Irs Form 4549 Instructions

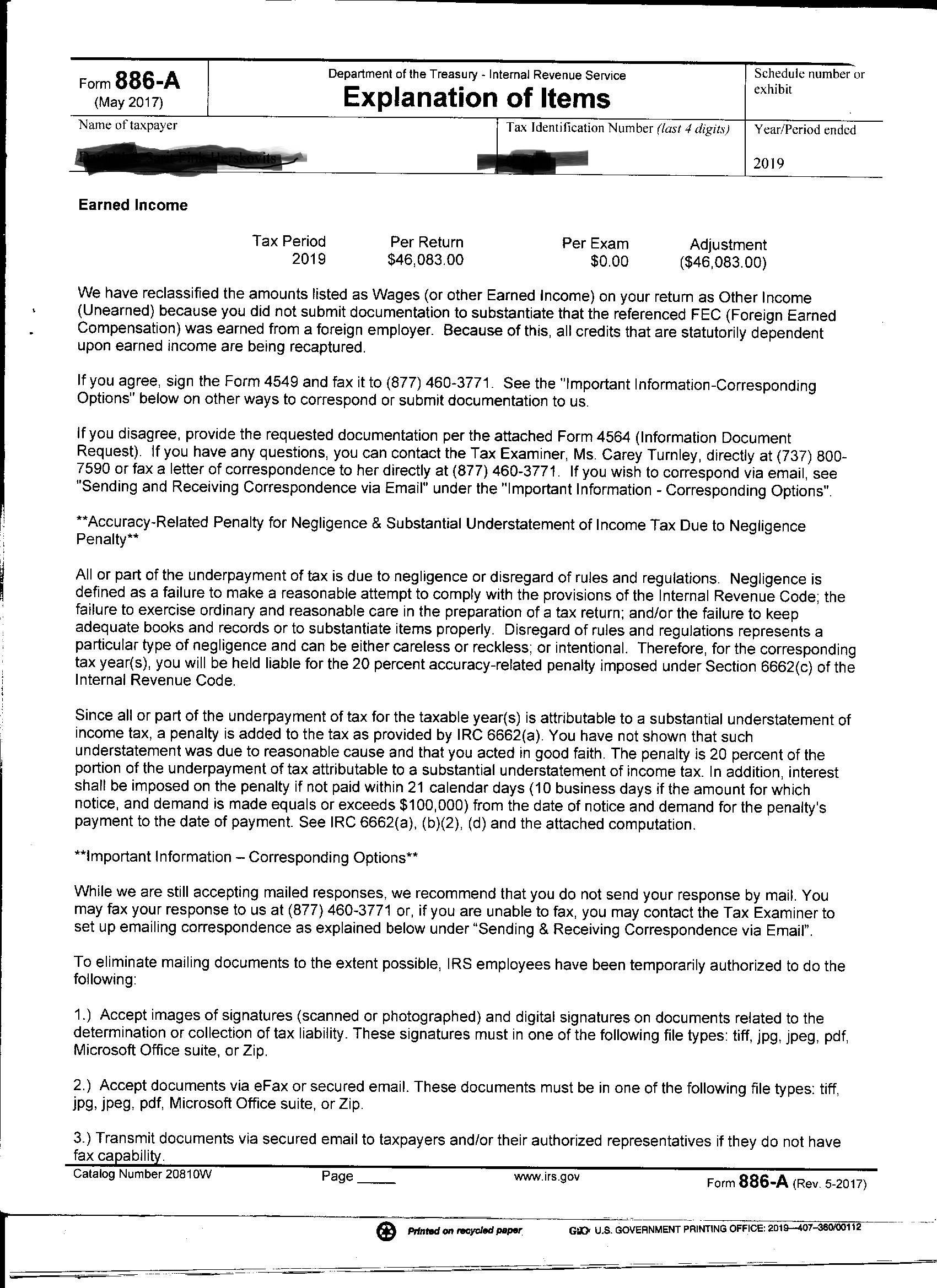

Irs Form 4549 Instructions - Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. 1) to pay the bill, 2) to gather more evidence or law to support your case & respond with form 12661, 3) appeal to the agent's manager, 4) appeal within the irs, or 5). The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. Letter 4306, reply to closed correspondence. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Form 4549 breaks down a few key things: Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. This form means the irs is questioning your tax return. Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Essentially, if the irs conducts an audit of. Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Form 4549 breaks down a few key things: Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Return form number adjustments to credit under section 6431 for certain state and local bonds The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. David hopkins, jd, llm, can give you. Letter 4306, reply to closed correspondence. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. This form means the irs is questioning your tax return. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the. Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the. If the irs reviews your return and decides to make a change, the. The tax attorney at taxhelplaw, j. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. David hopkins, jd, llm, can give you. Irs form 4549, also known as the income tax. If available, attach a copy of your examination report, form 4549, along with the new. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Form 4549 reflects adjustments to taxable income and the corrected tax liability, and allows. This bit compares what you reported on your taxes with what the irs thinks the numbers should be. This form means the irs is questioning your tax return. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. Prepare. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the. Form 4549 breaks down a few key things: Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your. This bit compares what you reported on your taxes with what the irs thinks the numbers should be. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns. Form 4549 breaks down a few key things: The internal revenue service has agreements with state. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. The tax attorney at taxhelplaw, j. Irs form 4549, also known as the income tax examination changes form, is issued. If available, attach a copy of your examination report, form 4549, along with the new. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax. Form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Form 4549 breaks down a few key things: Taxhelp recommends investigation, advice and resistance to signing form 4549, unless you totally agree. Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. Agreed rars require the taxpayer’s. Letter 4306, reply to closed correspondence. A regular agreed report (form 4549) may contain up to three tax years. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. The agency may think you failed to report some income, took too many deductions, or didn't. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. David hopkins, jd, llm, can give you. This bit compares what you reported on your taxes with what the irs thinks the numbers should be. Letter 4306, reply to closed correspondence. If available, attach a copy of your examination report, form 4549, along with the new. Taxhelp recommends investigation, advice and resistance to signing form 4549, unless you totally agree. Form 4549 is an irs form that is sent to taxpayers whose returns have been audited. A regular agreed report (form 4549) may contain up to three tax years. The tax attorney at taxhelplaw, j. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. If the irs reviews your return and decides to make a change, the. Form 4549, is the basic report form for most individual and corporate income tax cases. Essentially, if the irs conducts an audit of. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. 1) to pay the bill, 2) to gather more evidence or law to support your case & respond with form 12661, 3) appeal to the agent's manager, 4) appeal within the irs, or 5). Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax returns.Free IRS Form 4549 Tax Examination Changes PrintFriendly

Demystifying Form 4549 Understanding Your IRS Audit Report

Form 4549 Tax Examination Changes Internal Revenue Service

Form 4549 Response to IRS Determination

4.10.8 Report Writing Internal Revenue Service

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Form 4549 Tax Examination Changes Internal Revenue Service

Form 4549B Tax Examitation Changes printable pdf download

taxes How to resolve my unearned issue with the IRS

Form 4549 Response to IRS Determination

Irs Form 4549, Also Known As The Income Tax Examination Changes Form, Is Issued To Taxpayers When The Irs Completes An Audit And Determines That Changes Are Needed To A Previously.

Form 4549, Officially Known As The “Income Tax Examination Changes” Form, Is Issued By The Irs Following An Audit.

Form 12661, Disputed Issue Verification, Is Recommended To Explain The Issues You Disagree With.

Form 4549 Reflects Adjustments To Taxable Income And The Corrected Tax Liability, And Allows For A.

Related Post: