification Number (Itin), Regardless Of Immigration Status.

File Your Form Online For A More Convenient And Secure Experience.

Citizen And Do Not Have A Social Security Number.

Related Post:

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)