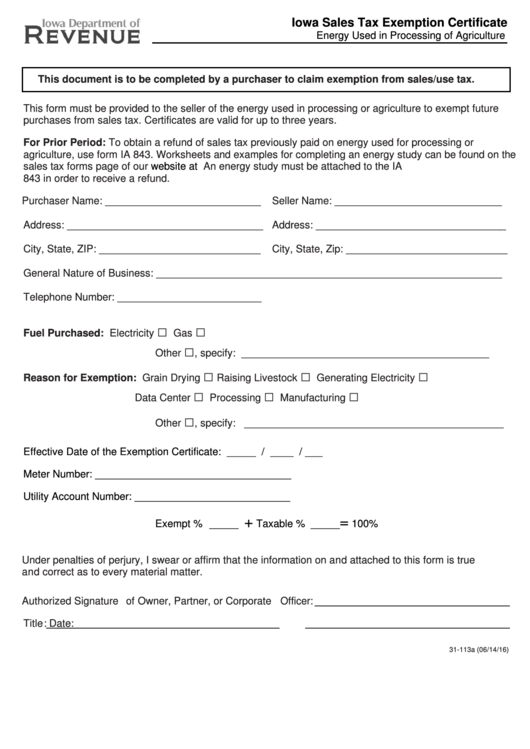

Iowa Tax Exemption Form

Iowa Tax Exemption Form - This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Keep this certificate in your files. Forms for these credits and exemptions are included within the descriptions. The lost (local option sales tax) of 1%. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the iowa sales tax. Usually, these are items for resale or for use in processing, but there are also. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this certificate as proof that exemption has been. This needs to be completed before giving the form to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. To be valid, this certificate must be executed or be in effect within 30 days. The seller must retain this certificate as proof that exemption has been. You can download a pdf of. The seller must retain this certificate as proof that exemption has been. This needs to be completed before giving the form to the seller. Your utility company will require. Usually, these are items for resale or for use in processing, but there are also. Modernizes iowa’s data center statute to recognize newer business and investment models for constructing to lease and limits the sales tax exemption. The lost (local option sales tax) of 1%. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. The assistive device tax credit was established in 2000 iowa acts, chapter 1194 (income and property taxes — credits, deductions, and exemptions act), to award taxpayers who are. This exemption certificate is to be completed by the purchaser claiming exemption from tax. Keep this certificate in your files. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The assistive device tax credit was established in 2000 iowa acts, chapter 1194 (income and property taxes — credits, deductions, and exemptions act), to award taxpayers who are. Forms for these credits and exemptions are. Tax credits tracking and analysis program. Purchaser is claiming exemption for the following reason: The seller must retain this certificate as proof that exemption has been. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Your utility company will require. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the iowa sales tax. The seller must retain this certificate as proof that exemption has been. Resale leasing processing qualifying farm machinery/equipment qualifying farm replacement parts The assistive device tax credit was established in 2000 iowa acts,. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Iowa sales tax exemption certificate this document is to be completed by a purchaser whenever claiming exemption from sales/use tax. Modernizes iowa’s. Iowa sales tax exemption certificate the current state sales tax rate is 6%. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. To be valid, this certificate must be executed or be in effect within 30 days. Iowa sales tax exemption certificate this document is to be completed by a purchaser. The seller must retain this certificate as proof that exemption has been. Modernizes iowa’s data center statute to recognize newer business and investment models for constructing to lease and limits the sales tax exemption. Purchaser is claiming exemption for the following reason: Iowa sales tax exemption certificate this document is to be completed by a purchaser whenever claiming exemption from. Forms for these credits and exemptions are included within the descriptions. Keep this certificate in your files. The seller must retain this certificate as proof that exemption has been. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the iowa sales tax. The seller must retain. You can download a pdf of. The seller must retain this certificate as proof that exemption has been. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. To be valid, this certificate must be executed or be in effect within 30 days. The seller must retain this certificate as proof that exemption has been. To be valid, this certificate must be executed or be in effect within 30 days. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The assistive device tax credit was established. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Keep this certificate in your files. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Forms for these credits and exemptions are included within the descriptions. The assistive device tax credit was established in 2000 iowa acts, chapter 1194 (income and property taxes — credits, deductions, and exemptions act), to award taxpayers who are. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the iowa sales tax. Resale leasing processing qualifying farm machinery/equipment qualifying farm replacement parts Iowa sales tax exemption certificate this document is to be completed by a purchaser whenever claiming exemption from sales/use tax. The seller must retain this certificate as proof that exemption has been. The seller must retain this certificate as proof that exemption has been. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this certificate as proof that exemption has been. The seller must retain this certificate as proof that exemption has been. Purchaser is claiming exemption for the following reason: Iowa sales tax exemption certificate the current state sales tax rate is 6%.Iowa sales tax exemption certificate Fill out & sign online DocHub

Iowa Sales Tax Exemption Certificate Fillable Fill Ou vrogue.co

Iowa Sales Tax Exemption Certificate Form Iowa Department Of Revenue

How To Get An Iowa Sales Tax Exemption Certificate StartUp 101

Iowa construction sales tax exemption certificate Fill out & sign

Fillable Online Fillable Online Iowa sales tax exemption certificate

IOWA SALES / USE TAX BASICS PART 1 ppt download

Fillable Sales And Use Tax Unit Exemption Certificate printable pdf

Top 26 Iowa Tax Exempt Form Templates free to download in PDF format

Fillable Online Streamlined Sales Tax Certificate of Exemption Iowa

This Exemption Certificate Is To Be Completed By The Purchaser Claiming Exemption From Tax And Given To The Seller.

This Needs To Be Completed Before Giving The Form To The Seller.

Certificates Are Valid For Up To Three Years.

Bbb A+ Rated Business Trusted By Millions 3M+ Satisfied Customers Edit On Any Device

Related Post: