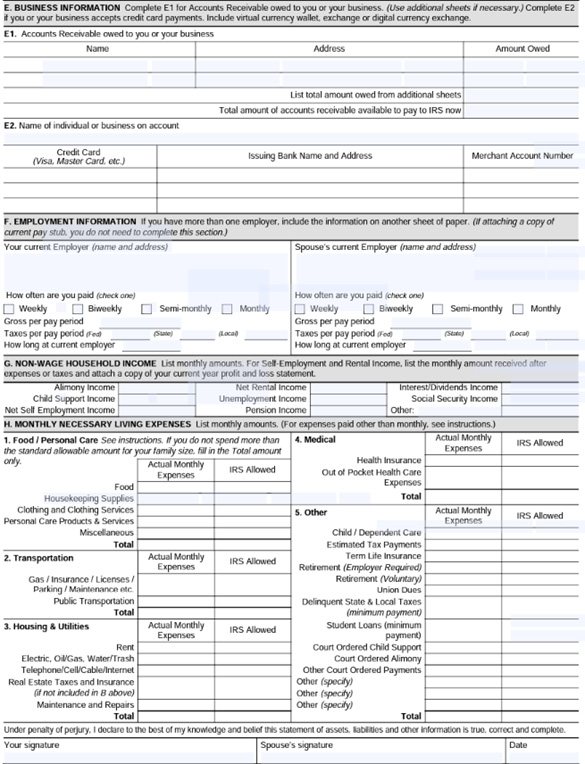

Irs Financial Hardship Form 433-F

Irs Financial Hardship Form 433-F - Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. We’ll show you how to fill out this form and navigate financial statements for individuals. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. Final thoughts section 111 of the tas act reflects a commonsense improvement to the oic process. By aligning irs resources with the complexity of cases, this provision. We cannot consider an installment agreement unless all returns have been filed. By completing this form accurately, you can take the first steps toward. The irs uses this information. The form gathers key financial. It shows the irs the taxpayer's ability to pay. Get tips and help now. By completing this form accurately, you can take the first steps toward. The form gathers key financial. The irs uses this information. The irs may establish a payment agreement for you based on the financial data you provided. Explore payment plans, offers in. Final thoughts section 111 of the tas act reflects a commonsense improvement to the oic process. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your current financial situation. No obligation to purchase connect with tax experts free case evaluation Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. 100,000+ clients annually a+ rating with the bbb get a free consultation We cannot consider an installment agreement unless all returns have been filed. We’ll show you how to fill out this form and navigate financial statements for individuals. The form gathers key financial. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. By completing this form accurately, you can take the first steps toward. We’ll show you how to fill out this form and navigate financial statements for individuals. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. It shows the irs the taxpayer's ability to pay. We’ll show you how to fill out this form and navigate financial statements for individuals. The form gathers key financial. The irs uses this information. Final thoughts section 111 of the tas act reflects a commonsense improvement to the oic process. By aligning irs resources with the complexity of cases, this provision. By accurately documenting your income, assets, and. The irs may establish a payment agreement for you based on the financial data you provided. Get tips and help now. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to gather your. The form gathers key financial. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. The irs may establish a payment agreement for you based on the financial data you provided. By aligning irs resources with the complexity of cases, this provision. Get tips and help now. By aligning irs resources with the complexity of cases, this provision. The irs uses this information. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. By accurately documenting your income, assets, and. We’ll show you how to fill out this form and navigate financial statements for individuals. The irs may establish a payment agreement for you based on the financial data you provided. We cannot consider an installment agreement unless all returns have been filed. By aligning irs resources with the complexity of cases, this provision. Get tips and help now. It shows the irs the taxpayer's ability to pay. By accurately documenting your income, assets, and. Final thoughts section 111 of the tas act reflects a commonsense improvement to the oic process. The form gathers key financial. By aligning irs resources with the complexity of cases, this provision. By accurately documenting your income, assets, and. Get tips and help now. 100,000+ clients annually a+ rating with the bbb get a free consultation Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. We cannot consider an installment agreement unless all returns have been filed. Explore payment plans, offers in. Final thoughts section 111 of the tas act reflects a commonsense improvement to the oic process. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. It shows the irs the taxpayer's ability to pay. Form 433f, also known as the collection information statement, is an internal revenue service (irs) document used to. We’ll show you how to fill out this form and navigate financial statements for individuals. By accurately documenting your income, assets, and. By aligning irs resources with the complexity of cases, this provision. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. Explore payment plans, offers in. The irs may establish a payment agreement for you based on the financial data you provided. It shows the irs the taxpayer's ability to pay. The form gathers key financial. No obligation to purchase connect with tax experts free case evaluation Get tips and help now. Final thoughts section 111 of the tas act reflects a commonsense improvement to the oic process. Current on tax guidelines 100,000+ clients annually up to 90% debt reduction. The irs uses this information.Irs Form 433 F Fillable & Printable PDF Templates

Printable Irs Form 433 F

Printable Irs Form 433 F

IRS Form 433F Instructions The Collection Information Statement

Fillable Form 433F Collection Information Statement Department Of

IRS Form 433F Instructions The Collection Information Statement

IRS Form 433F Who Should Use It?

IRS Form 433F Fill It out in Style

Printable Irs Form 433 F

IRS Form 433F A Guide to the Collection Information Statement

By Completing This Form Accurately, You Can Take The First Steps Toward.

We Cannot Consider An Installment Agreement Unless All Returns Have Been Filed.

100,000+ Clients Annually A+ Rating With The Bbb Get A Free Consultation

Form 433F, Also Known As The Collection Information Statement, Is An Internal Revenue Service (Irs) Document Used To Gather Your Current Financial Situation.

Related Post: