Irs Form 8985

Irs Form 8985 - Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment(s) to. On december 6, the irs released two new final forms (attached) for partnerships under the. Passthrough partners must file form 8985 (and accompanying forms 8986) with. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment (s). Form 8985 (december 2024) author: You'll need to file form 8985 (along with copies of the 8986s) with the irs by. For tax years beginning in 2018 and after, partnerships subject to the bba. Instructions for form 8985 and form 8985(rev. Form 8985 is used by partnerships to report imputed underpayments to partners under section. Instructions for form 8985 and form 8985(rev. Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Passthrough partners must file form 8985 (and accompanying forms 8986) with. For tax years beginning in 2018 and after, partnerships subject to the bba. You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment (s). Form 8985 (december 2024) author: Form 8985 is used by partnerships to report imputed underpayments to partners under section. On december 6, the irs released two new final forms (attached) for partnerships under the. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment(s) to. For tax years beginning in 2018 and after, partnerships subject to the bba. You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Form 8985 (december 2024) author: Form 8985 is used by partnerships to report imputed underpayments to partners under section. Instructions for form 8985 and form 8985(rev. Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment(s) to. Passthrough partners must file form 8985 (and accompanying forms 8986) with. On december 6, the irs released two new final forms (attached) for partnerships under the. Form 8985 (december 2024) author: You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Instructions for form 8985 and form 8985(rev. Form 8985 (december 2024) author: On december 6, the irs released two new final forms (attached) for partnerships under the. For tax years beginning in 2018 and after, partnerships subject to the bba. Instructions for form 8985 and form 8985(rev. Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Passthrough partners must file form 8985 (and accompanying forms 8986) with. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment(s) to. Form 8985 is used to summarize and transmit forms 8986, partner's share of. On december 6, the irs released two new final forms (attached) for partnerships under the. Form 8985 is used by partnerships to report imputed underpayments to partners under section. You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Instructions for form 8985 and form 8985(rev. Learn how to prepare and submit form 8985,. Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Form 8985 is used by partnerships to report imputed underpayments to partners under section. On december 6, the irs released two new final forms (attached) for partnerships under the. You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Form. Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Form 8985 (december 2024) author: You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Instructions for form 8985 and form 8985(rev. Passthrough partners must file form 8985 (and accompanying forms 8986) with. On december 6, the irs released two new final forms (attached) for partnerships under the. Form 8985 is used by partnerships to report imputed underpayments to partners under section. Passthrough partners must file form 8985 (and accompanying forms 8986) with. For tax years beginning in 2018 and after, partnerships subject to the bba. Form 8985 (december 2024) author: Instructions for form 8985 and form 8985(rev. For tax years beginning in 2018 and after, partnerships subject to the bba. You'll need to file form 8985 (along with copies of the 8986s) with the irs by. Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Form 8985 (december 2024) author: Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment(s) to. Instructions for form 8985 and form 8985(rev. Form 8985 is used by partnerships to report imputed underpayments to partners under section. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment (s). Passthrough partners must file form 8985 (and accompanying forms. Instructions for form 8985 and form 8985(rev. Form 8985 (december 2024) author: Learn how to prepare and submit form 8985, which summarizes and transmits forms 8986,. Form 8985 is used to summarize and transmit forms 8986, partner's share of adjustment(s) to. You'll need to file form 8985 (along with copies of the 8986s) with the irs by. For tax years beginning in 2018 and after, partnerships subject to the bba. On december 6, the irs released two new final forms (attached) for partnerships under the. Form 8985 is used by partnerships to report imputed underpayments to partners under section.Form DP87 PART Download Fillable PDF or Fill Online Business Taxes

Download Instructions for IRS Form 8985, 8985V PDF Templateroller

Form 8985 Fill Online, Printable, Fillable, Blank pdfFiller

Download Instructions for IRS Form 8985, 8985V PDF Templateroller

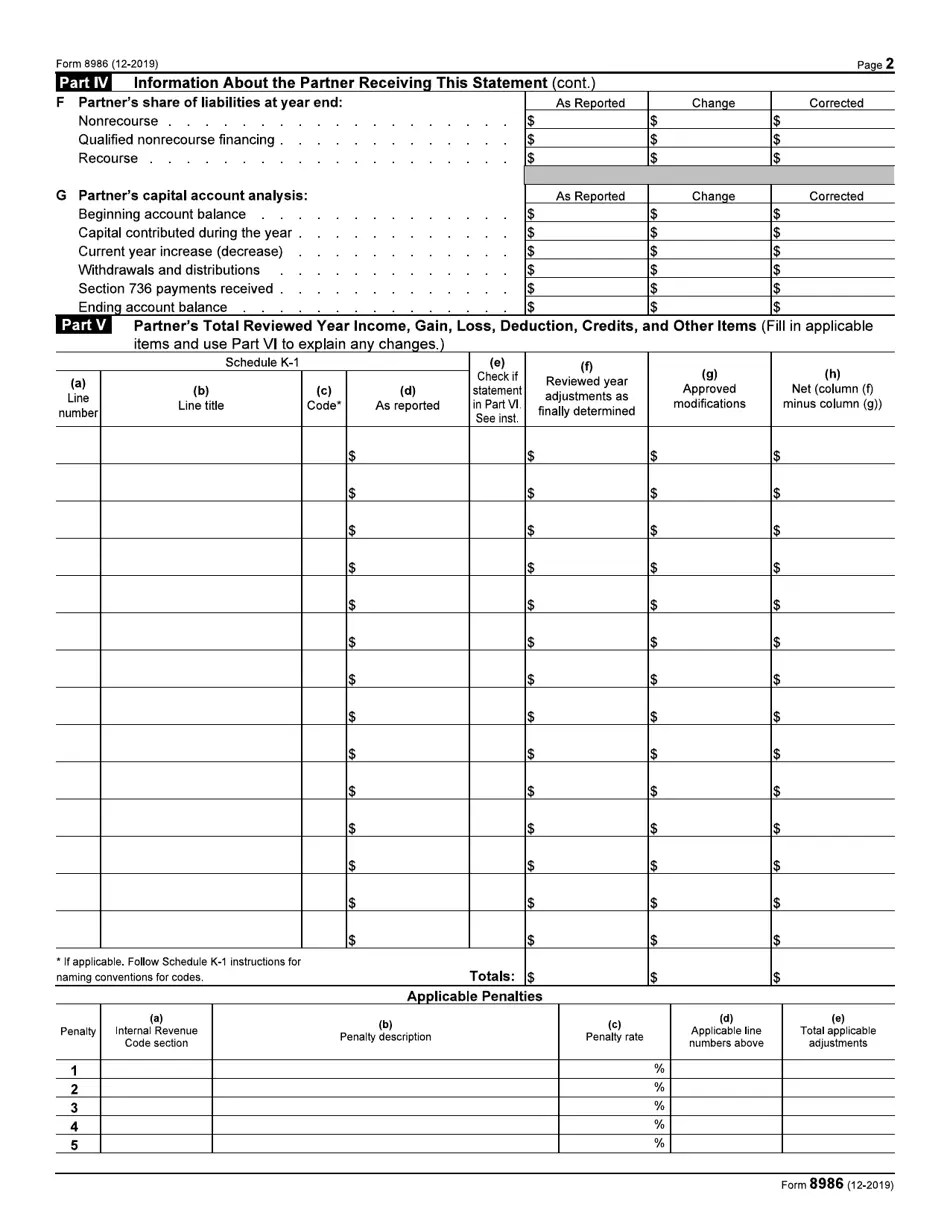

IRS Form 8978 Download Fillable PDF or Fill Online Partner's Additional

Form 8985 Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 8985 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8985V Fill Out, Sign Online and Download Fillable PDF

Download Instructions for IRS Form 8985, 8985V PDF Templateroller

Irs Form 8985 Fillable Printable Forms Free Online

Passthrough Partners Must File Form 8985 (And Accompanying Forms 8986) With.

Form 8985 Is Used To Summarize And Transmit Forms 8986, Partner's Share Of Adjustment (S).

Related Post: