Iowa Sales Tax Form

Iowa Sales Tax Form - Use black or blue ink only. The voluntary disclosure program encourages unregistered business entities and persons to. This document is to be completed by a purchaser claiming an exemption from sales/use/excise tax. Official state of iowa website. Once your business has an iowa sales tax license and begins to make sales, you are required to start collecting sales taxes on behalf of the iowa government and filing regular sales tax. The three key changes of this. Learn how to fill out the form, calculate the tax and. If you are a retailer or seller in iowa or a remote business that exceeds a certain number of sales into iowa, then you must collect and remit sales tax. File your return through efile & pay at the department's website: Use black or blue ink only. This needs to be completed before giving the form to the seller. Yes, you can file your iowa sales tax return by mail using the paper forms provided by the department of revenue. Iowa sales/retailer’s use tax and surcharge return. The three key changes of this. Download and print the official form for reporting and paying iowa sales tax and surcharge for the period ending september 21, 2020. General information regarding iowa fuel tax, filing, processes, reports, and more. On june 17, 2022, governor reynolds signed senate file 2367 that changed filing and payment requirements for sales, use, and excise taxes in iowa. Sales tax applies to sales. Zip codes with only 6% sales tax (no local tax). Sales tax is imposed on the sales price of the sale of tangible personal property, specified digital products, or taxable services at the time the sale takes place. Penalties can only be waived under limited circumstances, as described in iowa code section This document is to be completed by a purchaser claiming an exemption from sales/use/excise tax. On june 17, 2022, governor reynolds signed senate file 2367 that changed filing and payment requirements for sales, use, and excise taxes in iowa. Once your business has an iowa sales. On june 17, 2022, governor reynolds signed senate file 2367 that changed filing and payment requirements for sales, use, and excise taxes in iowa. Forms commonly used by iowans. To use this form, please print front and back. However, the department encourages electronic filing through the. Iowa sales/retailer’s use tax and surcharge return. Sales tax is imposed on the sales price of the sale of tangible personal property, specified digital products, or taxable services at the time the sale takes place. Download and print the official form for reporting and paying iowa sales tax and surcharge for the period ending september 21, 2020. Once your business has an iowa sales tax license and. Iowa sales/retailer’s use tax and surcharge return. On june 17, 2022, governor reynolds signed senate file 2367 that changed filing and payment requirements for sales, use, and excise taxes in iowa. Forms commonly used by iowans. Sales tax applies to sales. Use black or blue ink only. Official state of iowa website. Use black or blue ink only. The voluntary disclosure program encourages unregistered business entities and persons to. Official state of iowa website. To use this form, please print front and back. To use this form, please print front and back. This is the most commonly used form to file and pay sales tax in. This needs to be completed before giving the form to the seller. Iowa sales/retailer’s use tax and surcharge return. Yes, you can file your iowa sales tax return by mail using the paper forms provided by the. Use black or blue ink only. Yes, you can file your iowa sales tax return by mail using the paper forms provided by the department of revenue. To claim an exemption for fuel used to create heat, power, or steam for processing. Sales tax applies to sales. Use black or blue ink only. Learn how to fill out the form, calculate the tax and. Sales tax is imposed on the sales price of the sale of tangible personal property, specified digital products, or taxable services at the time the sale takes place. On june 17, 2022, governor reynolds signed senate file 2367 that changed filing and payment requirements for sales, use, and excise. Forms commonly used by iowans. Official state of iowa website. Iowa sales/retailer’s use tax and surcharge. Penalties can only be waived under limited circumstances, as described in iowa code section To use this form, please print front and back. Official state of iowa website. This needs to be completed before giving the form to the seller. Iowa sales/retailer’s use tax and surcharge return. Yes, you can file your iowa sales tax return by mail using the paper forms provided by the department of revenue. Most cities add a local tax of 1%, bringing the total sales tax to 7%; To use this form, please print front and back. Use black or blue ink only. Most cities add a local tax of 1%, bringing the total sales tax to 7%; Download and print the official form for reporting and paying iowa sales tax and surcharge for the period ending september 21, 2020. Official state of iowa website. Penalties can only be waived under limited circumstances, as described in iowa code section Iowa sales/retailer’s use tax and surcharge return. Iowa sales/retailer’s use tax and surcharge. This is the most commonly used form to file and pay sales tax in. Use black or blue ink only. Yes, you can file your iowa sales tax return by mail using the paper forms provided by the department of revenue. Official state of iowa website. The three key changes of this. Forms commonly used by iowans. Once your business has an iowa sales tax license and begins to make sales, you are required to start collecting sales taxes on behalf of the iowa government and filing regular sales tax. On june 17, 2022, governor reynolds signed senate file 2367 that changed filing and payment requirements for sales, use, and excise taxes in iowa.Iowa Sales Tax Exemption Form 2023 Printable Forms Free Online

Form 31010 Iowa Sales Tax Annual Return printable pdf download

Form 31113 Fill Out, Sign Online and Download Printable PDF, Iowa

Form Ia 1120s Iowa Tax Return For An S Corporation

Form 31007 Iowa Sales Tax Amended Return printable pdf download

Form Ia 1120 ≡ Fill Out Printable PDF Forms Online

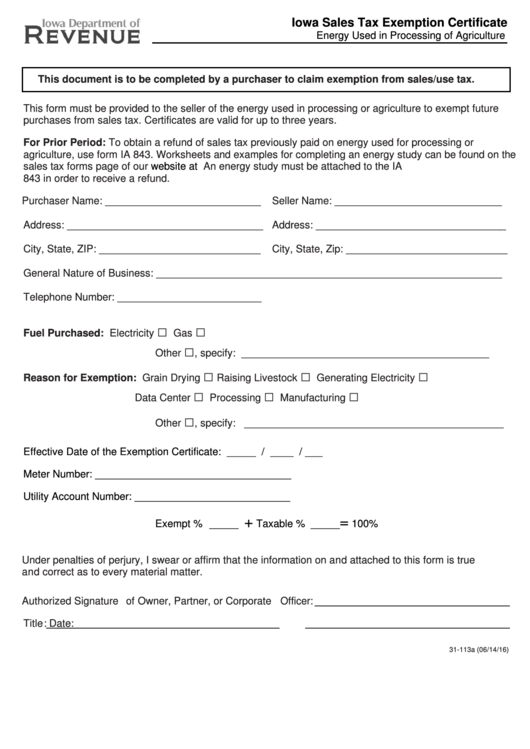

Iowa Sales Tax Exemption Certificate Form Iowa Department Of Revenue

Form 31091 Iowa Sales Tax Quarterly Return 2002 printable pdf download

Iowa Sales Tax Exemption Certificate WWW Iowa.gov/tax Iowa

Iowa Sales Tax Exemption Certificate 20202025 Form Fill Out and Sign

The Seller Of The Goods Or.

File Your Return Through Efile & Pay At The Department's Website:

The Voluntary Disclosure Program Encourages Unregistered Business Entities And Persons To.

If You Are A Retailer Or Seller In Iowa Or A Remote Business That Exceeds A Certain Number Of Sales Into Iowa, Then You Must Collect And Remit Sales Tax.

Related Post: