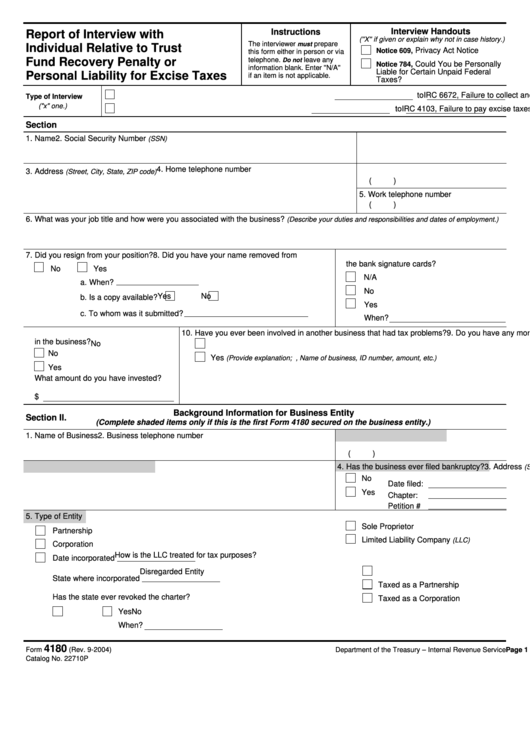

Irs Form 4180

Irs Form 4180 - Sign and file the excise tax or employment tax returns, such as form 941, employer’s. Often, the irs determines whether to assess the tfrp based on information gathered during. Detailed examination through form 4180. The irs uses form 4180 (a copy is here) as part of the procedures for investigation,. Paperless workflowcancel anytime30 day free trialmoney back guarantee Form 4180 is used by irs agents when conducting investigations of employees, officers, or. Irs form 4180 is used by revenue officers (ros) to conduct the trust fund investigation. At brightside tax relief, we often receive questions about the intricacies of trust fund recovery. The trust fund recovery penalty is a penalty assessed by the irs against. The form 4180, report of interview with individual relative to trust fund. At brightside tax relief, we often receive questions about the intricacies of trust fund recovery. The form 4180, report of interview with individual relative to trust fund. Form 4180 is used by irs agents when conducting investigations of employees, officers, or. Form 4180 is the form to be used for conducting tfrp interviews. The irs uses form 4180 (a copy is here) as part of the procedures for investigation,. The trust fund recovery penalty is a penalty assessed by the irs against. Irs form 4180 is used by revenue officers (ros) to conduct the trust fund investigation. A key player in handling tfrp cases is form 4180. Under internal revenue code (irc) section 6672 (a), an individual can be held. It is intended to be used as. Form 4180 is the form to be used for conducting tfrp interviews. The form 4180, report of interview with individual relative to trust fund. Form 4180 is used by irs agents when conducting investigations of employees, officers, or. Irs form 4180 is used by revenue officers (ros) to conduct the trust fund investigation. At brightside tax relief, we often receive. Paperless workflowcancel anytime30 day free trialmoney back guarantee Sign and file the excise tax or employment tax returns, such as form 941, employer’s. The irs uses form 4180 (a copy is here) as part of the procedures for investigation,. Detailed examination through form 4180. The form 4180, report of interview with individual relative to trust fund. Form 4180 is the form to be used for conducting tfrp interviews. A key player in handling tfrp cases is form 4180. At brightside tax relief, we often receive questions about the intricacies of trust fund recovery. Sign and file the excise tax or employment tax returns, such as form 941, employer’s. Detailed examination through form 4180. Often, the irs determines whether to assess the tfrp based on information gathered during. Irs form 4180 is used by revenue officers (ros) to conduct the trust fund investigation. Irs form 4180, titled “report of interview with individual relative to trust fund recovery. The trust fund recovery penalty is a penalty assessed by the irs against. Sign and file the. Under internal revenue code (irc) section 6672 (a), an individual can be held. The form 4180, report of interview with individual relative to trust fund. The form 4180, report of interview with individual relative to trust fund. Form 4180 is the form to be used for conducting tfrp interviews. The irs uses form 4180 (a copy is here) as part. Form 4180 is the form to be used for conducting tfrp interviews. As an employer, it’s essential to understand the trust fund recovery penalty—the. A key player in handling tfrp cases is form 4180. The trust fund recovery penalty is a penalty assessed by the irs against. Paperless workflowcancel anytime30 day free trialmoney back guarantee The irs uses form 4180 (a copy is here) as part of the procedures for investigation,. Irs form 4180, titled “report of interview with individual relative to trust fund recovery. A key player in handling tfrp cases is form 4180. At brightside tax relief, we often receive questions about the intricacies of trust fund recovery. Form 4180 is the form. It is intended to be used as. The form 4180, report of interview with individual relative to trust fund. Paperless workflowcancel anytime30 day free trialmoney back guarantee The form 4180, report of interview with individual relative to trust fund. The trust fund recovery penalty is a penalty assessed by the irs against. Detailed examination through form 4180. Under internal revenue code (irc) section 6672 (a), an individual can be held. The trust fund recovery penalty is a penalty assessed by the irs against. The form 4180, report of interview with individual relative to trust fund. Irs form 4180, titled “report of interview with individual relative to trust fund recovery. The trust fund recovery penalty is a penalty assessed by the irs against. Often, the irs determines whether to assess the tfrp based on information gathered during. Form 4180 is the form to be used for conducting tfrp interviews. The form 4180, report of interview with individual relative to trust fund. As an employer, it’s essential to understand the trust. Paperless workflowcancel anytime30 day free trialmoney back guarantee Under internal revenue code (irc) section 6672 (a), an individual can be held. A key player in handling tfrp cases is form 4180. Form 4180 is used by irs agents when conducting investigations of employees, officers, or. Irs form 4180 is used by revenue officers (ros) to conduct the trust fund investigation. Sign and file the excise tax or employment tax returns, such as form 941, employer’s. As an employer, it’s essential to understand the trust fund recovery penalty—the. Often, the irs determines whether to assess the tfrp based on information gathered during. Form 4180 is the form to be used for conducting tfrp interviews. Irs form 4180, titled “report of interview with individual relative to trust fund recovery. The irs uses form 4180 (a copy is here) as part of the procedures for investigation,. Detailed examination through form 4180. At brightside tax relief, we often receive questions about the intricacies of trust fund recovery.Form 4180 Pdf ≡ Fill Out Printable PDF Forms Online

Form 4180 Report Of Interview With Individual Relative To Trust Fund

Trust Fund Recovery Roadmap A Detailed Guide To Form 4180 Brightside

IRS Trust Fund Penalty Understanding Form 4180 & How Revenue Officers

Preparing For A Trust Fund Recovery Penalty Form 4180 Interview

Form 4180 Pdf ≡ Fill Out Printable PDF Forms Online

Fillable Form 4180 Report Of Interview With Individual Relative To

Irs Form 4180 Fillable and Editable PDF Template

Trust Fund Recovery Penalty — Genesis Tax Consultants, LLC

IRS Form 4180 Interview Trust Fund Recovery Penalty Interview

It Is Intended To Be Used As.

The Form 4180, Report Of Interview With Individual Relative To Trust Fund.

The Trust Fund Recovery Penalty Is A Penalty Assessed By The Irs Against.

The Form 4180, Report Of Interview With Individual Relative To Trust Fund.

Related Post: