Irs Form 4549

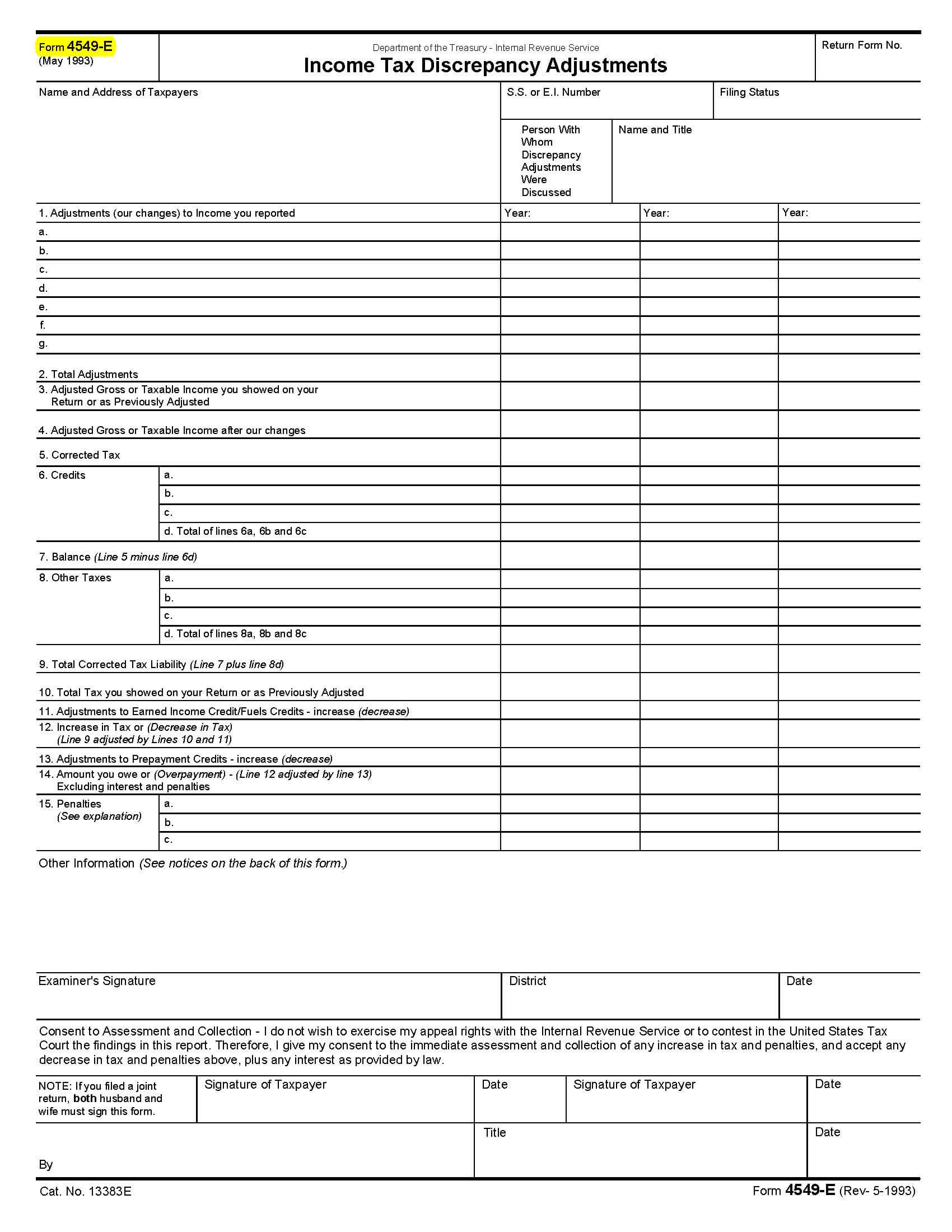

Irs Form 4549 - At the end of an audit, irs sends the taxpayer a letter along with form 4549, explaining the proposed changes to the audited tax return. Follow these steps & get your action plan. If you get one, it means the irs is questioning your. Irs form 4549, known as income tax examination changes, outlines audit results, detailing proposed changes to reported income, deductions, credits, and tax liability. Irs form 4549 is the irs audit report. Form 4549 shows the irs's proposed changes to your tax return and your updated tax liability. Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. Internal revenue service to help you when you disagree with the results of an irs audit of your tax return, or a return created for you by the irs because you did not file a tax return as. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Find out how to respond, what documents to send, and what form 4549 means. A taxpayer must file a timely refund. Form 4549 shows the irs's proposed changes to your tax return and your updated tax liability. Return form number adjustments to credit under section 6431 for certain state and local bonds Find out the difference between agreed and unagreed rars, and. Internal revenue service to help you when you disagree with the results of an irs audit of your tax return, or a return created for you by the irs because you did not file a tax return as. Irs form 4549, also known as the income tax examination changes form, is issued to taxpayers when the irs completes an audit and determines that changes are needed to a previously. If you get one, it means the irs is questioning your. Learn what to do if you receive a letter from the irs auditing your tax return by mail. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Find out how to respond, what documents to send, and what form 4549 means. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states.. At the end of an audit, irs sends the taxpayer a letter along with form 4549, explaining the proposed changes to the audited tax return. Internal revenue service to help you when you disagree with the results of an irs audit of your tax return, or a return created for you by the irs because you did not file a. Follow these steps & get your action plan. Form 4549 shows the irs's proposed changes to your tax return and your updated tax liability. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Learn what to do if you agree or disagree with form. Internal revenue service to help you when you disagree with the results of an irs audit of your tax return, or a return created for you by the irs because you did not file a tax return as. Return form number adjustments to credit under section 6431 for certain state and local bonds A taxpayer must file a timely refund.. Learn about the rars, the reports that contain the adjustments and tax liability computed by the examiners. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax. Form 4549 shows the irs's proposed changes to your tax return and your updated tax liability. Find out. Irs form 4549, known as income tax examination changes, outlines audit results, detailing proposed changes to reported income, deductions, credits, and tax liability. Follow these steps & get your action plan. Learn about the rars, the reports that contain the adjustments and tax liability computed by the examiners. Irs form 4549 is the irs audit report. Find out how to. Find out the difference between agreed and unagreed rars, and. Follow these steps & get your action plan. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. If you get one, it means the irs is questioning your. A taxpayer must file a timely refund. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax. Find out the difference between agreed and unagreed rars, and.. Follow these steps & get your action plan. Learn what to do if you agree or disagree with form 4549 and how to request an audit reconsideration with form 12661. Learn what to do if you receive a letter from the irs auditing your tax return by mail. Form 4549, officially known as the “income tax examination changes” form, is. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Form 4549, also known as the income tax examination changes form, is utilized by the irs to notify taxpayers of proposed adjustments to their tax. Form 4549, officially known as the “income tax examination changes” form, is issued by. Form 4549 shows the irs's proposed changes to your tax return and your updated tax liability. If you get one, it means the irs is questioning your. Form 4549, or income tax examination changes, is a document the irs uses to propose adjustments to your income tax return. Learn about the rars, the reports that contain the adjustments and tax liability computed by the examiners. Form 4549, or the income tax examination changes form, notifies taxpayers of potential adjustments to their tax returns by the irs. Return form number adjustments to credit under section 6431 for certain state and local bonds Internal revenue service to help you when you disagree with the results of an irs audit of your tax return, or a return created for you by the irs because you did not file a tax return as. Do not sign this form without legal advice. Irs form 4549 is the irs audit report. At the end of an audit, irs sends the taxpayer a letter along with form 4549, explaining the proposed changes to the audited tax return. Learn what to do if you agree or disagree with form 4549 and how to request an audit reconsideration with form 12661. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. A taxpayer must file a timely refund. Form 4549, officially known as the “income tax examination changes” form, is issued by the irs following an audit. Find out how to respond, what documents to send, and what form 4549 means. Find out the difference between agreed and unagreed rars, and.Form 4549B Tax Examitation Changes printable pdf download

Form 4549A Tax Discrepancy Adjustments printable pdf download

Form 4549 Response to IRS Determination

IRS Notices Colonial Tax Consultants

the first step in writing a report is Spencer Mortur

Form 4549 Tax Examination Changes Internal Revenue Service

Form 4549 Tax Examination Changes Internal Revenue Service

4.10.8 Report Writing Internal Revenue Service

Form 4549 Response to IRS Determination

Tax Letters Explained Washington Tax Services

Learn What To Do If You Receive A Letter From The Irs Auditing Your Tax Return By Mail.

Form 4549, Also Known As The Income Tax Examination Changes Form, Is Utilized By The Irs To Notify Taxpayers Of Proposed Adjustments To Their Tax.

Irs Form 4549, Known As Income Tax Examination Changes, Outlines Audit Results, Detailing Proposed Changes To Reported Income, Deductions, Credits, And Tax Liability.

Follow These Steps & Get Your Action Plan.

Related Post: